Stop Marking Invoices as Paid Manually

You sent the invoice. The client paid. Now you're hunting through your bank statement, matching payments to invoices one by one. There's a faster way.

The Problem With Manual Payment

Tracking

Every Swiss freelancer knows the drill. You log into e-banking, scan transactions, then flip back to your invoicing tool to mark each invoice as paid. Miss one? Your outstanding invoice list becomes unreliable.

Time Drain

2-3 minutes per invoice adds up to hours monthlyHuman Error

Similar amounts and delayed payments create mistakesDelayed Follow-ups

Can't trust your unpaid list, so reminders don't go outHow Bank Statement Import Solves This

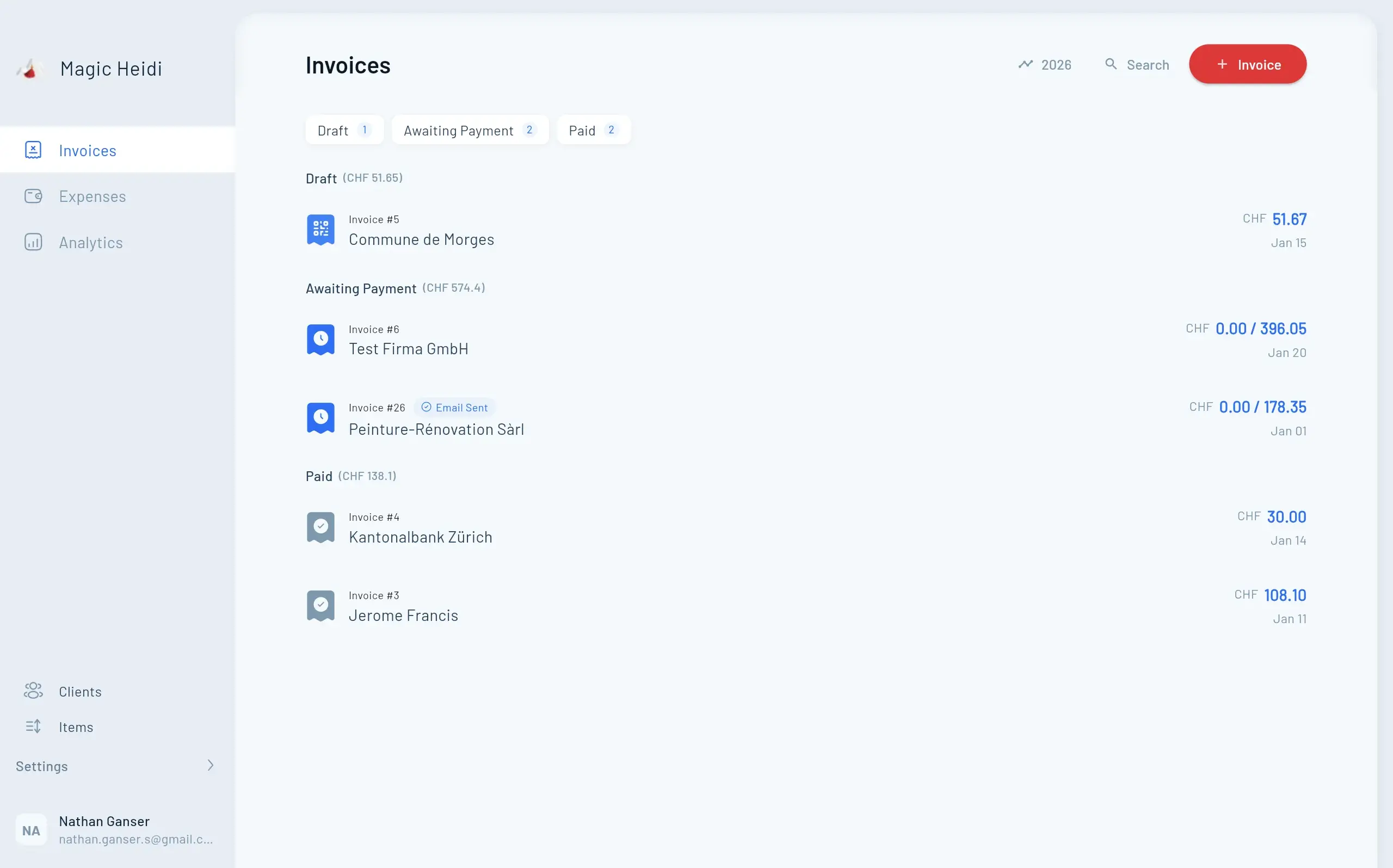

Export your bank statement once and drop it into Magic Heidi. The app reads every transaction and compares it against your open invoices. Matches are marked paid automatically. Only genuinely unpaid invoices remain visible. The entire process takes under 30 seconds.

What Makes This Different

Most Swiss accounting software demands CAMT.053 files. Magic Heidi accepts simple CSV or Excel exports instead—formats every Swiss bank offers.

Automatic Matching in 30 Seconds

Import your bank statement and let Magic Heidi do the matching work for you.

- 📥Export Statement

Download CSV or Excel from any Swiss e-banking

- 📎Drop the File

Drag into Magic Heidi or use mobile share

- ✅Review Results

Paid invoices marked automatically

- 📋See What's Outstanding

Only unpaid invoices remain visible

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

How the Matching Algorithm Works

Accurate matching requires comparing multiple data points. A single variable—like payment amount—isn't enough when you invoice CHF 1,500 to three different clients in the same month.

Magic Heidi's algorithm cross-references:

Payment amount. The primary matching criterion, accounting for minor variations from bank fees.

Transaction date. Payments typically arrive within days or weeks of invoicing. The algorithm weighs date proximity.

Reference numbers. When clients include your invoice number, matching becomes nearly certain.

Client information. Bank statements often include payer names or account details for comparison.

Historical patterns. Returning clients create recognizable patterns the algorithm learns from.

Real-World Payments Aren't Always Clean

The algorithm accounts for common complications in Swiss freelance billing.

Works With Every

Swiss Bank

Every bank offering CSV or Excel exports is compatible. In practice, this means all of them.

UBS, PostFinance, Credit Suisse

ZKB, BCGE, BCV, BEKB, and all others

Raiffeisen, Migros Bank, Cler

Neon, Yuh, and more

Security Without Credential Sharing

Some tools require your e-banking login. That's a security risk. Magic Heidi takes a different approach—you export statements yourself. Your banking credentials never leave your control. No bank login stored externally. No ongoing connection to monitor. No exposure if servers were compromised.

Where Does the Data Go?

Imported bank statement data stays on Swiss servers, subject to Swiss data protection law. The file contents are processed for matching and stored only as long as needed for your records. No transaction data gets shared with third parties or used for purposes beyond your invoicing.

Real Time Savings for Swiss Freelancers

The math is simple: stop wasting hours on administrative work.

Frequently Asked Questions

What file formats are supported?

CSV and Excel files (.xlsx, .xls) from any Swiss bank. CAMT.053 and CAMT.054 files also work if that's what you prefer to export.

What if a payment doesn't match any invoice?

Unmatched transactions are ignored—they might be personal transfers, subscriptions, or other non-invoice items. The algorithm only marks invoices when confident in a match.

Can I undo an incorrect match?

Yes. If the algorithm matches the wrong invoice (rare with multiple data points aligning), you can manually correct it. The invoice returns to unpaid status.

Does this work with multiple currencies?

Yes. The algorithm matches based on the transaction currency and amount. CHF, EUR, USD, and other currencies commonly used by Swiss freelancers are all handled.

How often should I import statements?

Most freelancers import monthly, aligning with their billing cycle. You can import more frequently for real-time visibility, or less frequently if invoicing is sporadic.

What if I use multiple bank accounts?

Import statements from each account separately. The algorithm processes them independently and matches against your full invoice database.

Does this replace proper accounting?

Bank statement import handles payment tracking. For full bookkeeping including expense categorization, VAT handling, and financial reporting, see Magic Heidi's accounting features.

Stop Wasting Time on Payment Tracking

Export your bank statement. Drop it into Magic Heidi. See exactly which invoices remain unpaid. Bank statement import is included with all plans.