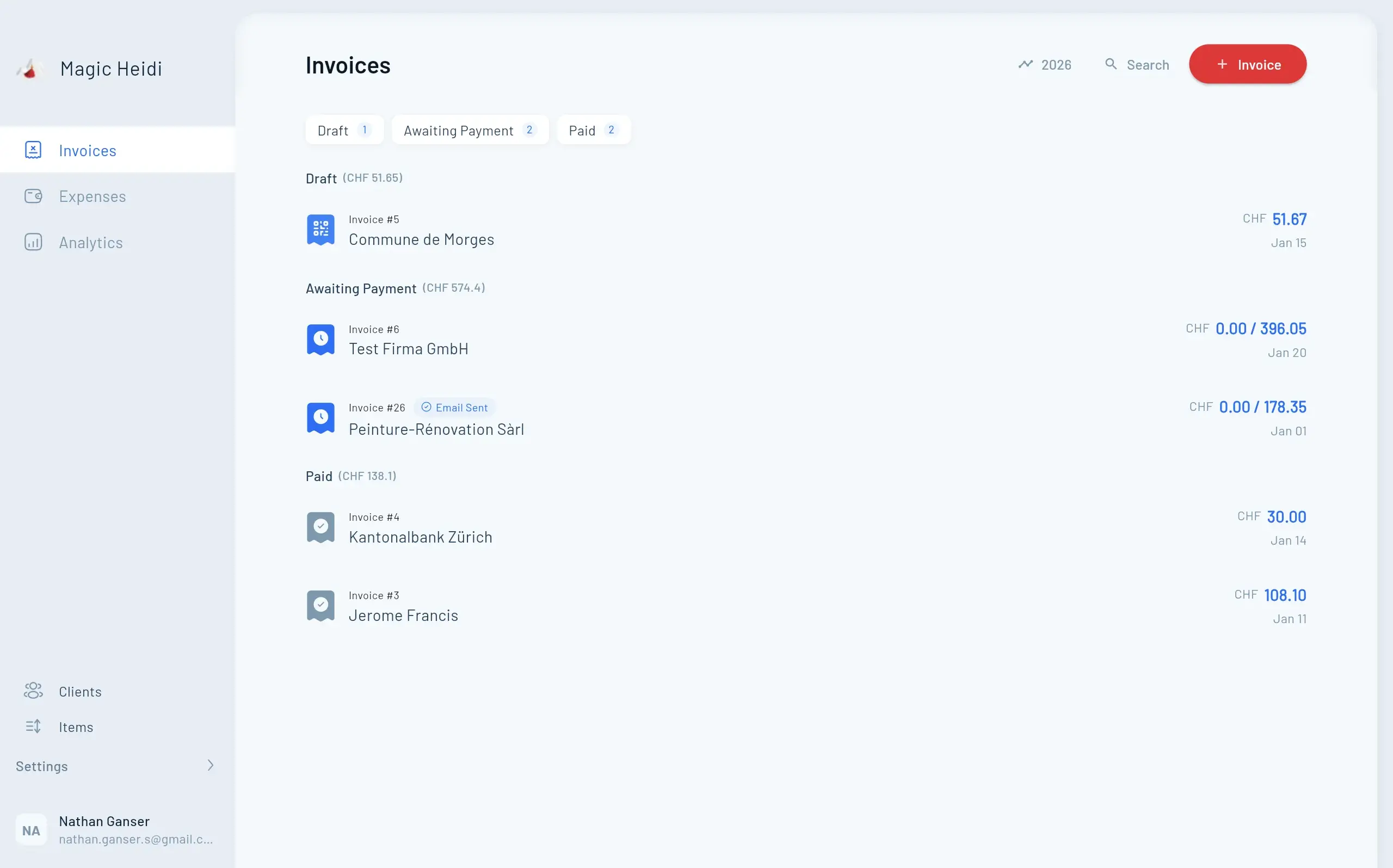

Set up tracking systems now

Don't wait until tax time to organize your finances.

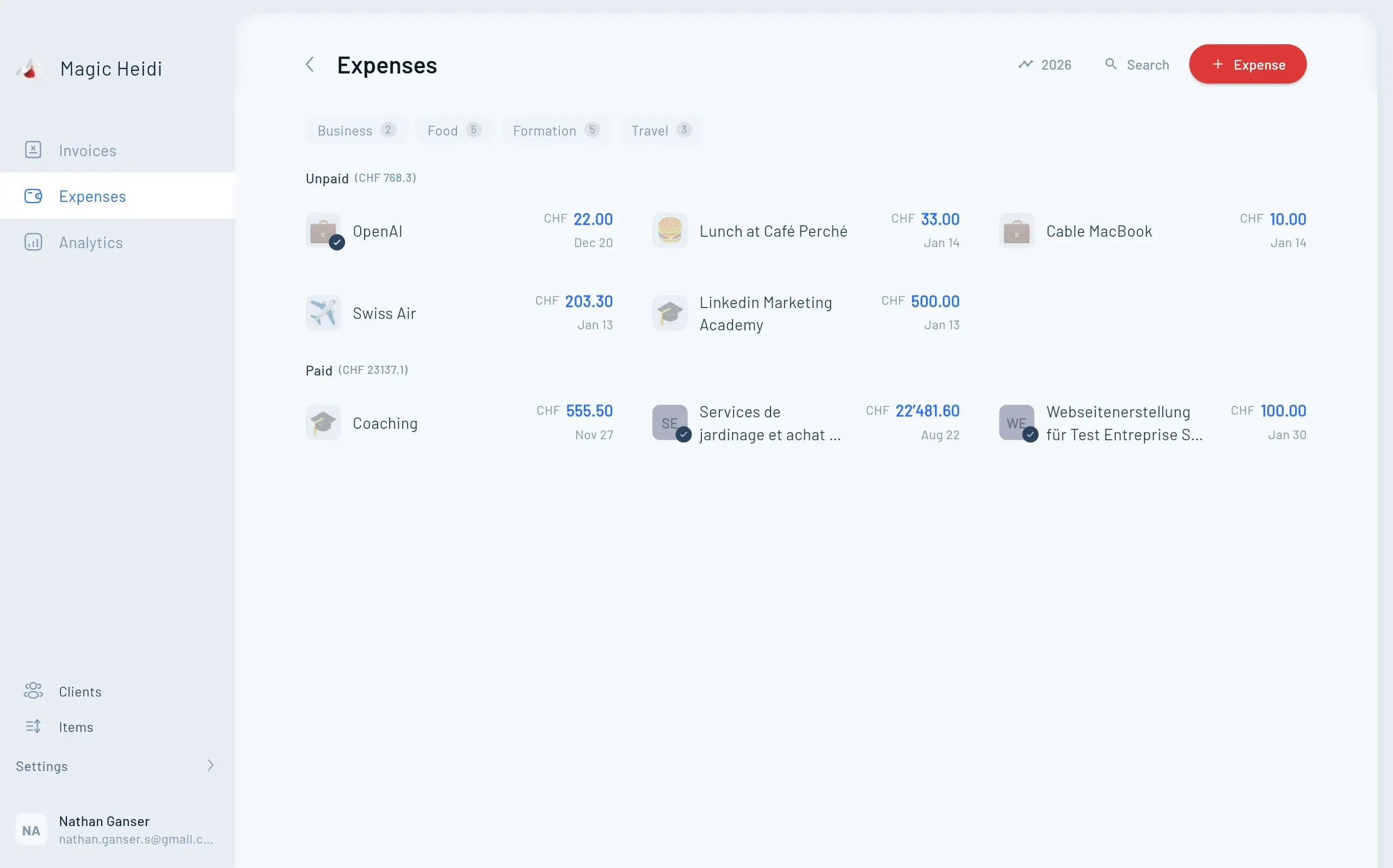

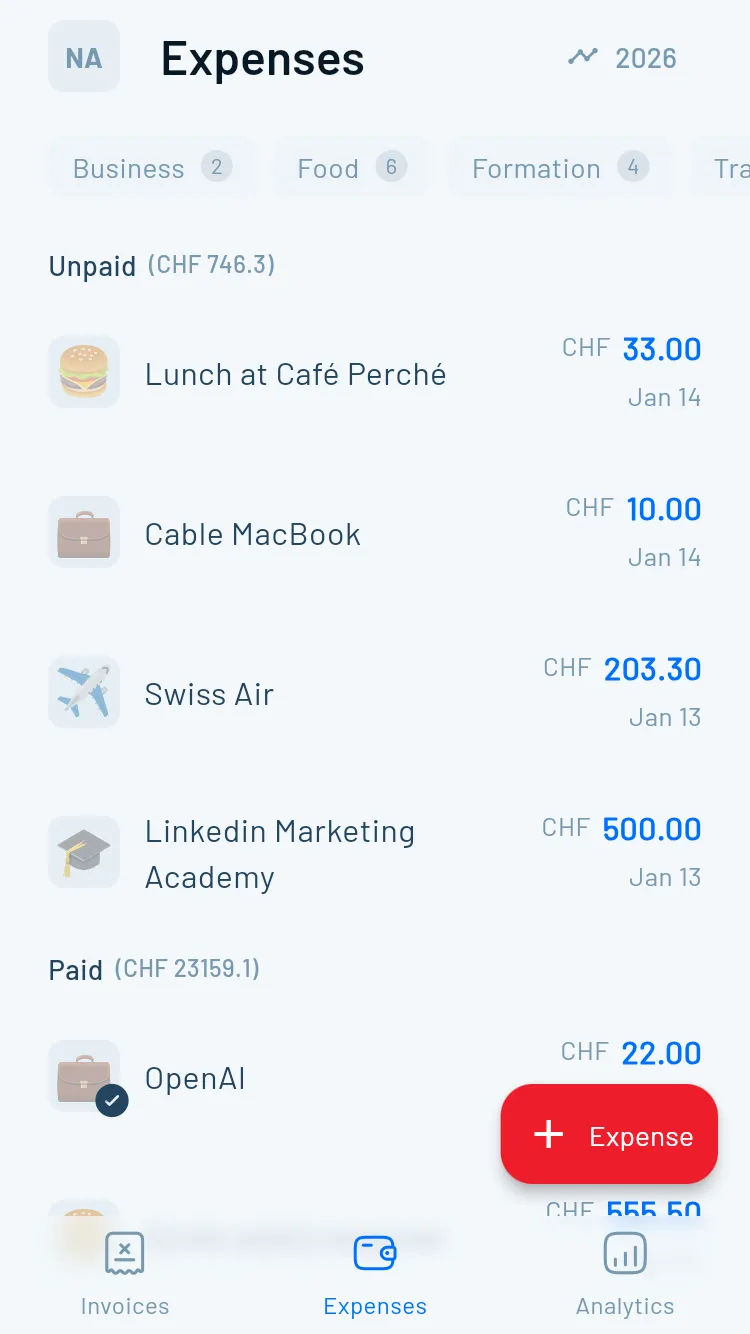

- Set up expense tracking system

- Photograph every business receipt immediately

- Note business purpose on client meal receipts

- Keep vehicle logbook if using actual cost method