Banana Accounting for Swiss Freelancers: Is This Swiss Classic Still Worth It?

For over 30 years, Banana Accounting has been a fixture in Swiss freelance finance. With over 400,000 licenses sold worldwide and a dominant position in the Swiss market, it's the accounting software your accountant probably knows by heart. But is its traditional, desktop-first approach still the right fit for how you work today?

What Is Banana Accounting?

Banana Accounting is a Swiss-developed desktop accounting software designed for small businesses, freelancers, and non-profits. Think of it as the Swiss Army knife of accounting: reliable, no-frills, and built for users who value control over convenience.

The core philosophy: Give users complete financial control through a spreadsheet-like interface, with local data storage and offline functionality. No cloud dependency. No monthly subscriptions. Just straightforward accounting fundamentals.

Market position: Banana is the most widely used accounting program among Swiss small enterprises and freelancers. It's the tool your fiduciary likely knows how to work with, and it's been refined specifically for Swiss tax requirements over three decades.

Pricing: What Banana

Actually Costs

Let's start with the numbers, because Banana's pricing structure is genuinely different from most modern software.

Free Plan

Up to 70 transactions, unlimited Cash Book & Timesheet. Perfect for minimal-activity side businesses.

- 70 transactions included

- Unlimited Cash Book

- Unlimited Timesheet

- No credit card required

Professional Plan

CHF 89/year for turnover under CHF 100,000. This is an annual cost, not monthly.

- Unlimited transactions

- All core features

- Swiss VAT support

- Multi-currency support

Advanced Plan

CHF 179/year for turnover over CHF 100,000, includes automation rules for bank imports.

- Everything in Professional

- Automation rules

- Advanced reporting

- Priority support

Key difference: This is an annual cost, not monthly. Compare that to cloud alternatives running CHF 19-100 per month (CHF 228-1,200 annually).

For budget-conscious freelancers starting out, Banana's CHF 89 annual cost is genuinely competitive. The free plan with 70 transactions can work for minimal-activity side businesses.

The catch: These are subscription costs, not one-time purchases. You need to renew annually to continue using the software and receive updates.

What Banana Actually Does

Understanding the real capabilities and workflows behind the interface.

Comprehensive Bookkeeping

Complete control over every financial entry with familiar spreadsheet interface.

Swiss VAT Management

Handle all Swiss VAT requirements with manual control and precision.

QR Invoice Support

Generate compliant QR invoices meeting Swiss legal requirements.

Multi-Currency

Critical support for international freelancers handling multiple currencies.

Spreadsheet-Style Financial Control

Banana's interface looks like Excel because it essentially is—a specialized spreadsheet for accounting. You'll see columns for account numbers, descriptions, debits, credits, and dates. Complete control over every financial entry with the ability to copy/paste from Excel.

What This Means in Practice

The advanced feature set includes:

- Multi-currency support (critical for international freelancers)

- Segments for tracking different business units

- Budget planning and comparison

- Cost accounting features

- Support for double-entry bookkeeping (required for larger Swiss businesses)

- Option for simplified income/expenditure accounting (milk-book method for sole proprietors under CHF 500,000)

Banana generates standard financial reports: balance sheets, income statements, and cash flow reports. These are thorough and detailed but text-heavy—don't expect colorful dashboards or visual insights.

Reality check: These features are powerful but require accounting knowledge to use effectively. Banana doesn't hold your hand through setup.

VAT Management for Swiss Compliance

If your freelance revenue exceeds CHF 100,000 annually, you must register for VAT in Switzerland. Banana handles Swiss VAT requirements but takes a hands-on approach.

How it works:

- Apply VAT codes to transactions manually

- Categorize expenses with appropriate VAT rates

- Generate VAT summaries for quarterly submissions

- Support for all Swiss VAT rates and changes

The learning curve: Banana assumes you understand Swiss VAT fundamentals. It won't automatically suggest which VAT code applies to your coffee meeting expense or software subscription. You need to know—or learn—the rules.

For VAT-registered freelancers comfortable with Swiss tax requirements, this works well. For newcomers, expect time investment or guidance from your accountant.

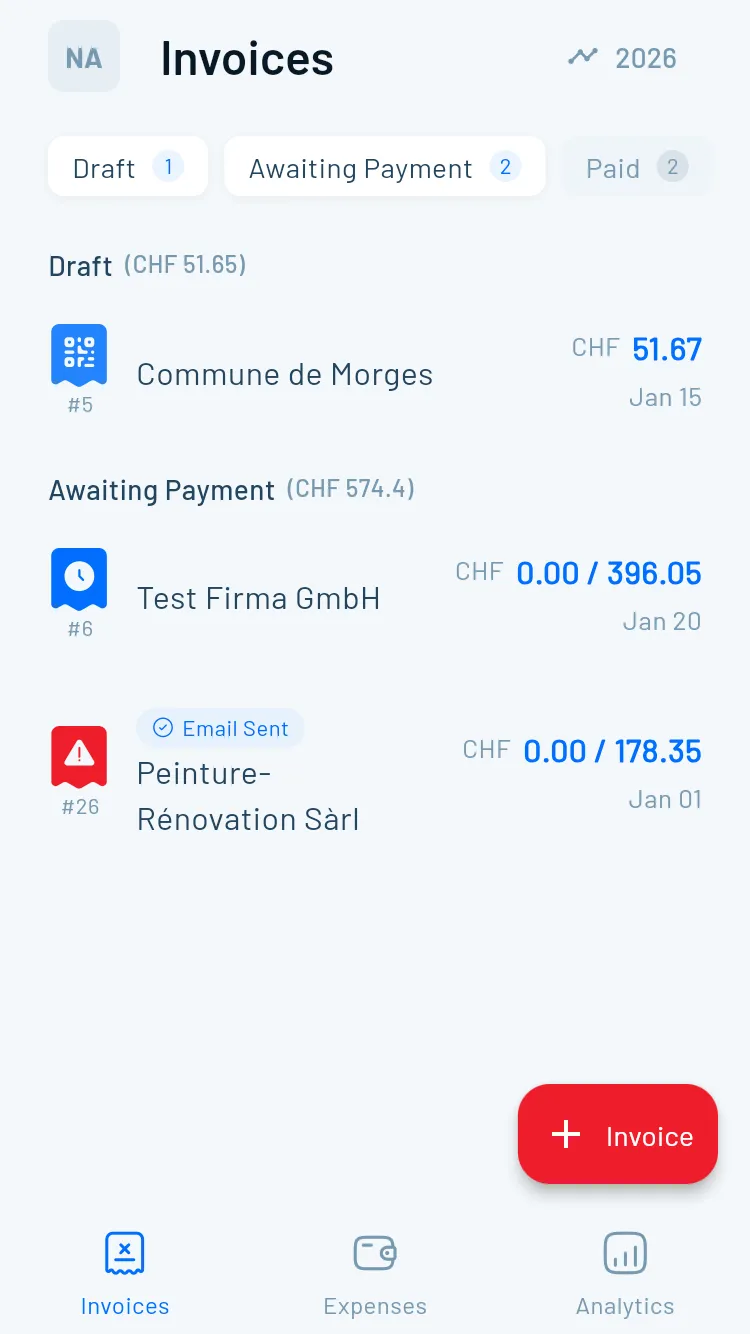

Invoicing: Two Methods,

Different Workflows

Here's where Banana's approach diverges significantly from modern cloud software—and where misunderstandings happen.

Two Invoicing Methods

Integrated or separate app—both require manual workNo Automation

No automated sending, payment tracking, or remindersManual Reconciliation

Disconnect between invoicing and accounting filesBanana offers TWO invoicing methods:

Method 1: Integrated Invoicing

Create invoices directly in your main accounting file's Transactions table. The invoice becomes a normal accounting transaction, automatically integrated with your books.

Pros: Everything in one place, immediate accounting integration

Cons: Less visual, requires more accounting knowledge

Method 2: Estimates & Invoices App

A separate application specifically for creating professional-looking quotes and invoices, without direct connection to your accounting file.

Pros: Better visual templates, easier for client-facing documents

Cons: Separate from accounting, manual reconciliation needed

What's missing:

- No automated invoice sending by email

- No payment reminders or tracking

- No integrated payment links

- No connection to timesheet or inventory apps

The reality: Banana's invoicing works but feels dated compared to integrated cloud platforms where you create an invoice, send it automatically, track payment status, and reconcile—all in one workflow.

Mobile Apps and Cloud Access: The Misunderstood Reality

Banana DOES have iOS and Android apps—contrary to some outdated reviews. However, the mobile experience has significant limitations: cannot import/export files, cannot print or create PDFs, optimized for tablets not phones, and primarily useful for viewing data while traveling.

Cloud access: Banana is desktop-installed software, but you CAN sync files through cloud storage services like Dropbox, iCloud, or OneDrive.

How it works:

- Save your Banana files to a cloud-synced folder

- Access from multiple computers

- Banana works completely offline, syncing happens at the file level

What this is NOT:

- Not real-time cloud collaboration

- Not accessible from any web browser

- Not automatic cloud backup (you must set this up manually)

The reality: You can access Banana files across devices via cloud storage, but it's not the seamless, anywhere-access experience of true cloud software.

Data Storage and Security

Banana stores all financial data locally on your device. No external servers. No cloud dependency.

For privacy-conscious freelancers, this means:

- Complete data control

- No third-party access to financial information

- Works without internet connection

- No concerns about cloud service outages

The trade-off:

- Your data is only as safe as your backup strategy

- Computer failure or theft means potential data loss unless you back up

- No automatic disaster recovery

- You're responsible for security and backups

Many Swiss freelancers specifically choose Banana for this local-storage approach, particularly those handling sensitive client information.

Who Should Actually

Use Banana Accounting?

Banana isn't for everyone—and that's okay. Here are the freelancer profiles where Banana genuinely makes sense:

You understand bookkeeping fundamentals or want to learn

You handle sensitive client data and prefer local storage

CHF 89/year fits your lean startup budget

You work primarily from one or two computers

Ideal Banana Users

The Accounting-Literate Freelancer

You understand bookkeeping fundamentals or want to learn. You're comfortable with debits, credits, and account structures. Banana's depth appeals to you.

The Privacy-First Professional

You handle sensitive client data (lawyers, therapists, consultants) and prefer local storage over cloud servers. Data control trumps convenience.

The Budget-Conscious Starter

CHF 89/year (or free for minimal transactions) fits your lean startup budget better than CHF 30-50/month cloud subscriptions.

The Desktop-Centered Worker

You primarily work from one or two computers, not across multiple devices while traveling. Your workflow is office-based.

The Excel Power User

Spreadsheets feel natural to you. You appreciate the ability to copy/paste and manipulate data directly.

The Offline Worker

You work in locations with unreliable internet or prefer not depending on connectivity for business operations.

Poor Banana Fits

The Mobile-First Freelancer

You invoice clients from your phone between meetings. You need full functionality on the go. Banana's limited mobile experience will frustrate you.

The Automation Seeker

You want software that auto-categorizes expenses, sends invoice reminders, and requires minimal manual input. Banana's hands-on approach isn't for you.

The Accounting Novice

You're confused by financial terminology and need guided workflows. Banana's steep learning curve will slow you down without accounting foundation.

The Multi-Device Juggler

You switch between desktop, laptop, tablet, and phone constantly. True cloud synchronization is essential for your workflow.

The Rapid Scaler

You're planning to hire employees soon or grow beyond solo freelancing. You'll likely outgrow Banana's structure quickly.

Honest Limitations You Should Know

Let's address what Banana genuinely doesn't do well.

Steep Learning Curve

Overwhelming interface for beginners without guided setup wizards.

Dated Interface

Text-heavy spreadsheet layout feels like a time warp compared to modern design.

Fragmented Workflow

Creating invoices and reconciling payments requires multiple manual steps.

Limited Automation

Minimal automation compared to AI-powered alternatives.

No Collaboration

Each subscription is personal—difficult for team or accountant access.

Manual Categorization

You'll spend time manually categorizing transactions and applying VAT codes.

Banana vs. Modern Alternatives

Direct comparison with representative cloud alternatives without excessive bias.

| Feature | Banana | Magic Heidi | bexio | KLARA |

|---|---|---|---|---|

| Annual Cost | CHF 89-179 | ~CHF 600+ | ~CHF 420+ | Free-CHF 228 |

| Interface | Spreadsheet-based | ✓ Modern, AI-driven | Dashboard | Simple |

| Invoicing | Two methods, manual | ✓ Integrated | ✓ Integrated | ✓ Automated |

| VAT | Manual setup | ✓ Automated | ✓ Automated | ✓ Automated |

| Mobile | ⚠ Limited apps | ✓ Full mobile | ✓ Full mobile | ✓ Full mobile |

| Cloud Access | Via file sync | ✓ Native cloud | ✓ Native cloud | ✓ Native cloud |

| Automation | ✗ Minimal | ✓ AI-powered | ⚠ Moderate | ✓ High (42%) |

| Learning Curve | ✗ Steep | ✓ Gentle | ⚠ Moderate | ✓ Gentle |

| Offline Work | ✓ Full functionality | ⚠ Limited | ⚠ Limited | ⚠ Limited |

| Data Control | ✓ Complete (local) | Provider-managed | Provider-managed | Provider-managed |

The cost reality check:

- Banana: CHF 89/year = CHF 7.42/month

- Cloud alternatives: CHF 19-100/month = CHF 228-1,200/year

If you invoice 10 clients monthly and Banana's manual invoicing costs you 15 extra minutes vs. automated cloud tools, that's 2.5 hours monthly. At your freelance rate, does that time cost more than the subscription difference?

When Banana wins:

- Annual cost matters more than time savings

- You value data privacy and local storage

- Offline functionality is essential

- You're comfortable with accounting fundamentals

- Your fiduciary prefers working with Banana files

When alternatives win:

- You prioritize time efficiency and automation

- Mobile-first workflow is critical

- You're accounting-averse and need guidance

- Integrated invoicing saves meaningful time

- You plan to scale beyond solo freelancing

A Day With Banana Accounting

Morning: Manual coffee expense entry. Midday: Import bank statements and reconcile. Afternoon: Create invoice in separate app, export PDF, email manually. Evening: Review detailed reports. Time investment: 20-30 minutes daily on financial tasks.

Morning: You meet a client for coffee (CHF 8.50). Back at your desk, you open Banana, navigate to the Transactions table, manually enter the expense, select the correct account code, apply the appropriate VAT code, and add "Client meeting" in the description field.

Midday: A client payment arrives. You download your bank statement CSV, import it into Banana, and use rules (if you have the Advanced plan) to automatically categorize known transactions. You manually mark the invoice as paid in your separate invoicing system or accounting file.

Afternoon: Time to invoice a new client. You open the Estimates & Invoices app, create a professional invoice with your QR code, export it as PDF, and email it manually. Later, you'll need to record this invoice in your main accounting file to track it.

Evening: You review your monthly financial summary. Banana generates detailed reports showing exactly where you stand, but you need to interpret the numbers yourself—no AI insights or visualizations.

Time investment: Maybe 20-30 minutes daily on financial tasks, assuming you're comfortable with the workflow.

Compare this to cloud alternatives where you photograph the receipt (AI categorizes it), payment auto-reconciles with the invoice you sent through the app, and dashboards visualize your financial health.

The question: Is the time difference worth the subscription cost difference for your specific situation?

Making Your Decision

Ask yourself these questions honestly to determine if Banana is right for you.

Financial Questions

What's my monthly income? How many transactions? What's my hourly rate?

Workflow Questions

Do I work from one location or multiple devices? Am I comfortable with spreadsheets?

Privacy & Control

How sensitive is my data? Do I prefer cloud vs. local storage?

Growth Questions

Will I stay solo or hire employees? Am I planning to scale significantly?

Financial Questions

- What's my current monthly freelance income?

- How many transactions do I process monthly?

- What's my hourly freelance rate?

- How much time could automation save me monthly?

- Does that time savings justify a higher subscription cost?

Workflow Questions

- Do I work primarily from one location or multiple devices?

- How comfortable am I with spreadsheets and accounting concepts?

- Do I need mobile access to create invoices and enter expenses?

- How important is offline functionality to my work?

- Am I willing to invest time learning accounting fundamentals?

Privacy & Control Questions

- How sensitive is my client data?

- Do I have strong preferences about cloud vs. local storage?

- Am I disciplined about regular data backups?

- Does my industry have specific data residency requirements?

Growth Questions

- Will I stay solo freelance or hire employees?

- Do I plan to scale revenue significantly?

- Will I need inventory or project management features?

- Am I looking for a 1-year solution or a 5-year platform?

If you answered:

- "Budget is tight, I'm tech-savvy, I work from my desk, and I value privacy" → Banana makes sense

- "Time is precious, I work on-the-go, I'm accounting-averse, and I plan to grow" → Consider cloud alternatives

Getting Started With Banana

(If You Choose It)

Setup essentials and what to expect in your first week.

Installation & Setup

Download from banana.ch (Windows, Mac, Linux) and choose your accounting template.

- Download and install software

- Choose income/expenditure or double-entry

- Configure chart of accounts

- Set up VAT codes

Invoicing Configuration

Create your invoicing workflow using integrated or separate app method.

- Choose invoicing method

- Set up templates

- Configure QR invoice details

- Test with practice invoices

Backup & Security

Establish a reliable backup routine using cloud sync or external drives.

- Set up cloud sync or external backup

- Test restore process

- Schedule regular backups

- Document your workflow

Time investment: Plan 2-4 hours for initial setup, more if you're new to accounting concepts.

Resources:

- Banana's help documentation is thorough and Swiss-specific

- Community forums for troubleshooting

- Your accountant/fiduciary likely knows the software

- YouTube tutorials available (search in German, French, Italian for Swiss-specific content)

Banana in 2026

Banana Accounting is not the 'best' or 'worst' accounting software for Swiss freelancers—it's a specific tool for specific users. Proven Swiss reliability over 30 years, unbeatable annual cost for budget-conscious starters, but with manual workflows and a steep learning curve.

Banana's Genuine

Value & Limitations

Understanding both sides helps you make an informed decision.

Over 30 years of Swiss-specific development

CHF 89/year for budget-conscious starters

Local storage with full privacy

Works without internet connection

The honest recommendation:

Choose Banana if you're a desktop-centered, budget-conscious, privacy-focused freelancer comfortable with accounting fundamentals who values control over convenience.

Consider cloud alternatives like Magic Heidi, bexio, or KLARA if you prioritize time savings, mobile-first workflows, automation, and ease of use over cost optimization.

Neither choice is wrong—they're different solutions for different freelancer profiles.

Ready to Decide?

Try Banana's free plan (70 transactions) to experience the interface firsthand. If it feels intuitive after a week of testing, you're likely a good fit. Or explore Magic Heidi if you want a modern, AI-powered alternative built for Swiss freelancers who value time over budget optimization.

What matters most to you: saving CHF 300/year, or saving 5 hours/month? Your honest answer to that question reveals your ideal choice.

The best accounting software is the one you'll actually use consistently—not the one that looks best on paper.