Magic Heidi saved me from spreadsheet hell. I was spending 6 hours a month on invoicing and expenses. Now it takes 30 minutes. Best decision I made for my business.

Graphic Designer, Zürich

Starting a sole proprietorship in Switzerland is the fastest way to become your own boss. With 326,205 active sole proprietorships across the country, it's the most popular business structure for freelancers and independent professionals.

Here's what you need to know to set up your business correctly—from naming requirements to tax registration—plus the hidden costs nobody talks about.

A sole proprietorship (Einzelfirma, raison individuelle, ditta individuale) is a business owned and run by one person. There's no legal separation between you and your business—you are the business.

Key characteristics:

Think of it this way: If your business owes CHF 50,000 and can't pay, creditors can go after your personal savings, property, and other assets.

Understanding the advantages and disadvantages before you commit.

No notary visits, no shareholder agreements. Start operating within 2-3 weeks.

Every decision is yours—pricing, clients, working hours, business direction.

Under CHF 500K revenue? Use simplified cash accounting instead of double-entry.

Deduct legitimate business expenses: home office, equipment, software, travel.

Closing involves minimal paperwork compared to liquidating a corporation.

Start with CHF 0 minimum capital. No large upfront investment needed.

The disadvantages that many new entrepreneurs overlook.

A single lawsuit can put your personal assets at risk. Your home, savings—everything.

Self-employed individuals can't contribute to unemployment insurance.

Investors prefer corporations with clear equity structures.

Bringing on partners means restructuring your entire business.

Some larger clients prefer working with incorporated businesses.

Rule of thumb: Start with a sole proprietorship if you're testing a service-based business. Switch to a GmbH when you hit CHF 200,000+ revenue.

| Factor | Sole Proprietorship | GmbH |

|---|---|---|

| Setup cost | CHF 120-500 | CHF 2,000-4,000 |

| Minimum capital | CHF 0 | CHF 20,000 |

| Personal liability | Unlimited | Limited to capital |

| Setup time | 2-4 weeks | 4-8 weeks |

| Accounting | Simplified (under CHF 500K) | Always double-entry |

| Credibility | Lower | Higher |

| Tax treatment | Income tax on profits | Corporate + income tax |

If you're 18+ with no recent bankruptcy or relevant criminal convictions, you're good to go.

You need a residence permit that allows self-employment:

More restrictive. You typically need:

Getting a work permit solely to start a sole proprietorship as a non-EU national is difficult. Switzerland prioritizes permit holders who already have employment.

Under 18? You need your legal guardian to represent the business legally.

Married? In community of property regime, your spouse must consent to business activities that exceed ordinary management.

Follow these 10 steps to set up your business correctly and avoid costly mistakes.

Everything you need to do, in the right order, with realistic timelines and costs.

Your business name must include your surname. That's the law. Acceptable: 'Müller', 'Anna Müller', 'Müller Grafikdesign'. Not acceptable: 'Creative Studios' (no surname), 'SwissDesign GmbH' (implies different structure).

Even without seeking funding, a business plan forces clarity on your service offering, target market, competition, pricing, and first-year projections. Time investment: 8-12 hours for a solid plan.

Non-negotiable within 90 days of starting. Register with your cantonal compensation office. Contribution rates: 5.371% to 10% of net income depending on earnings. Total social security contributions typically 8-12% of net income.

Mandatory if annual revenue exceeds CHF 100,000 or if you operate in a commercial manner. Optional registration increases credibility. Cost: CHF 120-200. Processing: 5-60 days depending on canton.

Healthcare, finance, legal, construction, hospitality, and transportation fields require cantonal or federal licenses. Check with your cantonal economic affairs office before operating.

Not legally required but highly recommended. Separates personal and business finances, makes accounting easier, looks professional. Cost: CHF 100-300 annually. PostFinance offers first two years free.

Mandatory: Health, accident (if 8+ hrs/week), AHV/AVS. Recommended: Professional liability (CHF 500-2,000/year), business interruption, legal expenses, income protection.

Mandatory if annual revenue exceeds CHF 100,000. Can register voluntarily at lower revenue to reclaim VAT on expenses. Rates (2026): 8.1% standard, 2.6% reduced, 3.8% accommodation.

Inform cantonal and municipal tax offices. You'll receive questionnaires about expected income, and authorities calculate provisional payments. Sole proprietorship profits are taxed as personal income.

Under CHF 500K revenue: simplified cash accounting works. Over CHF 500K: double-entry bookkeeping mandatory. Better solution: Use accounting software from day one. Record retention: Keep all records for 10 years.

Your business is registered. Now comes the real work: setting up operations, finding clients, and building momentum.

Learn from others' mistakes and save yourself time, money, and headaches.

Keep separate accounts from day one. Mixing personal and business finances creates tax nightmares.

Set aside 25-35% of income for taxes and social contributions. Set up automatic transfers.

Calculate: desired salary + taxes (30%) + social security (10%) + expenses + sick days + holidays.

Always have written agreements outlining deliverables, timelines, payment terms, and dispute resolution.

If 70%+ of income from one client, authorities may reclassify you as employee. Diversify clients.

One serious illness without income protection can bankrupt your business. Don't skip coverage.

Consider upgrading your legal structure when:

Revenue exceeds CHF 200,000-300,000

Tax optimization becomes more important. Corporate structures offer more flexibility.

You need to limit liability

Taking on larger contracts or clients where errors could be costly.

You want to bring on partners

Easier to split ownership and define roles with a corporate structure.

You're planning to sell

Selling shares of a GmbH is simpler than transferring a sole proprietorship's assets.

You need outside investment

Investors require equity stakes, which sole proprietorships can't offer.

The conversion process involves transferring assets to the new company and closing the sole proprietorship. Work with a notary and tax advisor to structure it properly.

Here's what you'll actually spend to launch and run your business.

Switzerland makes self-employment accessible, but success requires clear financial tracking from day one. Professional invoicing that gets you paid faster. Automated VAT calculation to avoid costly mistakes.

Over 10,000 Swiss sole proprietors trust Magic Heidi to handle their accounting so they can focus on the work they love.

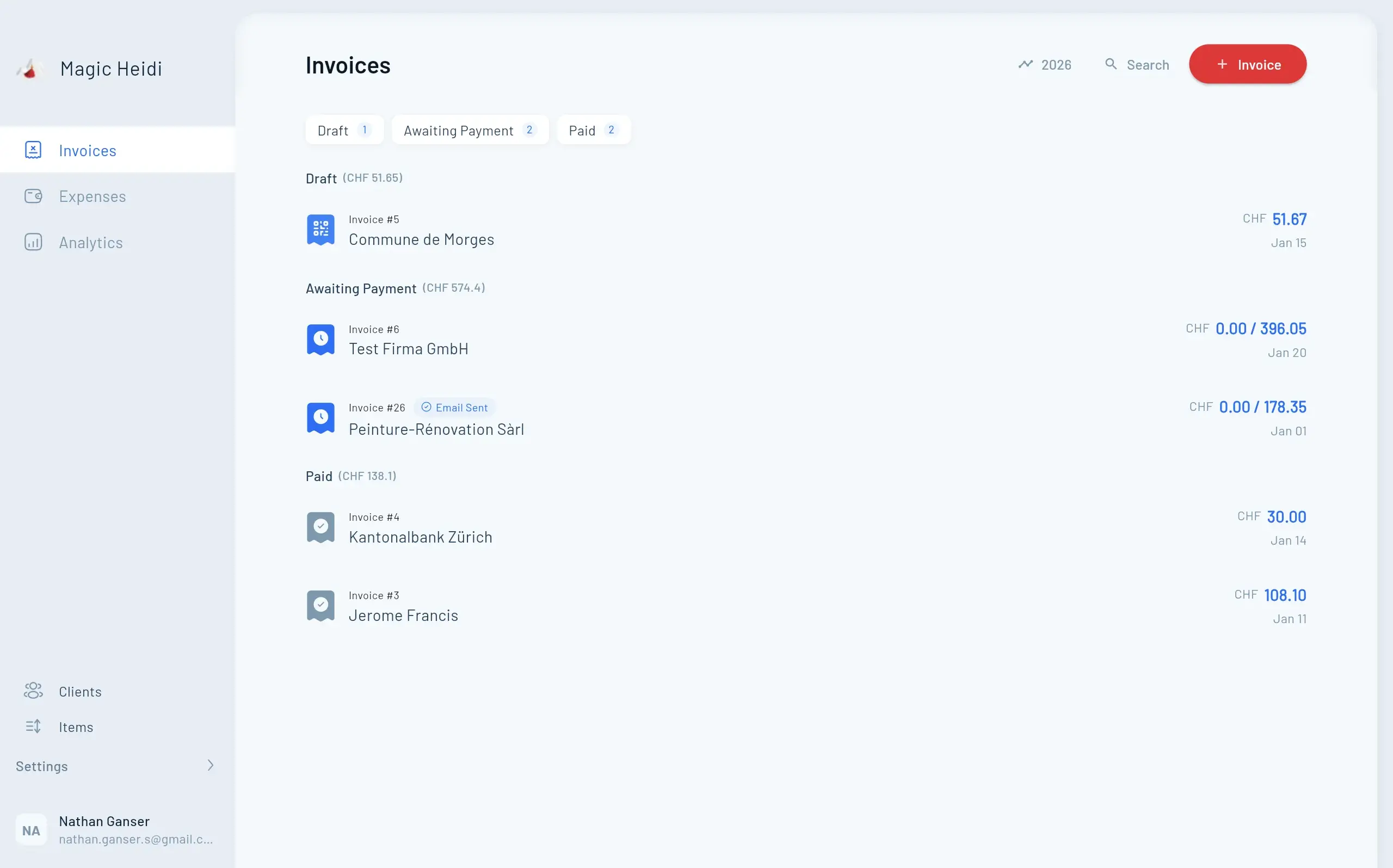

Create QR invoices in 30 seconds. Automatic VAT calculation. Multi-currency support. Send by email or download as PDF. Get paid faster with professional invoices that include all Swiss requirements.

Photograph receipts with your phone. AI extracts date, amount, VAT, category, and vendor automatically. No more manual data entry. No more shoeboxes of receipts. Save hours every month.

Know your business health at a glance. Track revenue, expenses, profit margins, and VAT obligations in real-time. Make informed decisions with instant financial visibility.

Join over 10,000 Swiss freelancers who trust Magic Heidi for their accounting.

Magic Heidi saved me from spreadsheet hell. I was spending 6 hours a month on invoicing and expenses. Now it takes 30 minutes. Best decision I made for my business.

Graphic Designer, Zürich

Als Einzelunternehmer brauche ich einfache Tools. Magic Heidi ist perfekt. QR-Rechnungen in 30 Sekunden, MWST automatisch berechnet. Genau was ich brauche.

IT Consultant, Bern

J'étais perdu avec la TVA et la comptabilité. Magic Heidi m'a tout simplifié. Je photographie mes reçus et l'IA fait le reste. Incroyable.

Marketing Consultant, Geneva

Your business deserves the same attention you give your clients. Let Magic Heidi handle the numbers so you can focus on the work you love.

Last updated: January 2026

Sources: Swiss Federal SME Portal, Federal Tax Administration, AHV/AVS Information Center