2024 Tax Return for Self-Employed: Your Complete Swiss Guide

Tax season is stressful—especially when you're self-employed and managing everything alone. Between understanding which forms you need, calculating AVS contributions, and maximizing deductions, it's easy to feel overwhelmed. This guide walks you through everything you need to complete your 2024 tax return in Switzerland with confidence.

Quick Facts: What You Need to Know Right Now

Most cantons grant automatic extensions until September-December if requested before the March deadline. AVS contribution: 10% on income above CHF 60,500. Keep all documents for 10 years. Digital filing available in all cantons since 2024.

March 31, 2025

Deadline (varies by canton—extensions available)Form 15a or 15

Plus Form 02 for your personal returnCHF 36,288

Max pillar 3a deduction for 2025Are You Self-Employed for Tax Purposes?

For Swiss tax purposes, you're considered self-employed (and need to file as such) if you:

✓ Issue invoices in your own name

✓ Work for multiple clients

✓ Bear your own business risk

✓ Make your own business decisions

✓ Use your own equipment and tools

Important: Self-employed individuals are taxed as natural persons (individuals), not legal entities (companies). Your business income goes on your personal tax return.

Mixed Status?

Many people are both employed and self-employed (e.g., part-time job + freelance work). You'll report both income sources but file as a natural person.

Understanding Your Accounting Requirements

Your annual revenue determines which accounting method you must use—and which forms you'll complete.

Under CHF 100k

Simplified 'Milk Book' accounting. Track income and expenses chronologically as cash moves. Form 15a required.

CHF 100k - CHF 500k

Simplified with Inventory. Track income/expenses by invoice date, count year-end inventory. Form 15a required.

Over CHF 500k

Commercial Double-Entry. Full balance sheet, income statement, and notes required. Form 15 required.

What's a "milk book"?

This traditional Swiss term refers to simple chronological record-keeping—like farmers tracking milk sales. You record money when it actually comes in or goes out.

VAT Registration: A Separate Decision

VAT registration becomes mandatory at CHF 100,000 annual revenue. However, it's separate from income tax.

Consider early voluntary registration if:

- You're making significant equipment investments (recover VAT on purchases)

- You have high startup costs

- Your clients are mostly VAT-registered businesses

Note: VAT doesn't affect your income tax calculation. You report revenue excluding VAT, and you can't deduct VAT paid as a business expense (you recover it separately through VAT returns).

Key Deadlines by Canton

Most cantons require your 2024 tax return by March 31, 2025. Here are notable variations.

Pro tip: File an extension request before the deadline, even if you're not sure you'll need it. It's free or low-cost and removes deadline stress.

Forms You'll Need:

A Clear Breakdown

Understanding which forms to use and what information they require.

Form 02: Natural Persons Tax Declaration

This is your main personal tax return. Every taxpayer completes this, whether employed or self-employed. Section you'll focus on: Part 2, number 2—'Income from self-employed activity'. This section requires information from your business questionnaire (Form 15 or 15a).

- Required for all taxpayers

- Includes personal and business income

- References Forms 15/15a data

- Available digitally in all cantons

Form 15a: Simplified Accounting Questionnaire

Use this if: Your revenue is under CHF 500,000. Most freelancers and small self-employed businesses use this form.

- Total revenue (turnover)

- Business expenses by category

- Private withdrawals and contributions

- Vehicle usage (business vs. private)

- Home office expenses

- Inventory (if applicable)

- Asset depreciation

- Attach: Income/expense records, bank statements, depreciation schedule

Form 15: Commercial Accounting Questionnaire

Use this if: Your revenue exceeds CHF 500,000. This level requires professional accounting. Most self-employed individuals at this revenue level work with fiduciaries or accountants.

- Balance sheet

- Income statement

- Notes explaining inventory, depreciation, and reserves

- Private and capital account statements

Maximizing Your Deductions: Keep More of What You Earn

Smart deductions reduce your taxable income legally. Here's what you can deduct and how to calculate them correctly.

Pillar 3a: Your Biggest Deduction

Self-employed without a 2nd pillar pension: Up to CHF 36,288 (2025)

Self-employed with a 2nd pillar pension: Only CHF 7,258 (2025)

This retirement saving also reduces your tax burden immediately. If you haven't maxed out your pillar 3a contribution, consider doing so before year-end.

Business Expense Categories

Fully Deductible Expenses:

- Professional fees and subscriptions

- Business insurance

- Office supplies and software

- Marketing and advertising

- Professional development courses

- Travel for business purposes

- Workspace costs (office rent or home office)

- Subcontractor payments

- Banking and accounting fees

Partially Deductible Expenses:

- Vehicle usage (business percentage only)

- Phone and internet (business percentage only)

- Home office (proportional to space and usage)

- Meals during business travel (with limits)

Vehicle Deductions: Calculate Your Business Use

Swiss tax authorities accept two methods:

1. Mileage logbook method:

- Track all business trips with dates, destinations, and purposes

- Calculate: (Business km / Total km) × Total vehicle costs

- Most accurate for vehicles used heavily for business

2. Flat rate method:

- CHF 0.70 per business kilometer

- Simpler if you use your vehicle occasionally for business

Example: If you drive 30,000 km annually and 12,000 km are for business:

- Business use: 40%

- If total car costs are CHF 8,000: Deduct CHF 3,200

Home Office Deductions

Requirements:

- Dedicated workspace used exclusively for business

- Necessary for your professional activity

- Not available elsewhere (e.g., client offices)

Calculation methods:

1. Square meter method:

(Office space m² / Total home m²) × Rent + proportional utilities

2. Room method:

(Number of office rooms / Total rooms) × Rent + proportional utilities

Example: 20m² office in a 100m² apartment renting for CHF 2,000/month:

- Deductible: CHF 400/month × 12 = CHF 4,800 annually

Depreciation: Spreading Major Purchases

You can't deduct the full cost of major equipment in the year you buy it. Instead, you depreciate it over its useful life.

Common depreciation rates:

- Computer equipment: 40% per year (33% declining balance)

- Office furniture: 20% per year

- Vehicles: 20-30% per year

- Software: 33-50% per year

- Technical equipment: 20-40% per year

Example: Laptop purchase

- Purchase price: CHF 2,000

- Year 1 depreciation (40%): CHF 800

- Remaining value: CHF 1,200

- Year 2 depreciation (40% of CHF 1,200): CHF 480

- And so on...

Medical Expenses

You can deduct medical expenses (including health insurance premiums) exceeding 5% of your net income.

Example:

- Net income: CHF 80,000

- Threshold: CHF 4,000 (5%)

- Medical costs: CHF 6,500

- Deductible: CHF 2,500

Understanding AVS Contributions

As a self-employed person, you pay AVS (social security) contributions directly—unlike employees whose employers pay half.

10% flat rate

Degressive scale from 5.371% to 10%

CHF 530 annually (even if income is low or zero)

AVS contributions reduce your taxable income

What's Included in the 10%?

- AVS (Old-age insurance): 8.1%

- AI (Disability insurance): 1.4%

- APG (Income compensation): 0.5%

- Plus administrative fees (capped at 5% of contributions)

Example calculation:

- Self-employed income: CHF 75,000

- AVS/AI/APG contribution: CHF 7,500 (10%)

- Administrative fee: CHF 200 (approximately)

- Total: CHF 7,700

Good news: AVS contributions are tax-deductible as social security expenses.

Common Mistakes That Cost Money

Avoid these errors that trigger penalties or missed deductions.

Missing Deadline Without Extension

Penalty: Up to CHF 10,000 for non-declaration. Solution: Mark your calendar for February to request an extension.

Mixing Business and Personal

Problem: Unable to prove business usage during audits. Solution: Use separate bank accounts and credit cards for business.

Forgetting Foreign Income

Requirement: Switzerland taxes worldwide income. Solution: Include all international earnings, even from foreign platforms or clients.

Incorrect Business Percentages

Problem: Overestimating business usage without documentation. Solution: Keep detailed logs for vehicles, phones, and home office.

Not Keeping Receipts

Requirement: 10-year retention for all business documents. Solution: Use accounting software that stores digital receipts automatically.

Claiming Full Asset Costs

Rule: Major purchases must be depreciated over time. Solution: Apply correct depreciation rates from year one.

Completing Your Tax Return

A month-by-month timeline to help you prepare and file your 2024 tax return without stress.

Month-by-Month Preparation

January-February:

- Download forms from your cantonal tax website

- Gather all 2024 bank statements

- Collect receipts and invoices

- Calculate total revenue and expenses

- Request deadline extension if needed

March:

- Complete Form 15a or 15 with your business numbers

- Calculate depreciation schedules

- Determine business use percentages

- Fill out Form 02 (main tax return)

- Double-check AVS calculations

April-May (if extended):

- Review for missed deductions

- Verify all attachments included

- Submit digitally or by mail

- Keep copies of everything

Pro Tips for Faster Filing

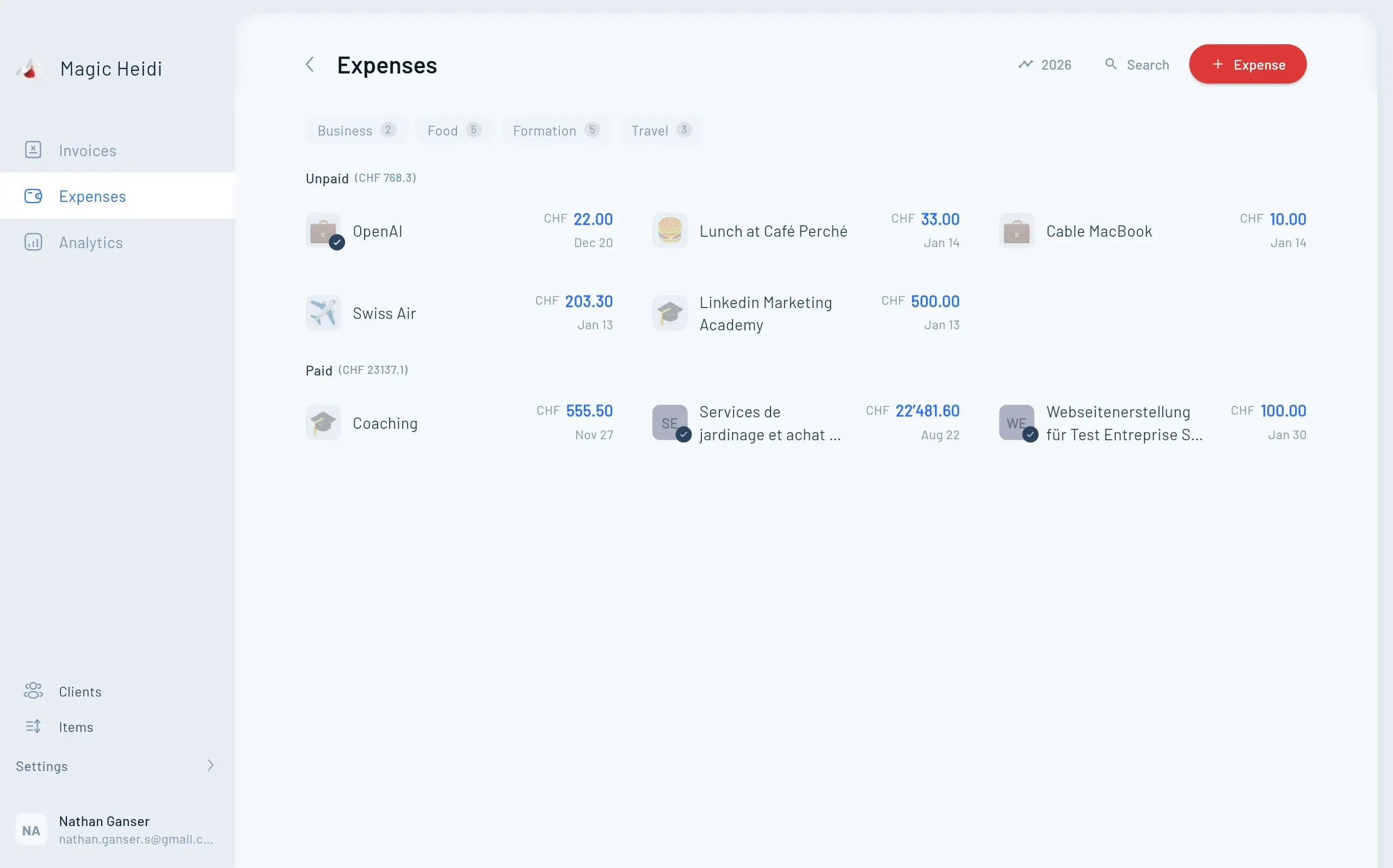

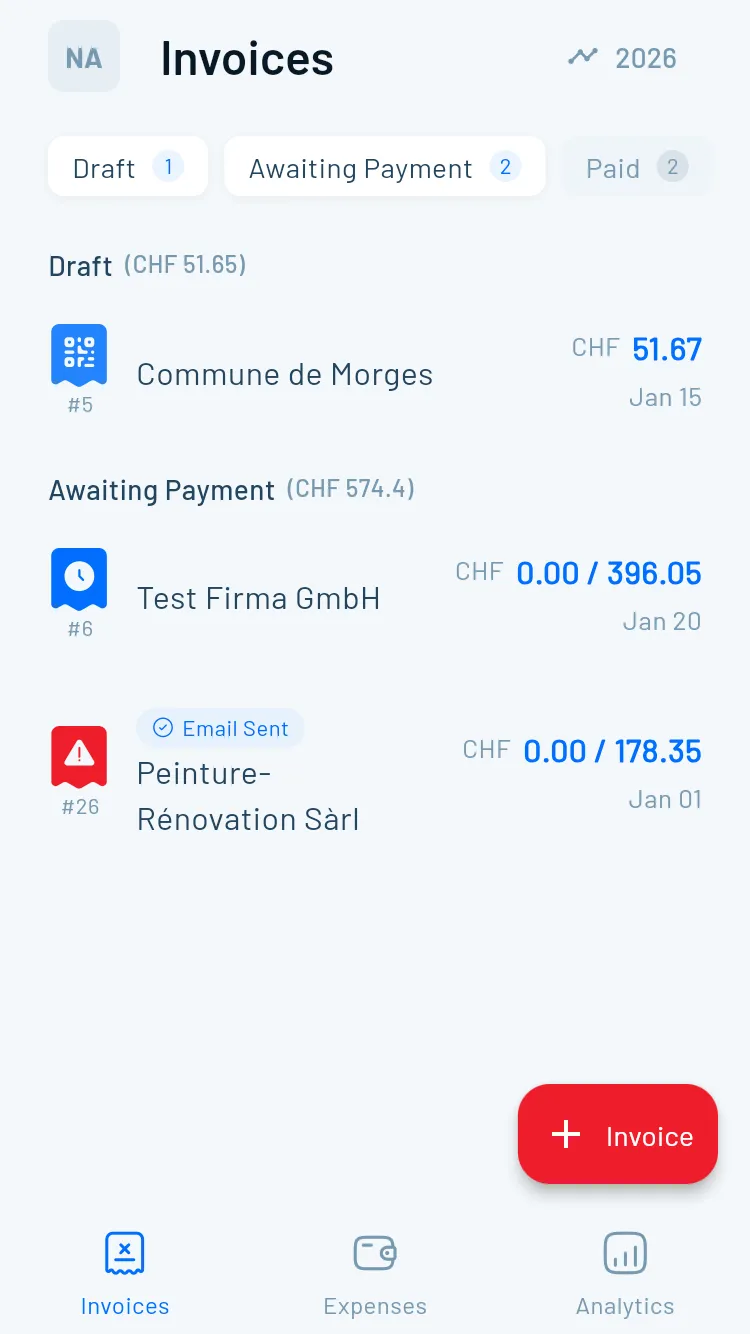

1. Use accounting software year-round

Tools like Magic Heidi automatically categorize expenses and generate tax-ready reports—saving 10+ hours at tax time.

2. Reconcile monthly

Don't wait until March to review your finances. Monthly reconciliation catches errors early.

3. Keep a deduction checklist

Create a running list of potential deductions as you encounter them throughout the year.

4. Set aside money for taxes

Save 20-30% of income in a separate account to avoid year-end cash flow stress.

5. Consider professional help at thresholds

When approaching CHF 500,000 revenue or dealing with complex situations (international income, multiple businesses), consult a fiduciary.

When to DIY vs. Hire an Accountant

Making the right choice for your situation and revenue level.

Do It Yourself If:

Revenue under CHF 100,000 • Straightforward expense categories • Single business activity • Comfortable with numbers • Using good accounting software. Cost savings: CHF 500-1,500 annually

Hire Professional Help If:

Revenue over CHF 500,000 (commercial accounting required) • Multiple income sources • International business operations • Complex depreciation needs • Property or investment income • Major business structure changes planned. Cost: CHF 1,500-5,000+ annually

Tools That Make Tax Season Easier

Join thousands of Swiss freelancers who've made tax season stress-free with automated expense tracking, instant categorization, and tax-ready reports.

- 📱Mobile Scanning

Snap receipts instantly with your phone

- 🤖AI Categorization

Auto-tag expenses to correct tax categories

- 📊Tax Reports

Generate form-ready reports with one click

- 🔒Secure Storage

10-year document retention included

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Swiss-Focused Accounting Software

Magic Heidi

- Built for Swiss freelancers by freelancers

- Automatically processes QR-invoice expenses

- Generates tax-ready reports

- Mobile app for on-the-go expense tracking

- Direct export to tax forms

bexio

- Popular with small businesses

- Full invoicing and accounting features

- Saves approximately 12 hours monthly on admin

Crésus

- Swiss-compliant standards built-in

- User-friendly interface

- Good for service businesses

CashCtrl

- Strong free tier

- Swiss-hosted servers (data privacy)

- Simple interface

Choosing the Right Tool

For simple freelancing (under CHF 100k):

Magic Heidi or CashCtrl provide everything you need without overwhelming features.

For growing businesses (CHF 100k-500k):

bexio or Magic Heidi offer scalability with invoicing, expense tracking, and client management.

For established businesses (over CHF 500k):

Consider comprehensive solutions plus professional accounting support.

Frequently Asked Questions

Can I file my tax return entirely online?

Yes. Since 2024, all Swiss cantons accept digital tax returns. Check your cantonal tax administration website for their platform.

What if I started my self-employed activity mid-year?

File Form 02 as usual and complete Form 15a only for the months you were self-employed. Include any employment income from the same year in the appropriate sections.

Do I need to register with the commercial register?

Registration becomes mandatory if you exceed CHF 100,000 in annual revenue. Below this threshold, registration is optional but can provide professional credibility.

Can I deduct health insurance premiums?

Yes, but only amounts exceeding 5% of your net income. These go in the general deductions section of Form 02, not on the business form.

What happens if I file late?

Without requesting an extension: fines up to CHF 10,000. With an approved extension: no penalty. Late payment of owed taxes: interest charges apply (typically 3-4.5% annually).

Should I register for VAT if I'm under CHF 100,000?

Consider it if you have significant equipment purchases planned or if most clients are VAT-registered businesses who can reclaim VAT. Otherwise, the administrative burden may outweigh benefits.

How do I handle expenses paid from my personal account?

Document them clearly with receipts and bank statements. Include them in your business expenses and record them as 'private contributions' to balance your accounts.

Can I deduct meals?

Business meals with clients or during business travel: Yes, partially. Daily personal meals, even when working: No. Keep receipts and note who you met and the business purpose.

What if I have income from multiple countries?

Declare all worldwide income on your Swiss tax return. Switzerland has tax treaties with most countries to avoid double taxation. Keep foreign tax documents as you may receive credits.

Do I need separate bank accounts for business?

Not legally required for sole proprietors, but highly recommended. It simplifies record-keeping and provides clear documentation during audits.

How long until I receive my tax bill after filing?

Typically 3-6 months. You'll receive a provisional assessment first, then a final assessment. Payment deadlines are usually spread across 3-4 quarterly installments.

Can I amend my return after submitting?

Yes. Contact your cantonal tax administration immediately if you discover errors. It's better to correct mistakes proactively than wait for an audit.

What records should I keep and for how long?

Keep all business-related documents (invoices, receipts, contracts, bank statements) for 10 years. Digital copies are acceptable.

Are there penalties for incorrect returns?

Unintentional errors: typically just late payment interest. Intentional false declarations: substantial fines and potential criminal charges. When in doubt, consult a professional.

Can I claim a computer used partially for personal use?

Yes, but only the business percentage. If you use it 70% for business, depreciate 70% of its cost. Claiming 100% when it's also for personal use is a common audit trigger.

Your Tax Return Action Checklist

A complete timeline to ensure you don't miss anything important.

Before March 1

Download forms • Request extension if needed • Gather bank statements and receipts • Calculate revenue and expenses • Determine business percentages • Verify pillar 3a contributions • Calculate depreciation

Before March 31 (or extended deadline)

Complete Forms 15a/15 and 02 • Include all deductions • Attach documentation • Review for mistakes • Sign and date • Submit digitally or by mail • Save copies

After Submission

Mark calendar for provisional assessment (3-6 months) • Set up payment plan if needed • File confirmation documents • Start organizing for next year

Make Next Year Easier: Start Now

The secret to stress-free tax season is preparation throughout the year. Use accounting software that automatically categorizes transactions, digitize receipts immediately, review finances monthly, track mileage as you drive, and save 25% of income for taxes quarterly.

With Magic Heidi, you can:

✓ Scan receipts with your phone instantly

✓ Auto-tag expenses to correct tax categories

✓ Generate form-ready reports with one click

✓ Track both business and personal expenses separately

✓ Access your financial data anywhere, anytime

Start your free trial and experience how much time you can save—not just during tax season, but all year long.

Ready to Simplify Your Tax Filing?

You don't need to be an accountant to handle your taxes confidently. With the right preparation and tools, completing your 2024 tax return can be straightforward. Join thousands of Swiss freelancers who've made tax season stress-free.

Last updated: January 2025 for the 2024 tax year

Legal disclaimer: This guide provides general information about Swiss tax obligations. Individual circumstances vary, and tax regulations change. Consult with a qualified tax advisor or fiduciary for personalized advice.