Withholding Tax in Switzerland: The 2026 Guide Every Freelancer Needs

If you're a foreign freelancer working in Switzerland, you've probably encountered the term 'Quellensteuer' or withholding tax. Understanding it isn't as complicated as it seems—and with the right knowledge, you can navigate Switzerland's tax system confidently while maximizing your take-home income.

If you're a foreign freelancer working in Switzerland, you've probably encountered the term "Quellensteuer" or withholding tax. It's one of those aspects of Swiss tax law that catches many off-guard—especially when you realize your clients are deducting taxes before you even see your payment.

But here's the good news: understanding withholding tax isn't as complicated as it seems. And with the right knowledge (and tools), you can navigate Switzerland's tax system confidently while maximizing your take-home income.

This guide covers everything you need to know about withholding tax in 2026, including recent updates, cantonal variations, and practical strategies for managing your tax obligations.

What is Withholding Tax (Quellensteuer)?

Withholding tax—known as "Quellensteuer" in German, "impôt à la source" in French, and "imposta alla fonte" in Italian—is a tax deducted directly from your income at the source, before you receive payment.

In Switzerland, withholding tax primarily affects foreign nationals without permanent residence status. Instead of filing an annual tax return and paying taxes later, your employer or clients deduct taxes monthly and forward them to the relevant tax authority.

Think of it as a pay-as-you-earn system that ensures foreign residents contribute their fair share of taxes, even if they leave the country mid-year.

Who Actually Pays Withholding Tax?

Here's where many freelancers get confused. Not everyone pays withholding tax in Switzerland.

You pay withholding tax if:

- You hold a B permit (residence permit) or L permit (short-term residence)

- You're a cross-border commuter (G permit) working in Switzerland

- You earn under CHF 120,000 annually from employment or self-employment

You DON'T pay withholding tax if:

- You hold a C permit (permanent residence)

- You're a Swiss citizen

- You're married to a Swiss citizen or C-permit holder

- Your annual income exceeds CHF 120,000 (you must file an ordinary tax return instead)

This CHF 120,000 threshold is crucial. Once your income crosses this line, you automatically transition from withholding tax to ordinary taxation—regardless of your permit type.

The CHF 120,000 Rule Nobody Explains

Most articles about Swiss taxes gloss over this critical threshold. But if you're a freelancer on a B or L permit, understanding the CHF 120,000 rule could save you thousands of francs.

Ordinary Tax Filing Required

Income over CHF 120,000? You must file an ordinary return, unlocking major deductions.Advance Payment System

Withholding tax becomes an advance payment against your final tax bill.Strategic Deductions

Claim home office, equipment, travel, and Pillar 3a contributions up to CHF 35,280.Real example: Marco, a freelance developer from Italy with a B permit, earned CHF 135,000 in 2025. His clients withheld approximately CHF 18,000 in taxes throughout the year. By filing an ordinary return and claiming CHF 25,000 in legitimate business deductions, he reduced his taxable income to CHF 110,000—resulting in a tax refund of CHF 4,500.

Even if you earn less than CHF 120,000, you can voluntarily request ordinary taxation to claim these deductions. This process is called "rectification" and typically makes sense if you have significant business expenses.

How Withholding Tax Rates Work in 2026

Switzerland updated its cantonal withholding tax rates in December 2025, and the variations are significant.

At the federal level, the highest tax rate caps at 11.5%. But cantons and municipalities add their own layers, creating substantial regional differences.

Real-world example from Zurich:

- A married couple with a single income of CHF 200,000: 13.7% withholding tax rate

- The same couple with dual incomes totaling CHF 200,000: 9.7% rate

That's a 4% difference—CHF 8,000 annually—based solely on how income is distributed.

Why Cantonal Variations Matter for Freelancers

If you're location-independent, choosing where to live in Switzerland directly impacts your tax burden. The difference between living in Zug versus Geneva can be 5-8% of your annual income—potentially CHF 10,000+ for higher earners.

Zug, Schwyz, Nidwalden offer competitive rates

Geneva, Basel-Stadt, Vaud reflect urban costs

Choose wisely to maximize take-home income

Up to 8% variation between cantons

The 2021 Withholding Tax Reform (Still Confusing People)

On January 1, 2021, Switzerland implemented a major withholding tax reform that many freelancers still don't understand.

What changed: Before 2021, withholding tax rates were calculated based on your primary employment income only. Side income from freelancing, consulting, or secondary jobs wasn't factored into the rate calculation.

After the reform, all gross employment income from all sources must be included when determining your applicable rate. This means if you have a part-time job earning CHF 40,000 and freelance income of CHF 60,000, your withholding tax rate is based on the combined CHF 100,000—not just one income stream.

Why this matters: Many freelancers with multiple income sources were underassessed pre-2021. The reform closed this loophole, but it also created complexity. You're now responsible for ensuring your withholding tax rate reflects your total income, not just what one client reports.

If your rate is too low, you'll face a tax bill (plus interest) when authorities catch up. If it's too high, you're essentially giving the government an interest-free loan.

VAT Obligations: The CHF 100,000 Threshold

Value Added Tax (VAT) is separate from withholding tax, but equally important for freelancers. Once your annual turnover exceeds CHF 100,000, VAT registration becomes mandatory.

Understanding Swiss VAT Rates in 2026

Switzerland operates three VAT rates, and knowing which applies to your services is crucial for compliance.

Standard Rate: 8.1%

Applies to most services and goods provided by freelancers, consultants, and service providers.

- Consulting and professional services

- Digital products and software

- Marketing and creative services

- Most B2B and B2C transactions

Reduced Rate: 2.6%

Limited to basic necessities like food products, books, newspapers, and medications.

- Food and beverages

- Books and printed materials

- Medications and healthcare

- Water supply services

Special Rate: 3.8%

Exclusively for accommodation services in the hospitality sector.

- Hotel and lodging services

- Bed & breakfast operations

- Holiday apartment rentals

- Camping and hostels

When You Must Register for VAT

Mandatory registration triggers: If your annual turnover exceeds CHF 100,000, VAT registration becomes mandatory. For Swiss-based freelancers, this means revenue from all Swiss clients.

For foreign companies providing services in Switzerland, there's a critical twist: the threshold is based on your worldwide annual turnover, not just Swiss revenue. This 2018 rule change means most foreign businesses making taxable transactions in Switzerland need VAT registration—even if their Swiss revenue is modest.

VAT Registration Process

Once you cross the CHF 100,000 threshold, here's what happens:

- Register within 30 days with your cantonal tax authority

- Receive your VAT identification number (CHE-XXX.XXX.XXX)

- Add 8.1% VAT to all invoices to Swiss clients

- File quarterly VAT returns (monthly if turnover exceeds CHF 5 million)

- Remit collected VAT minus input tax deductions

Common mistake: Many freelancers only count their freelance income toward the CHF 100,000 threshold, forgetting to include income from part-time employment or other business activities. The threshold applies to your total turnover from all sources.

For voluntary sports clubs, cultural organizations, and non-profit institutions, the threshold is higher: CHF 250,000.

Social Security Contributions: The Hidden Cost

Here's what many new freelancers in Switzerland don't budget for: social security contributions are mandatory and substantial.

Unlike employees whose employers cover half of these contributions, self-employed individuals pay the full amount themselves.

Mandatory contributions:

- AHV/IV/EO (Old Age, Disability, and Income Compensation): 5.4% to 10% of net income, depending on profit level

- Minimum threshold: CHF 2,300 annual income triggers the obligation

If your annual self-employment income is below CHF 60,000, you pay the maximum 10% rate. As income rises, the rate decreases to a minimum of 5.4%. This structure disproportionately affects freelancers in their early years.

Important: Unlike employees, self-employed individuals have no mandatory occupational pension (second pillar). However, you can voluntarily join a pension fund or maximize Pillar 3a contributions (CHF 35,280 for 2024) to secure your retirement.

You must register with your cantonal social insurance office and file annual declarations. Failing to register can result in retroactive assessments with interest charges.

Tax Deductions That Actually Move the Needle

Smart freelancers don't just pay their taxes—they optimize them. Here are the deductions that make the biggest difference.

Pillar 3a Contributions

The single most effective tax deduction for Swiss freelancers. Contributing the maximum CHF 35,280 reduces your taxable income by the full amount.

- CHF 35,280 maximum annual contribution

- Full tax deduction on contribution

- Tax-free capital growth

- CHF 8,820 savings in 25% bracket

Home Office Expenses

If you work from home in a space used exclusively for professional purposes, you can deduct proportional costs.

- Proportional rent or mortgage

- Utilities and internet

- Office furniture and equipment

- Pro-rata calculation by square meters

Professional Development

Courses, certifications, conferences, and seminars directly related to your field are fully deductible.

- Online courses and certifications

- Industry conferences and travel

- Professional licenses

- Technical books and subscriptions

More Deductible Business Expenses

Business Equipment and Software: Computers, cameras, specialized software, and tools used for your work are deductible business expenses. For items over CHF 1,000, you may need to depreciate them over their useful life rather than deducting the full cost immediately.

Client-Related Travel: Transportation, accommodation, and meals for client meetings or work-related events are deductible. Keep detailed records including:

- Purpose of travel

- Client or project name

- Receipts for all expenses

- Calendar confirmation of meetings

Home office calculation example: Your home office occupies 20 square meters of your 100-square-meter apartment. You pay CHF 2,000 monthly rent. Your deductible home office expense: 20% of CHF 24,000 = CHF 4,800 annually.

Common Tax Mistakes That Cost Freelancers

After reviewing hundreds of freelancer tax situations, these mistakes appear most frequently. Avoid them to keep more of your income.

Forgetting VAT Registration

Missing the 30-day deadline leads to fines up to CHF 5,000 plus retroactive assessments.Poor Record Keeping

Missing receipts mean rejected deductions and estimated income additions.Mixed Personal/Business Finances

Creates documentation nightmares and raises audit red flags.Underreporting Side Income

International income, crypto, and rental income surface eventually with penalties.Incorrect Permit Classification

Wrong tax status creates compliance issues and potential back-payments.Managing Withholding Tax with Modern Tools

Swiss tax compliance is complex. Between withholding tax, VAT, social security contributions, and cantonal variations, freelancers spend countless hours on administrative tasks. This is where smart automation makes a difference.

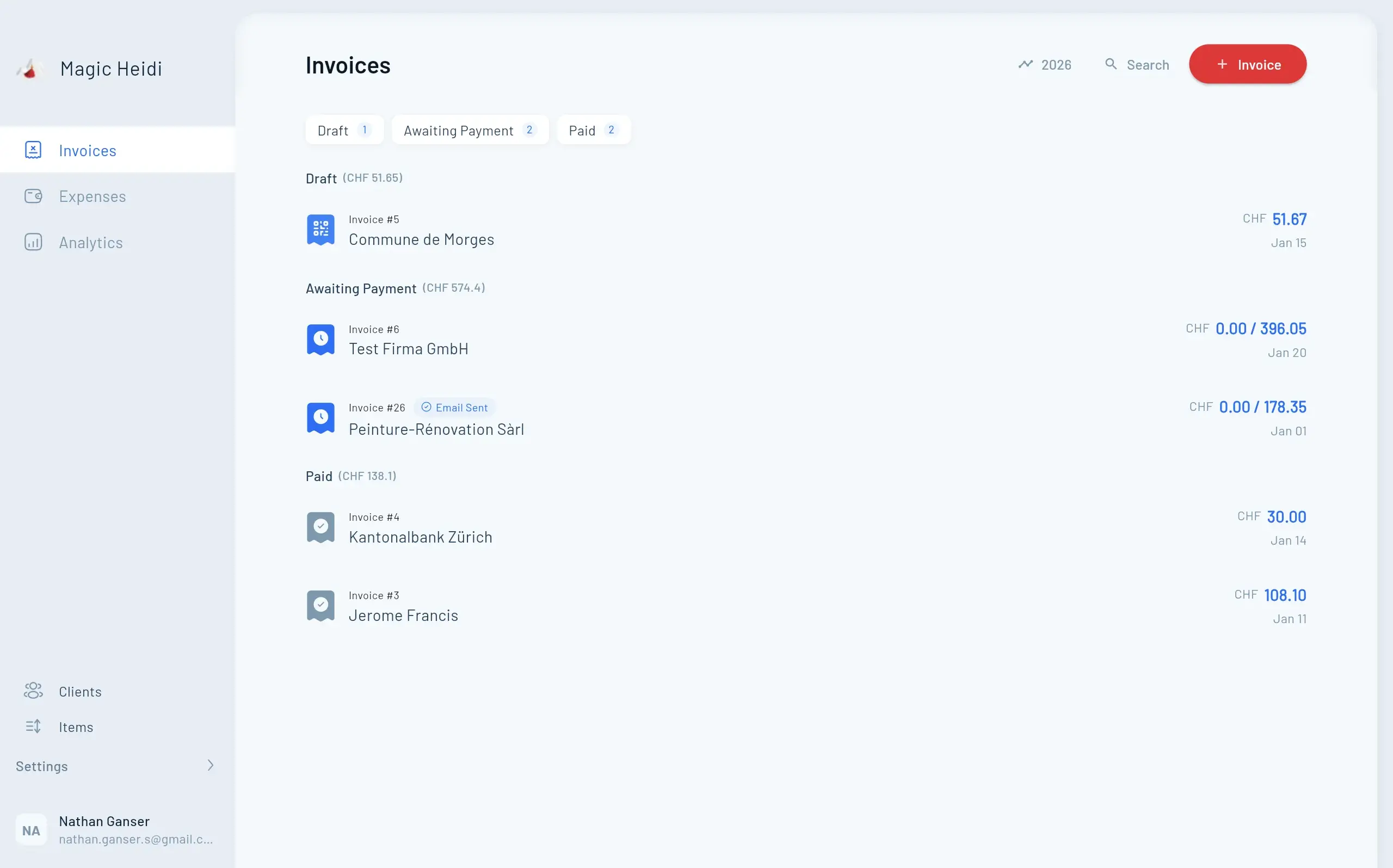

Magic Heidi: Tax Compliance Simplified

Built specifically for Swiss freelancers, with features that address the exact pain points of withholding tax, VAT, and expense tracking.

- 💰Withholding Tax Tracking

Real-time visibility into taxes withheld by clients

- 🧾Automatic VAT Calculations

Correct 8.1% VAT applied to all invoices automatically

- 📱Swiss QR Invoices

Compliant QR codes for seamless Swiss payments

- 🤖AI Expense Scanning

Snap receipts, AI extracts everything automatically

- 🌐Multi-Language Support

English, German, French, and Italian interfaces

- 💻Multi-Platform Access

iPhone, Mac, Android, web—all synced in real-time

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Simple, Transparent Swiss Pricing

CHF 25/month for unlimited invoicing, expense tracking, VAT management, and bank integration. No hidden fees or per-transaction charges.

Try Magic Heidi Free for 30 Days

No credit card required. Full access to all features.

Cross-Border Considerations

If you're a cross-border commuter (G-permit holder) or provide services to Swiss clients from abroad, additional complexities arise:

Quasi-Residence Status

Cross-border workers who derive at least 90% of their worldwide income from Swiss sources can claim "quasi-residence" status. This allows you to claim the same deductions available to Swiss residents, including:

- Professional expenses

- Insurance premiums

- Pillar 3a contributions

To qualify, file a request with your cantonal tax authority with documentation proving your income sources.

Double Taxation Agreements

Switzerland has agreements with most European countries preventing double taxation. However, you must actively claim treaty benefits—they're not automatic.

For example, if you live in France and work for Swiss clients, you may need to:

- Pay withholding tax in Switzerland (as a cross-border worker)

- Declare the income in France

- Claim a tax credit in France for Swiss taxes paid

Each country's treaty terms differ. Consult a tax advisor familiar with cross-border situations.

When to Hire a Tax Professional

While tools like Magic Heidi handle day-to-day compliance, certain situations warrant professional advice:

- Income exceeds CHF 150,000 annually (optimization opportunities increase)

- Multiple income streams across different countries

- Significant capital gains from investments or crypto

- Business structure decisions (sole proprietorship vs. GmbH/Sàrl)

- First-year transition from employee to freelancer

- Audit or dispute with tax authorities

A good Swiss tax advisor costs CHF 150-300/hour but can save you multiples of their fee through proper tax planning.

Your 2026 Tax Calendar

Mark these dates to avoid penalties and stay compliant with Swiss tax authorities.

Quarterly VAT Returns

For VAT-registered freelancers, quarterly filing deadlines are mandatory.

- January 31: Q4 2025 VAT return due

- April 30: Q1 2026 VAT return due

- July 31: Q2 2026 VAT return due

- October 31: Q3 2026 VAT return due

Annual Filings

Key annual deadlines for social security and tax returns.

- January 31, 2027: Social security declaration for 2026

- March 31, 2027: Tax return deadline (varies by canton)

- Extensions available in most cantons

- Plan ahead for documentation

Continuous Monitoring

Year-round tasks to stay on top of your tax obligations.

- Monthly: Track income vs CHF 100,000 VAT threshold

- Monthly: Monitor withholding tax deductions

- Weekly: Scan and categorize receipts

- Quarterly: Review deduction opportunities

Taking Control of Your Swiss Tax Obligations

Withholding tax doesn't have to be intimidating. With the right knowledge and tools, you can understand what you owe, claim every deduction, avoid penalties, and keep more of your hard-earned income.

Stay Organized

Track income, expenses, and withholding tax year-round.

Use Smart Tools

Swiss-specific compliance tools save hours of manual work.

Claim All Deductions

Don't leave money on the table with proper deductions.

Plan Ahead

Know your thresholds and deadlines in advance.

Ready to Simplify Swiss Tax Compliance?

Join thousands of Swiss freelancers using Magic Heidi for automated invoicing, expense tracking, and tax management.

Frequently Asked Questions

Do I need to file a tax return if I'm subject to withholding tax?

It depends. If you earn under CHF 120,000 and have no other income sources requiring a return, your withholding tax may be your final tax obligation. However, you can voluntarily file (or request rectification) to claim deductions that could result in a refund.

Can I claim deductions with withholding tax?

Yes, through rectification or by requesting taxation ordinaire ultérieure (ordinary subsequent taxation). This allows you to claim business expenses, home office costs, and Pillar 3a contributions.

What happens when I upgrade from B permit to C permit?

Your tax status changes immediately. You'll stop paying withholding tax and must file ordinary tax returns going forward. Plan for this transition, as it affects your cash flow—you'll pay taxes annually instead of monthly.

How do I know my withholding tax rate is correct?

Check your rate certificate (Quellensteuerbescheinigung) against your total income from all sources. If you have multiple income streams, your rate should reflect the combined amount. Contact your cantonal tax office if you suspect errors.

Is Magic Heidi suitable for my business?

Magic Heidi works best for freelancers and solo entrepreneurs with straightforward business models. If you have complex corporate structures, extensive inventory, or specialized industry requirements, you might need enterprise accounting software. But for most freelancers invoicing Swiss clients, handling expenses, and managing VAT, Magic Heidi provides everything you need at CHF 25/month.

Start Your Free 30-Day Trial

No credit card required. Full access to all features. Join thousands of Swiss freelancers who've automated their invoicing, expense tracking, and tax management.