How to Become Self-Employed in Switzerland in 2026

Ready to be your own boss? Switzerland welcomed 52,978 new companies in 2024—a record high. Here's everything you need to know about starting your freelance journey: from CHF 0 setup costs to OASI registration, VAT thresholds, and accounting essentials.

What Qualifies as Self-Employment in Switzerland?

According to Swiss federal law, you're considered self-employed when you meet these criteria:

- Work on your own account and risk - You bear financial responsibility for success or failure

- Professional autonomy - You decide how, when, and where you work

- Multiple clients - You work for several clients (minimum 2-3 is standard)

- Own infrastructure - You provide your own tools, equipment, or workspace

- Invoice in your name - You issue invoices bearing your name and assume collection risk

This typically means operating as a sole proprietorship (Einzelfirma/Raison individuelle), the simplest business structure in Switzerland.

The Pseudo-Self-Employment Warning

Swiss authorities carefully examine whether genuine self-employment exists. Working exclusively for one client, following their schedule, using their equipment, and having no entrepreneurial risk may be classified as disguised employment (Scheinselbständigkeit).

This matters because:

- The "employer" becomes liable for unpaid social security contributions

- You miss out on employee protections (accident insurance, unemployment benefits)

- Back taxes and contributions can be demanded retroactively

Rule of thumb: Maintain at least 3 active clients and genuine entrepreneurial freedom.

Who Can Become Self-Employed?

Your path to self-employment depends on your residency status and professional qualifications.

Swiss Citizens & C Permit

Start immediately without special authorization. Full freedom in all professions (with required qualifications).

EU/EFTA Nationals

Apply for B permit with business plan showing 3+ clients. Processing: 4-8 weeks. Renewable 5-year permit.

Third-Country Nationals

Only eligible with C permit or marriage to C permit holder/Swiss citizen. No work permits issued for self-employment.

Cross-Border Workers

G permit holders can work self-employed with Swiss business address, 3+ clients, and regular home country return.

Regulated Professions

Healthcare, legal, technical, and trade professions require recognized diplomas regardless of nationality.

The Complete Step-by-Step Process

From zero to fully registered self-employed: 2-4 months. Here's exactly what you need to do, in order.

Secure First Clients

2-8 weeks: Get proof of business activity before official registrationOASI Registration

3-6 weeks: Register with compensation fund using client invoices as proofCommercial Register

1-2 weeks: Optional initially, mandatory above CHF 100,000 revenueVAT Registration

4 weeks: Required when annual revenue exceeds CHF 100,000Secure Your First Clients (Before Official Registration)

This seems backward, but it's how Switzerland works: you need proof of business activity before you can register. You don't need official self-employed status to invoice—if your activity stays below CHF 2,500 annually, OASI registration is optional.

What You Need

- At least 2 clients - OASI requires proof you're not just an employee

- Invoices showing payment - Evidence of completed work

- Clear service descriptions - Demonstrating your professional activity

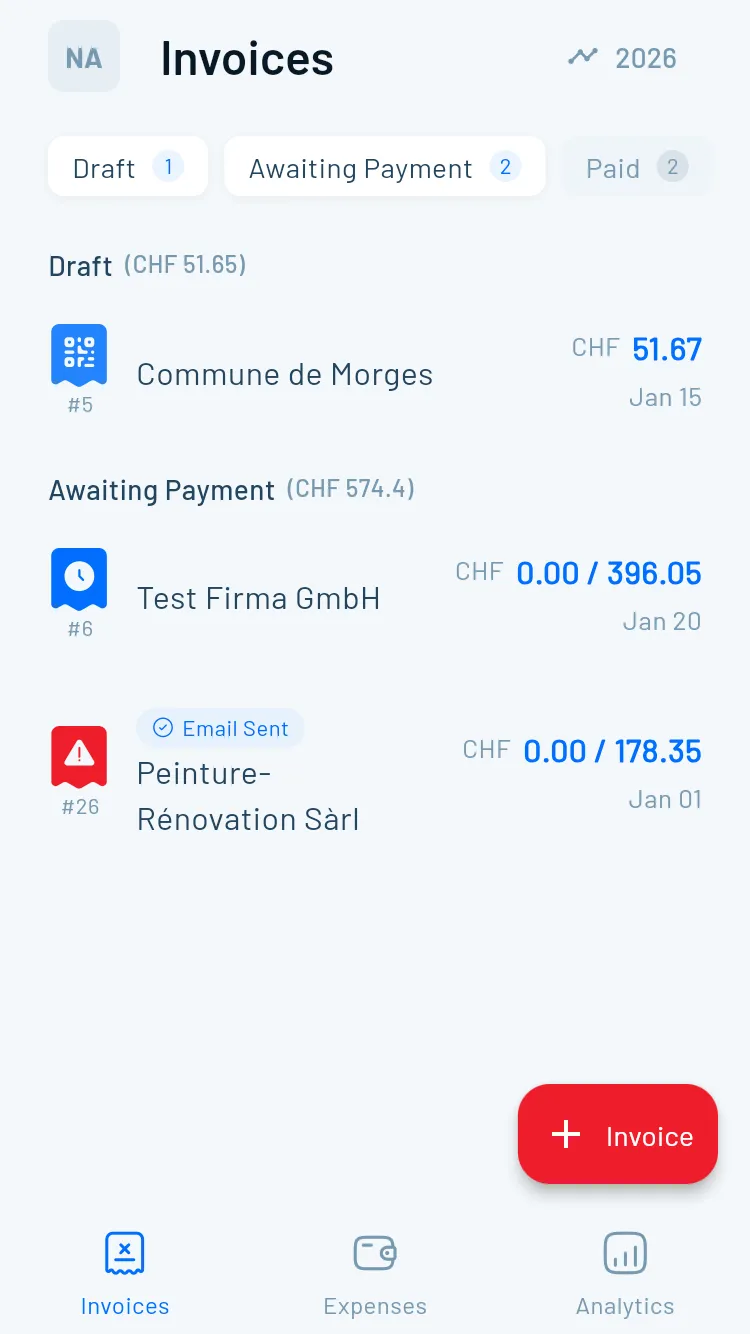

Creating Your First Invoices

You can create professional invoices immediately using tools like Magic Heidi. Your invoices should include:

- Your name and address

- Client's name and address

- Service description

- Amount in CHF

- Payment terms

- Date and invoice number

At this stage (under CHF 100,000 annual revenue), you don't need a VAT number or commercial register entry.

Register with OASI (AVS/AHV)

Once you have proof of business activity, register with the Old Age and Survivors' Insurance—Switzerland's social security system. Processing time: 3-6 weeks.

Required Documents

- Completed OASI self-employment questionnaire

- Minimum 2 paid invoices or client contracts

- Business description

- Revenue projections

- ID/permit documentation

Where to Register

- Your cantonal compensation fund (most freelancers), or

- Your professional compensation fund (if your profession has one—teachers, healthcare, etc.)

What Happens Next

The compensation fund evaluates whether you genuinely qualify as self-employed. If approved, you'll receive:

- Confirmation of self-employed status

- OASI number

- Quarterly contribution payment schedule (Akontobeiträge)

Important: Register during your first quarter of activity. Retroactive registration is possible but complicates initial contributions.

Commercial Register title:

Both become mandatory when you cross the CHF 100,000 revenue threshold.

Commercial Register

Mandatory above CHF 100k revenue. Benefits: professional credibility, business name different from personal name, required for some banks. Cost: CHF 120-250.

VAT Registration

Mandatory within 30 days of exceeding CHF 100k. You'll receive CHE number, charge VAT on invoices, but also deduct input VAT (7-8% savings!).

What Self-Employment Actually Costs in 2026

Starting costs CHF 0. Here's what you'll pay ongoing, with real examples for different income levels.

- 🎯Initial Setup

CHF 0 - No registration fees, no mandatory capital

- 📊OASI Contributions

5.371% to 10% of net income + family allowance

- 💻Accounting Software

CHF 19-50/month for professional invoicing

- 🛡️Insurance

CHF 1,500-3,000/year recommended

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Ongoing Mandatory Costs Breakdown

1. OASI Contributions

Rate: 5.371% to 10% of net annual income

The percentage depends on your income level:

- CHF 9,800 or less: 5.371%

- CHF 9,801 to CHF 60,500: Progressive scale

- CHF 60,500 or more: 10.0%

Plus family allowance contributions: 0.3% to 3.0% (varies by canton—Zurich is typically 2.5%)

Example calculation for CHF 60,000 net income:

- OASI: CHF 6,000 (10%)

- Family allowance: CHF 1,500 (2.5%)

- Total: CHF 7,500/year or CHF 625/month

2. Accounting & Invoicing Software

Options:

- Basic (Excel): Free but time-consuming and error-prone

- Magic Heidi: CHF 25/month (CHF 300/year) - purpose-built for Swiss freelancers

- bexio, CashCtrl: CHF 350-600/year - more complex, designed for SMEs

3. Insurance (Recommended)

- Accident insurance: CHF 800-1,500/year (optional but recommended)

- Professional liability: CHF 500-2,000/year depending on profession

- Legal protection insurance: CHF 300-600/year

First-Year Cost Example

Scenario: Graphic designer earning CHF 50,000 net income

| Expense | Amount |

|---|---|

| Setup costs | CHF 0 |

| OASI contributions | CHF 4,500 |

| Accounting software (Magic Heidi) | CHF 300 |

| Accident insurance | CHF 1,200 |

| Professional liability | CHF 600 |

| Total first year | CHF 6,600 |

As percentage of income: 13% (decreases as income grows)

Insurance and Pension Planning

As an employee, you're automatically covered. As self-employed, you're suddenly responsible for all of this yourself. Here's what you need to know.

The Reality No One Tells You

Unlike employees (automatically covered for accidents, unemployment, and building pension savings), self-employed individuals must arrange everything themselves.

Mandatory Insurance

Health insurance: Already mandatory for all Swiss residents—no change from employment.

Optional But Critical Insurance

Accident Insurance

Options:

- Voluntary employment-based accident insurance through compensation funds

- Private accident insurance policies

Cost: CHF 800-1,500/year for comprehensive coverage

Why it matters: Without coverage, a ski accident or cycling injury could bankrupt your business.

Unemployment Insurance

Not available to self-employed people, period.

This is the biggest financial risk of self-employment. If your business fails or clients disappear, there's no unemployment benefit safety net.

Mitigation strategy: Build an emergency fund covering 3-6 months of living expenses before going full-time self-employed.

Retirement Planning: Your Responsibility Now

Pillar 2 (Occupational Pension/BVG)

Status: Optional for self-employed. Many skip this due to cost and inflexibility.

Pillar 3a (Private Retirement Savings)

Maximum 2026 contributions:

- CHF 7,056 if you have a Pillar 2 pension fund

- CHF 36,288 (20% of net income, capped) if you have no Pillar 2

Why this matters:

- Immediate tax deduction - Reduces taxable income by contribution amount

- Tax-sheltered growth - No wealth or income tax on growth

- Forced retirement savings - Locked until retirement (with exceptions)

The Math That Matters

Example: Self-employed earning CHF 80,000 net

- Max Pillar 3a contribution: CHF 36,288

- Tax savings (assuming 30% rate): CHF 10,886

- Real cost of saving: CHF 25,402

You're building retirement security at a 30% discount thanks to tax deductions.

Start immediately—compound growth is powerful.

Accounting Essentials for Beginners

Simplified accounting under CHF 500,000 revenue means tracking income and expenses without complex bookkeeping. Here's what you must track and the expenses you can deduct.

What You Must Track

- All income - Every invoice, every payment received

- All business expenses - Receipts, invoices paid, bank fees

- Private withdrawals - Money moved from business to personal use

- Asset purchases - Equipment, computers, furniture over CHF 500

Essential Business Expenses You Can Deduct

The fastest way to increase your take-home income? Claim every legitimate business expense.

Home Office Deduction

Simple method: Flat rate per square meter (varies by canton, typically CHF 70-100/m² annually)

Actual cost method: Proportional share of rent, utilities, insurance based on office percentage

Example: 20m² office in 100m² apartment paying CHF 2,000/month rent = 20% business use = CHF 4,800 annual deduction

Technology & Communication

- Internet and phone: 50-100% deductible

- Computer hardware: Fully deductible

- Software subscriptions: Magic Heidi, Adobe Creative Cloud, Microsoft 365

- Website hosting: Fully deductible

Professional Development

- Training courses and certifications

- Professional books and publications

- Conference attendance including travel

Business Travel

- Public transport: Keep receipts or SBB business account

- Car expenses: CHF 0.70/km or actual costs

- Bicycle: CHF 0.50/km for business trips

- Parking and tolls for business trips

Marketing & Client Acquisition

- Website development

- Business cards and printed materials

- Advertising: Google Ads, social media, directories

- Networking events: entrance fees, client meals

Other Deductions

- Coworking space membership

- Professional insurance: liability, legal protection

- Bank fees: business account, transactions

- Accounting software: Magic Heidi and similar tools

Pricing Your Services: Don't Make This Mistake

The #1 mistake new freelancers make: Pricing too low because they compare their rate to their former salary.

The Real Cost Calculation

Formula: (Target annual income + all costs + 30% profit margin) ÷ billable hours

Example breakdown:

Target income: CHF 70,000

- OASI contributions: CHF 7,000

- Pension (Pillar 3a): CHF 7,056

- Insurance: CHF 2,500

- Software/tools: CHF 500

- Marketing: CHF 2,000

- Subtotal: CHF 89,056

- 30% profit margin: CHF 26,717

- Total revenue needed: CHF 115,773

Billable hours calculation:

- 52 weeks × 40 hours = 2,080 potential hours

- Minus holidays (4 weeks): 160 hours

- Minus sick days (1 week): 40 hours

- Minus admin/marketing (25%): 470 hours

- Billable hours: 1,410

Minimum hourly rate: CHF 115,773 ÷ 1,410 = CHF 82/hour

Most new freelancers underestimate non-billable time and forget to include profit margin, especially when choosing between project and hourly billing—leading to burnout and business failure.

Part-Time Self-Employment: Can You Do Both?

Yes—many Swiss workers start their self-employment journey alongside regular employment. Here's what you need to know.

OASI Requirements

Below CHF 2,500: optional. Above CHF 2,500: register with compensation fund. Your employer continues paying OASI on employment income separately.

Employment Contract

Check for non-compete clauses, management position restrictions, and intellectual property ownership. Get written approval from employer.

Time Management

Start with 5-10 hours/week for side business. Build client base gradually, test market demand, accumulate emergency fund before going full-time.

Common Mistakes and How to Avoid Them

Learn from others' experiences. These are the most frequent mistakes new freelancers make—and how to prevent them.

Underpricing Services

Charge 2-3× your former hourly rate to cover all costs and profitVerbal Agreements

Every client needs [written contracts](/contracts-and-legal-documents) with deliverables, timeline, payment termsChaotic Record-Keeping

Use accounting software from day one—saves 10-15 hours at tax timeNeglecting Pension

Start Pillar 3a contributions immediately for compound growthNo Marketing When Busy

Dedicate 10-20% time to marketing even when swamped with workWorking for One Client

Maintain minimum 3 active clients for income diversificationWhen to Consider a Sàrl (GmbH/LLC)

As your business grows, you might wonder whether to transition from sole proprietorship to a limited liability company.

Sole Proprietorship Advantages

- CHF 0 to start

- Simple accounting (if under CHF 500k)

- All profits taxed once (as personal income)

- Minimal administration

- Easy to close if needed

Sàrl Advantages

- Limited liability: Personal assets protected

- Tax optimization: Potential savings above ~CHF 150,000 profit

- Professional credibility: Clients may prefer incorporated businesses

- Succession planning: Easier to sell or transfer

The Break-Even Analysis

Consider Sàrl when:

- Annual profit consistently exceeds CHF 100,000-150,000

- Tax optimization creates 5-10% savings

- You want liability protection (consulting, construction, healthcare)

- Planning to raise investment or bring in partners

Costs of Sàrl:

- Initial setup: CHF 2,000-4,000

- Minimum capital: CHF 20,000

- Annual accounting: CHF 2,000-5,000

- Additional administrative burden

Frequently Asked Questions

How much does it cost to become self-employed in Switzerland?

CHF 0 initially. You only pay ongoing costs: OASI contributions (5.371-10% of income), accounting software (CHF 25+/month), and recommended insurance (CHF 1,500-3,000/year). Commercial register (CHF 120-250) is only required above CHF 100,000 annual revenue.

Can I start invoicing before registering as self-employed?

Yes. You can issue invoices before official OASI registration, particularly if annual income stays below CHF 2,500. You need invoices as proof when you do register with OASI.

How long does OASI registration take?

3-6 weeks from application submission. Register during your first quarter of activity for smoothest process.

What's the minimum number of clients I need?

OASI requires minimum 2 clients as proof of genuine self-employment. For work permits (foreigners) and legal security, maintain 3+ active clients.

Can foreigners become self-employed in Switzerland?

EU/EFTA nationals: Yes, by applying for B permit with business plan showing 3+ clients. Third-country nationals: Only if you hold C permit or are married to C permit holder/Swiss citizen.

Do I need accident insurance?

Not mandatory but strongly recommended. Unlike employment (automatic coverage), self-employed must arrange their own. Cost: CHF 800-1,500/year.

What happens to my pension when self-employed?

You're responsible for your own retirement savings. Pillar 2 becomes optional. Maximize Pillar 3a contributions (CHF 7,056 or up to CHF 36,288 in 2026) for tax-deductible retirement savings.

Can I be employed and self-employed simultaneously?

Yes. Above CHF 2,500 annual self-employed income, register with OASI compensation fund. Check employment contract for restrictions and get written approval.

What's the difference between fake and real self-employment?

Real self-employment: Multiple clients, entrepreneurial autonomy, own tools, bear financial risk. Fake (Scheinselbständigkeit): One client, follow their schedule, use their equipment, no real business risk. Authorities can reclassify you as employee with retroactive consequences.

Do I need a business bank account?

Not legally required but highly recommended for clear separation of business and personal finances. Simplifies accounting and tax preparation significantly.

What if my business fails—do I get unemployment benefits?

No. Self-employed individuals cannot access unemployment insurance. Build a 3-6 month emergency fund before going full-time self-employed.

When do I need an accountant?

Most freelancers manage their own simplified accounting under CHF 100,000. Consider an accountant in Romandie when: VAT-registered, revenue exceeds CHF 200,000, transitioning to Sàrl, or you want to focus on client work instead of bookkeeping.

Start Your Self-Employment Journey the Right Way

Managing invoices, expenses, and VAT shouldn't consume hours every week. Magic Heidi is built specifically for Swiss freelancers—handling QR-code invoices, automatic VAT calculations, receipt scanning, and tax-ready reports.

Your Next Steps

Becoming self-employed in Switzerland is surprisingly accessible—starting costs nothing, and the system supports entrepreneurship once you understand the requirements.

Your immediate action plan:

- Secure 2 clients and invoice them - Proof of activity comes first

- Register with OASI - Within your first quarter of activity

- Set up proper accounting - Don't wait for tax season chaos

- Plan for retirement - Start Pillar 3a contributions immediately

- Build emergency fund - 3-6 months of expenses for safety net

Why Magic Heidi Makes Sense

For just CHF 25/month, you get:

- Swiss-compliant QR-code invoicing

- Automatic expense tracking

- VAT management and tracking

- Mobile + desktop apps

- Support in EN/DE/FR/IT

The self-employment journey comes with challenges, but Switzerland offers one of the world's most supportive environments for independent professionals. You've got this. 🚀