Rough calculation to compare:

NTDR annual cost: Revenue × Your NTDR rate

Effective annual cost: (Revenue × 8.1%) - (Costs × 8.1%)

If Effective cost is lower AND you're making investments, switch to Effective.

Since 2025, businesses with diverse activities can use multiple NTDR rates—if each activity represents more than 10% of turnover.

Example: A sports shop with:

- Retail sales (60%): 2.1% NTDR

- Equipment rental (25%): 3.0% NTDR

- Repair services (15%): 5.3% NTDR

Each activity gets its own rate, calculated separately.

Both methods now qualify for annual filing if:

- Annual turnover under CHF 5,024,000

- You request it from ESTV

This reduces administrative burden from 4-6 reports per year to just one.

Critical for exporters: As of 2025, businesses using NTDR can no longer reclaim VAT on export-related expenses. If exports exceed 20% of your turnover, Effective Method is now mandatory for optimization.

Non-resident businesses can no longer use NTDR since January 2025. Only Swiss-registered businesses qualify.

This trips up many businesses using NTDR.

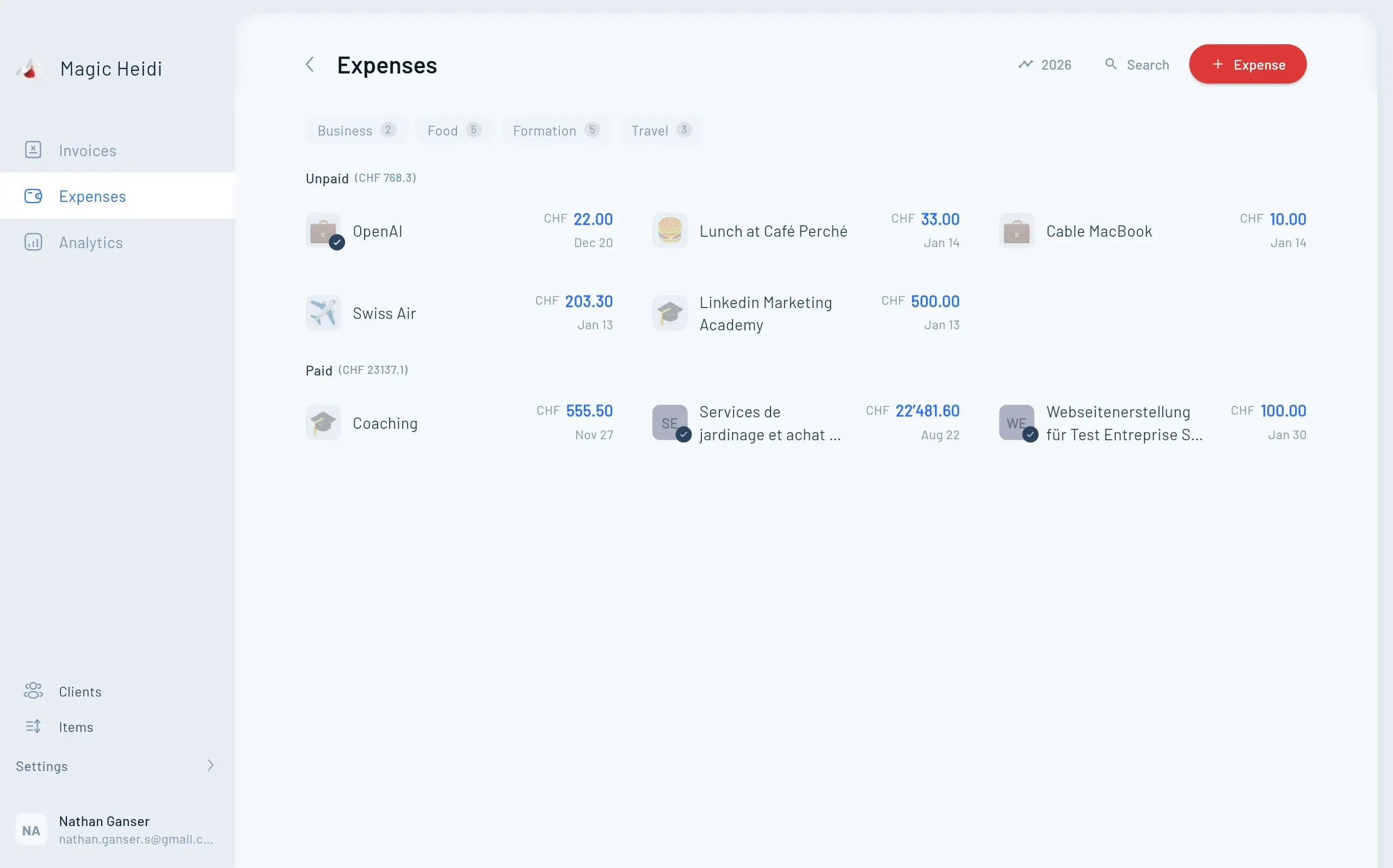

When you buy services from foreign companies (outside Switzerland), you owe acquisition tax (Bezugssteuer) at 8.1%. Examples:

- Google Ads

- Facebook advertising

- AWS cloud hosting

- Microsoft 365 subscriptions

- Zoom licenses

With Effective Method: You pay 8.1% but immediately deduct it as input VAT (net effect: zero)

With NTDR: You pay 8.1% with no deduction (net cost: 8.1% of all foreign services)

A freelance consultant spending CHF 10,000/year on Google Ads pays CHF 810 extra under NTDR.