Stop Chasing Payments: Automate Your Reminders

Late payments drain your business. 85% of freelancers experience them. Learn how automation can cut late payments by 45% while preserving client relationships.

Late Payments Hit Swiss Freelancers.

Harder Than You Think.

According to Remote's 2025 Contractor Management Report, 85% of freelancers experience late payments. Even worse, 21% get paid late more often than on time. Every hour spent tracking down overdue invoices is an hour not spent on billable work.

Hours wasted

Writing follow-up emails manuallyAwkward conversations

Personally asking clients for moneyCash flow gaps

Dipping into savings to cover billsThe Real Cost of Chasing Payments

The 2025 Global Freelance Payment Analysis reveals the scale of this problem:

- 63% of freelancers wait more than 30 days for payment after completing work

- 31% experience delays exceeding 60 days

- Late payments cost the global freelance economy an estimated CHF 79 billion annually in lost productivity

A study by the Association of Independent Professionals found that 43% of freelancers have considered quitting self-employment entirely because of payment stress.

What Swiss Law Says About Payment Reminders

Here's something many Swiss freelancers don't realise: payment reminders aren't legally required in Switzerland.

5% Default Interest

Charge annual interest from the first reminder date under Swiss Code of Obligations.

Reminder Fees

Charge fees for reminders if stated in your contract or general terms.

No Waiting Period

Set 10-day, 14-day, or 30-day terms—whatever works for your business.

Immediate Collection

You can initiate Betreibung immediately after deadline—no warning needed.

The Three-Tier Reminder Process

Swiss businesses typically follow a three-step process:

- Zahlungserinnerung (payment reminder) – A friendly nudge

- Mahnung (formal dunning notice) – A firmer request with consequences mentioned

- Betreibung (debt collection proceedings) – The legal enforcement option

Automating the first two steps lets you maintain professionalism while protecting your cash flow.

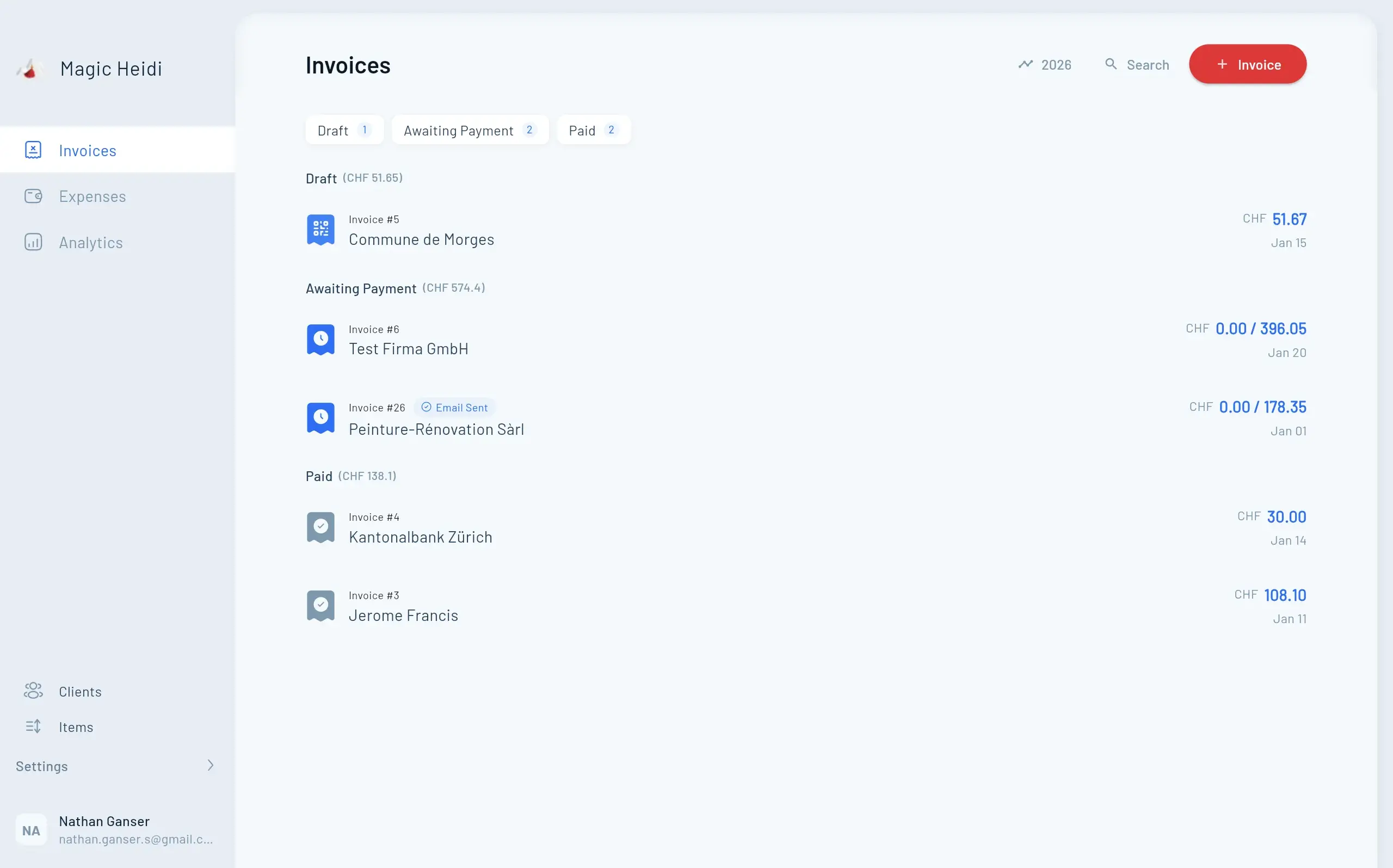

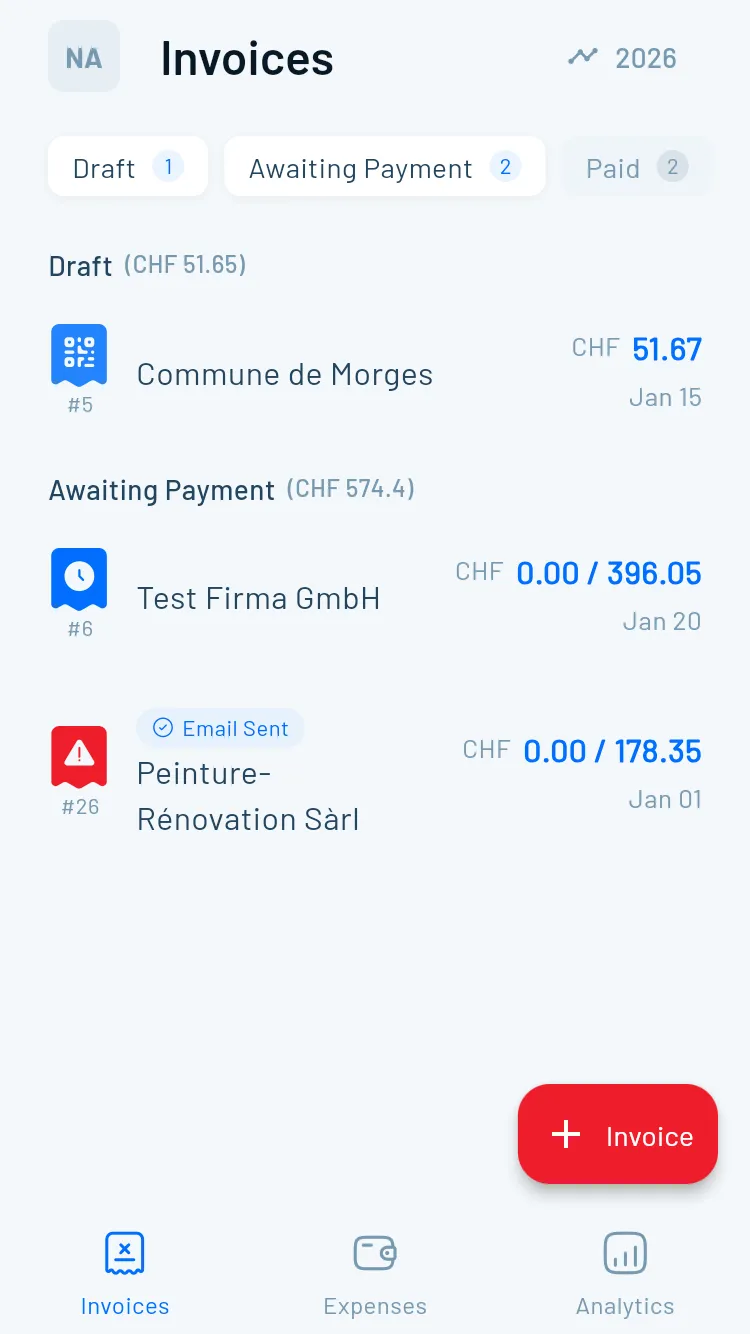

How Automated Payment Reminders Work

Instead of manually tracking due dates and writing individual follow-up emails, automation handles the entire reminder sequence. Set it up once, and the system monitors your invoices, sending reminders at exactly the right moments.

What Good Automation

Looks Like

Data from FreshBooks shows automated reminders reduce late payments by 45% on average.

Smart Detection

Automatically detects when an invoice becomes overdue.

- Real-time payment monitoring

- Instant overdue alerts

- No manual tracking needed

- Works across all invoices

Timed Reminders

Send pre-written reminders at intervals you choose.

- Customisable schedules

- Professional templates

- Multi-language support

- QR payment codes included

Full Tracking

Know exactly which reminders have been sent and when.

- Complete reminder history

- Escalation alerts

- Payment confirmation

- Client communication log

Your Automated Reminder Timeline

The most effective reminder sequence balances persistence with professionalism. Here's a Swiss-specific timeline that works.

Day 0: Invoice Sent

Send promptly with clear terms and QR-code. Since 2022, QR-invoices are the Swiss standard.

Day 7-14: First Reminder

Friendly nudge: 'Perhaps it slipped through? Here's the QR code for convenience.'

Day 15-20: Second Reminder

Firmer tone: 'Per our agreement, 5% interest applies. Please pay within 7 days.'

Day 30: Final Warning

Reference next steps: 'If unpaid in 10 days, I'll consider formal collection.'

Customising for Your Clients

Consider your client relationships when setting up automation:

- Long-term trusted clients: Start reminders later with softer language

- New clients: Stick to the standard schedule

- Large corporations: Expect 30 or 60-day standard terms

- International clients: Payment norms vary by country

Also consider language. Switzerland has four official languages, and your reminders should match your client's preference. Most Swiss invoicing software supports German, French, Italian, and English templates.

Choosing the Right

Swiss Software

Your invoicing software should make automation effortless. Look for Swiss-specific features that ensure compliance and efficiency.

Essential for Swiss compliance

DE, FR, IT, EN templates

Customisable intervals

No double entry

Best Practices for Effective Reminders

Automation handles the timing, but your messaging still matters.

Keep It Professional

Let automated reminders remove the awkwardness. Avoid emotional language.

Always Include the Invoice

Attach the original with QR payment code. Fewer steps = faster payment.

Reference Your Terms

Citing contract terms adds legitimacy. It's not personal—it's business.

Clear Next Steps

Amount due, how to pay, deadline, and contact info for questions.

When Clients Still Don't Pay

Automation handles most situations, but some clients need more intervention:

Step 1: Personal Contact

After your automated sequence, pick up the phone. Sometimes a direct conversation uncovers problems—cash flow issues, disputes, or administrative errors.

Step 2: Formal Demand Letter

Send a registered letter (Einschreiben) stating the outstanding amount, accrued interest, a 10-day deadline, and your intention to pursue legal collection.

Step 3: Betreibung (Debt Collection)

Switzerland's Betreibung system lets you pursue debts without a court judgment:

- File at the local Betreibungsamt

- Debtor has 20 days to pay or dispute

- Entry affects client's credit for 5 years

- Use only when other options fail

Step 4: Know When to Walk Away

For small amounts, collection costs may exceed the debt's value. Write off bad debt and find clients who pay reliably.

Prevent Late Payments Before They Happen

The best collection strategy is never needing one. These practices reduce late payments from the start.

- 📅Shorter Payment Terms

Use 10-14 days, not 30

- 💵Require Deposits

25-50% upfront for large projects

- ⚡Invoice Immediately

Send the moment work completes

- 🎁Early Payment Discount

2% off for payment within 10 days

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Have Clear Contracts

Your contract should specify:

- Payment terms (due date, accepted methods)

- Late payment interest (5% is standard, higher requires agreement)

- Reminder fees (if any)

- Consequences of non-payment

Vet New Clients

Ask about payment processes during onboarding. Large companies often have fixed payment cycles. Understanding this helps you set realistic expectations.

Take Control of Your Cash Flow

Automating your reminder process eliminates hours of manual follow-up, gets invoices paid 45% faster, and maintains professional relationships. The setup takes an hour. The time savings last forever.

Frequently Asked Questions

Are payment reminders legally required in Switzerland?

No. Under Swiss law, you can technically initiate debt collection (Betreibung) immediately after a payment deadline passes. However, a structured reminder process is better for maintaining client relationships and usually resolves most late payments.

What interest rate can I charge on late payments?

Under the Swiss Code of Obligations, you can charge 5% annual interest from the first reminder date. Higher rates are only valid if explicitly specified in your contract.

How much can automated reminders reduce late payments?

Data from FreshBooks shows that automated reminders reduce late payments by 45% on average. That's nearly half your late payment problems solved with a one-time setup.

What payment terms should I use as a Swiss freelancer?

While 30 days is common in Switzerland, freelancers often use 10-14 day terms. Shorter deadlines create urgency and improve cash flow.

What if a client still doesn't pay after all reminders?

After automated reminders fail, try personal contact first. If that doesn't work, send a formal demand letter via registered mail. As a last resort, you can initiate Betreibung proceedings at the local Betreibungsamt.