Swiss VAT for Freelancers: Your Complete 2026 Guide

Everything you need to know about MWST/TVA/IVA registration, rates, filing deadlines, and compliance. Cut through the complexity and stay tax-ready.

You've landed your first major client. Business is growing. You're on track to hit six figures this year.

Then reality hits: VAT registration.

If you're a freelancer in Switzerland approaching or exceeding CHF 100,000 in annual turnover, you need to understand Mehrwertsteuer (MWST), Taxe sur la valeur ajoutée (TVA), or Imposta sul valore aggiunto (IVA) – Switzerland's Value Added Tax system.

This guide cuts through the complexity. You'll learn exactly when to register, how to charge the correct rates, what you can deduct, and how to stay compliant without drowning in paperwork.

Do You Need to Register?

Understanding the CHF 100,000 threshold and what counts toward it.

The CHF 100,000 Threshold

The threshold is CHF 100,000 in annual turnover. Once you exceed this amount, you have 30 days to register with the Swiss Federal Tax Administration (ESTV/AFC/AFD).

Here's what counts toward that CHF 100,000:

- All revenue from goods and services you provide

- Revenue from both Swiss and international clients

- Income calculated on a rolling 12-month basis (not just the calendar year)

How the Rolling 12-Month Calculation Works

You don't wait until December 31 to check your numbers. Track your turnover continuously.

Example: Sophie is a graphic designer. Her monthly revenue in 2025:

- January to August: CHF 7,000/month = CHF 56,000

- September: CHF 15,000 (landed a big client)

- October to November: CHF 8,000/month = CHF 16,000

By November 30, her trailing 12-month total is CHF 103,000. She exceeded the threshold in November, which means she must register by December 30.

The 30-day deadline is strict. Miss it, and you face penalties.

The CHF 250,000 Exception

Non-profit sports and cultural organizations have a higher threshold of CHF 250,000. Standard businesses stick with CHF 100,000.

Should You Register Voluntarily?

Consider These Factors.

If you're below CHF 100,000, voluntary registration can make financial sense in specific situations.

When It Makes Sense

Large business purchases, B2B clients, significant input tax deductionsWhen to Avoid It

Private clients, minimal expenses, price-sensitive marketCash Flow Impact

Reclaim VAT on expenses but add 8.1% to your pricesUnderstanding Swiss VAT Rates in 2026

Switzerland uses three different rates depending on what you sell or provide.

Standard Rate: 8.1%

Most services including consulting, IT, marketing, and standard retail goods

Reduced Rate: 2.6%

Essential items: food, books, newspapers, medicines, agricultural products

Special Rate: 3.8%

Accommodation services including hotels, B&Bs, and breakfast

Exempt: 0%

Healthcare, education, insurance, financial services, some cultural activities

Which Rate for Your Services?

Most freelancers charge 8.1%. Unless you're in publishing, food production, or hospitality, you'll use the standard rate.

Mixed services require attention. If you're a freelance writer creating content for a book (2.6%) versus marketing copy (8.1%), track these separately.

Common mistake: Applying 2.6% to e-books because printed books qualify. Digital publications actually fall under 8.1% unless specifically exempted.

VAT-Exempt Services

Some services are completely exempt from VAT:

- Healthcare and medical services

- Education and training (with specific conditions)

- Insurance and financial services

- Cultural activities (some)

If your services are exempt, you don't charge VAT. The downside? You can't deduct input tax on your business expenses either.

How to Register for Swiss VAT

Registration happens through the ESTV's ePortal. Electronic filing has been mandatory since January 2025.

Registration Steps

1. Gather your information:

- UID number (Unternehmens-Identifikationsnummer/Numéro d'identification des entreprises)

- Business details and structure

- Estimated annual turnover

- Start date of VAT liability

- Bank account for VAT payments

2. Submit online application: Visit the ESTV ePortal and complete the registration form. The system guides you through each section.

3. Wait for approval: Processing typically takes 3-4 weeks. You'll receive your VAT registration number (starts with CHE, followed by nine digits and ending in MWST/TVA/IVA).

4. Update your invoices: Once registered, all invoices must include your VAT number and show VAT separately.

The 30-Day Rule

You must register within 30 days of exceeding the threshold. This isn't a suggestion – it's a legal requirement.

Your VAT liability begins when you exceed CHF 100,000, not when you complete registration. If you register late, you owe VAT retroactively from that date.

Creating VAT-Compliant Invoices

Your invoices must include specific elements to satisfy ESTV requirements and avoid penalties.

- 📋Required Information

Business details, VAT number, client info, invoice number and date

- 💰Financial Details

Net amount, VAT rate, VAT amount, total including VAT, payment terms

- 🌍International Rules

Different rules for B2B vs B2C clients, 0% for foreign business clients

- ✓Swiss Terminology

Use MWST/TVA/IVA on invoices, not "VAT"

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Sample Invoice Layout

Invoice #2026-001

Date: January 15, 2026

From:

Marc Dupont Consulting

Hauptstrasse 123

8000 Zürich

CHE-123.456.789 MWST

To:

ABC Company AG

Bahnhofstrasse 45

8001 Zürich

Services provided:

Marketing strategy consultation CHF 5,000.00

Net amount: CHF 5,000.00

MWST 8.1%: CHF 405.00

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Total due: CHF 5,405.00

Payment due: February 14, 2026

Invoicing International Clients

For foreign business clients (B2B):

- No Swiss VAT charged (0% rate)

- Note on invoice: "Service provided outside Switzerland, 0% VAT"

- Keep proof of client's business status and location

For foreign private clients (B2C):

- Generally 0% if service is used outside Switzerland

- Physical presence matters – where is the service consumed?

Switzerland is not in the EU. This is crucial. You don't follow EU VAT rules, despite being geographically close. No MOSS registration. No reverse-charge mechanisms with EU clients.

Filing Your VAT Returns

Once registered, you'll file periodic VAT returns and pay what you owe (or claim refunds if you're in credit).

Quarterly Filing

Default option. File every three months covering Jan-Mar, Apr-Jun, Jul-Sep, Oct-Dec.

Monthly Filing

Available if you regularly receive VAT refunds. Improves cash flow for high-expense businesses.

Annual Filing

For SMEs under CHF 5,005,000 with good compliance. Requires quarterly advance payments.

60-Day Deadline

You have 60 days after each period to file and pay. Late payments incur 4.75% annual interest.

How to Calculate What You Owe

The effective method (standard approach):

- Calculate output tax: Total VAT collected from clients

- Calculate input tax: Total VAT paid on business expenses

- Subtract input from output: The difference is what you owe (or are owed)

Example: Laura runs a consulting business.

Q1 2026:

- Invoiced clients: CHF 32,400 (including CHF 2,430 VAT at 8.1%)

- Business expenses: CHF 5,405 (including CHF 405 VAT at 8.1%)

Output tax: CHF 2,430

Input tax: CHF 405

Amount due: CHF 2,025

Laura files her return and pays CHF 2,025 to ESTV by May 31.

The Flat-Rate Method Alternative

Eligible businesses (turnover under CHF 5,005,000) can use simplified flat-rate percentages instead of tracking every transaction.

You apply a fixed percentage to your total turnover, based on your industry. For most service businesses, the rate is around 0.1% to 6.5%.

Benefit: Much less bookkeeping.

Drawback: Often results in paying more VAT than the effective method.

What You Can Deduct:

Input Tax Explained

One major benefit of VAT registration is reclaiming VAT on business expenses.

Deductible Expenses

Claim input tax on legitimate business expenses used for VAT-taxable activities.

- Office supplies and equipment

- Software subscriptions and tools

- Professional services (legal, accounting)

- Marketing and advertising costs

- Business travel and accommodation

- Telecommunications and internet

- Workspace rental and utilities

- Vehicle expenses (business use)

Non-Deductible Expenses

These expenses cannot be claimed for input tax deduction.

- Personal living expenses

- Entertainment (50% limited on meals)

- Fines and penalties

- Expenses without VAT receipts

- Private use portion of mixed items

- VAT-exempt service expenses

Record Retention

Maintain proper documentation to support your deductions and stay compliant.

- Keep all records for 10 years minimum

- Digital records acceptable if organized

- Proper backups essential

- ESTV can audit during this period

Cash Flow Impact: What VAT Really Means

VAT registration changes your financial reality. Understanding the impact helps you plan effectively.

The Mental Shift

Before VAT registration:

You invoice CHF 5,000. You keep CHF 5,000.

After VAT registration:

You invoice CHF 5,405 (CHF 5,000 + 8.1% VAT). You keep CHF 5,000. The CHF 405 belongs to the ESTV.

Your effective revenue doesn't change, but your invoices increase by 8.1%. Your clients pay more, but you don't keep it.

Managing Quarterly Payments

Many freelancers struggle with VAT payments because the money feels like "theirs" until the return is due.

Solution: Set aside VAT immediately when invoiced. Open a separate bank account or use accounting software that tracks VAT liability in real-time.

Example scenario:

You invoice CHF 10,810 in January (CHF 10,000 + CHF 810 VAT). Immediately move CHF 810 to your VAT account. When you file in May, the money is waiting.

Input Tax Helps Your Cash Flow

The input tax deduction reduces your VAT burden significantly.

If you invoice CHF 10,000 (CHF 810 VAT) but spend CHF 2,000 on business expenses (CHF 162 VAT), you only owe CHF 648 to ESTV.

High business expenses actually improve your VAT position. This is why voluntary registration makes sense for freelancers with significant costs.

Common Mistakes That Trigger Audits

Learn from others' errors. These mistakes attract ESTV attention and can result in penalties, interest charges, and compliance issues.

Missing Deadlines

Late registration, late filing, retroactive liability and penaltiesWrong VAT Rates

Charging incorrect rates creates problems with ESTV and clientsPoor Documentation

Incomplete invoices, missing receipts, inadequate record keepingMixing Business & Personal

Using business accounts for personal expenses raises red flagsNot Monitoring Threshold

Failing to track rolling 12-month turnover leads to non-complianceForgetting to File

Missing quarterly deadlines results in interest and penaltiesWhen to Get Professional Help

VAT compliance isn't impossibly complex, but knowing when to hire help saves money and stress.

Consider a Tax Advisor When:

You're approaching the registration threshold. A one-hour consultation before you hit CHF 100,000 prevents costly mistakes.

You have mixed Swiss and international clients. Place-of-supply rules get complicated with cross-border services.

You're audited. Don't face the ESTV alone. Professional representation pays for itself.

Your business structure changes. Moving from sole proprietor to GmbH affects VAT obligations.

You're consistently in VAT credit. An advisor can help optimize filing frequency and improve cash flow.

DIY Makes Sense When:

Your business is straightforward: Swiss clients, one VAT rate, standard services. Modern accounting software handles calculations and return preparation automatically.

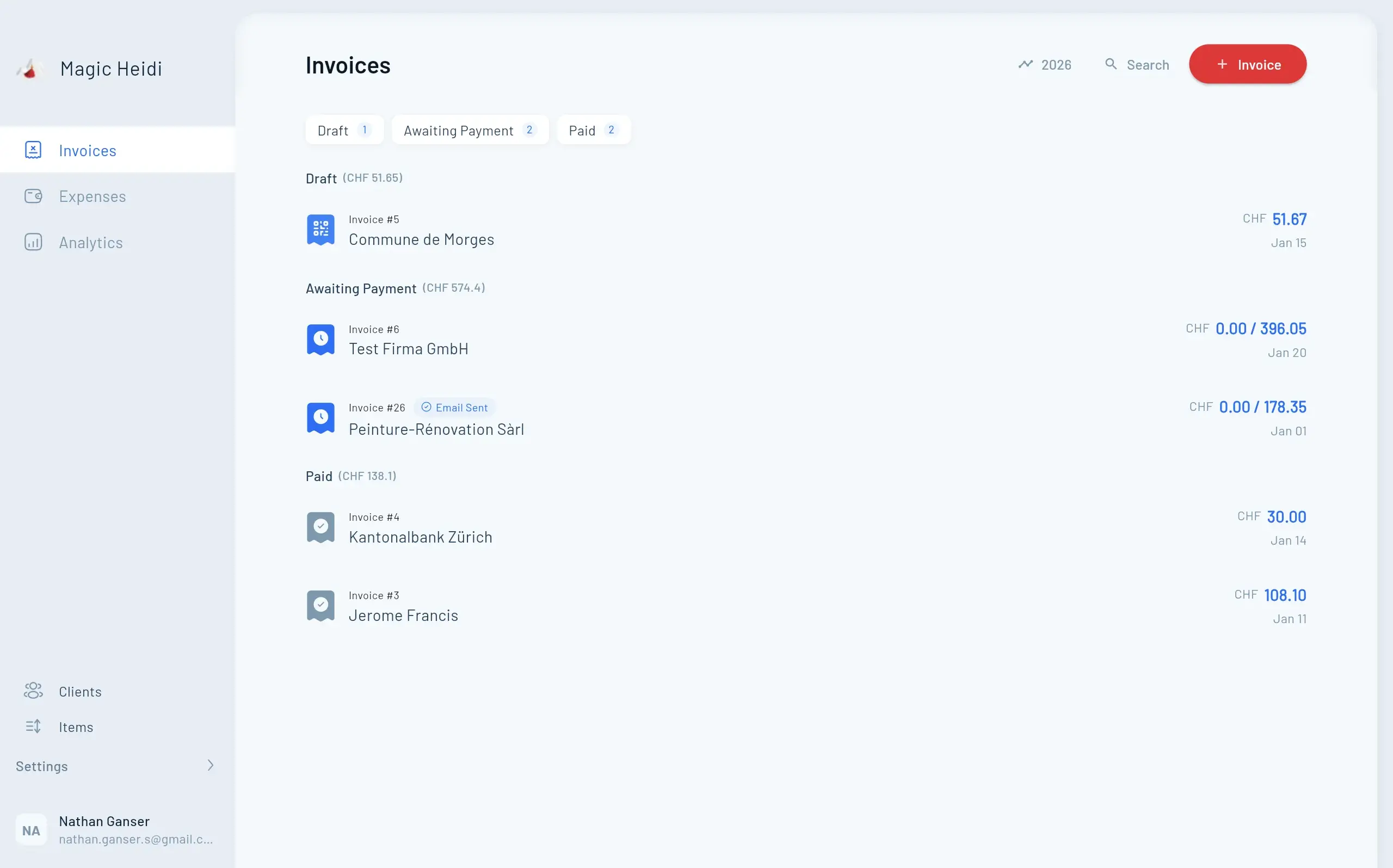

Simplifying VAT Management with Software

Manual VAT tracking works but consumes hours every quarter. Software eliminates repetitive work and reduces errors.

- 🧾Automatic Calculations

Correct VAT amounts on invoices, no manual math needed

- 📊Expense Tracking

Track input tax deductions automatically

- 🔔Threshold Monitoring

Real-time tracking of your CHF 100,000 threshold

- 📁Digital Records

Store receipts and documents for 10 years securely

- ⏰Deadline Reminders

Never miss a filing deadline again

- 📄Return Preparation

Generate ePortal-compatible reports instantly

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Magic Heidi handles all VAT requirements for Swiss freelancers

Create compliant invoices in seconds, track expenses with automatic VAT extraction, and generate quarterly return data without spreadsheets. More time creating value for clients. Less time wrestling with tax forms.

Your Next Steps

Take action based on where you are in your VAT journey.

Below CHF 100,000

Track monthly revenue, monitor rolling 12-month total, decide on voluntary registration, create registration timeline

Near CHF 100,000

Register immediately if exceeded, update invoicing system, set up VAT account, consider tax advisor consultation

Already Registered

Review VAT rate application, audit record-keeping, set automated reminders, optimize filing frequency, maximize deductions

The Bottom Line

Swiss VAT registration changes how you invoice and manage cash flow. But it's not a burden once you understand the rules:

- Register within 30 days of exceeding CHF 100,000

- Charge 8.1% on most services

- File quarterly returns within 60 days

- Deduct VAT on business expenses

- Keep records for 10 years

- Use software to automate the process

Thousands of Swiss freelancers manage VAT successfully. With the right system, you'll spend 30 minutes per quarter on compliance instead of days.

Simplify Swiss VAT Management

Try Magic Heidi free for 14 days. Create compliant MWST/TVA invoices, track expenses automatically, and prepare VAT returns without the headache.

Frequently Asked Questions

Do I need to register for VAT immediately when I start freelancing?

No. You only need to register once your annual turnover exceeds CHF 100,000 (calculated on a rolling 12-month basis). Below this threshold, registration is optional.

What happens if I don't register after exceeding CHF 100,000?

You face retroactive VAT liability from when you exceeded the threshold, plus penalties and 4.75% annual interest. The ESTV will eventually discover non-compliance through client audits or other reporting.

Can I charge VAT to clients before I'm officially registered?

No. Only charge VAT once you receive your official MWST/TVA/IVA number from the ESTV. Charging VAT without registration is illegal.

How long does VAT registration take in Switzerland?

Typically 3-4 weeks from submitting your complete application through the ePortal. Apply as soon as you exceed the threshold to avoid compliance gaps.

Do I charge VAT to clients in other countries?

Generally no for B2B clients – use 0% rate and note service provided internationally. For B2C clients abroad, it depends on where the service is consumed. Switzerland is not in the EU, so EU VAT rules don't apply.

What if I only exceed CHF 100,000 for one year, then drop below?

Once registered, you must stay registered until your turnover drops below CHF 100,000 for an entire calendar year. You can then apply for deregistration for the following year.

Can I switch from quarterly to annual filing?

Yes, if you qualify for the annual filing option (turnover under CHF 5,005,000 and good compliance record). Apply through the ePortal before the start of the year you want to switch.

What counts as business expenses for input tax deduction?

Any expense directly related to your VAT-taxable business activities: equipment, software, professional services, marketing, office supplies, business travel, and workspace costs. Keep all receipts with visible VAT amounts.