MWST Nummer Switzerland: When Freelancers Must Register for VAT

The complete 2026 guide to Swiss VAT registration, compliance, and the CHF 100,000 threshold that every freelancer needs to understand.

If you're a Swiss freelancer earning close to CHF 100,000 annually, you need to understand the MWST Nummer—before the tax authorities come knocking.

Here's what most freelancers get wrong: The CHF 100,000 threshold isn't calculated by calendar year. It's a rolling 12-month period. Hit that number today, and you have just 30 days to register. Miss that deadline, and you could face retroactive VAT obligations going back five years.

This guide walks you through everything: when registration becomes mandatory, how to apply, what rates to charge, and how to stay compliant without drowning in paperwork.

What Is the MWST Nummer?

The MWST Nummer is your Swiss VAT identification number. MWST stands for "Mehrwertsteuer" (Value Added Tax in German). Once registered, you're authorized to charge VAT on your services and reclaim VAT on business expenses.

The MWST Nummer builds on your UID (Unique Business Identification Number)—a universal ID assigned to every Swiss business entity. When you register for VAT, your UID gets the suffix "MWST":

CHE-123.456.789 MWST

UID vs. MWST Nummer: The Key Difference

- UID: Your business identification number, used across government agencies

- MWST Nummer: Your UID + "MWST" suffix, proving you're VAT-registered

Think of your UID as your business passport. The MWST Nummer is the customs stamp that lets you participate in taxable activities.

Language note: Use "MWST" (German), "TVA" (French), or "IVA" (Italian) on invoices. Never use "VAT"—it's not legally recognized in Switzerland.

When Freelancers Must Register for MWST

Understanding the registration threshold is critical. Get it wrong, and you could face penalties, retroactive payments, and years of compliance headaches.

CHF 100,000 Threshold

Mandatory registration when annual turnover exceeds CHF 100,000 from taxable services30-Day Registration Window

Once you cross the threshold, you have just 30 days to submit your applicationWorldwide Turnover Counts

Since 2018, your global revenue counts—not just Swiss incomeMandatory Registration Threshold

You must register for MWST when your annual turnover from taxable services exceeds:

- CHF 100,000 for most freelancers

- CHF 150,000 for non-profits and sports clubs

Critical detail: This is calculated on a rolling 12-month basis, not by calendar year.

Let's say you launched your freelance business in March 2025. By January 2026, you've earned CHF 105,000 over the past 10 months. You've crossed the threshold. The clock starts ticking—you have 30 days to register.

The 30-Day Rule Most Freelancers Miss

Once you exceed CHF 100,000, you must submit your MWST registration within 30 days. Processing takes approximately 2-4 weeks. Factor this into your timeline.

What happens if you miss the deadline?

The Federal Tax Administration can:

- Impose penalties for non-compliance

- Require retroactive VAT payments up to 5 years

- Charge interest on unpaid amounts

Worldwide Turnover Rule (Important for International Freelancers)

Since 2018, the threshold considers your global annual turnover, not just Swiss revenue.

Example: You're a German consultant earning €300,000 annually worldwide. You land your first Swiss client for CHF 5,000. You're MWST-liable from your first Swiss franc because your worldwide turnover exceeds CHF 100,000.

This catches many international freelancers off-guard.

Should You Register Below CHF 100,000?

Freelancers below the threshold can register voluntarily. But is it worth the administrative burden?

Input Tax Deduction

Reclaim 8.1% VAT on business expenses like equipment, software, and professional services

Professional Credibility

Many corporate clients expect VAT-registered suppliers for larger projects

Future-Proofing

Avoid scrambling when you hit CHF 100,000 mid-project with a major client

Competitive Positioning

B2B clients can reclaim your VAT, making your pricing competitive

Drawbacks to Consider

1. Administrative Burden

- Quarterly VAT returns (or semi-annual if tax liability under CHF 4,000)

- Detailed record-keeping for 10 years

- Separate tracking of input and output VAT

2. Cash Flow Management

You collect VAT from clients but must pay it quarterly to authorities. If a client pays late, you still owe the VAT on time.

3. Minimum Commitment

Voluntary registration must be maintained for at least one full calendar year. You can't deregister early because it became inconvenient.

Decision Framework: When Voluntary Registration Makes Sense

Register voluntarily if:

- Your business expenses exceed CHF 15,000 annually

- Most clients are VAT-registered businesses (they can reclaim your VAT)

- You're projecting growth toward CHF 100,000 within 12-18 months

Skip voluntary registration if:

- Your expenses are minimal (under CHF 10,000)

- You primarily serve private consumers (B2C)

- Administrative complexity outweighs tax benefits

How to Register for Your MWST Nummer

The registration process is straightforward if you have the right documents prepared. Here's exactly what you need to do.

Step 1: Obtain Your UID

Before applying for MWST registration, you need a UID. Register through your cantonal commercial registry when establishing your business.

Format: CHE-123.456.789

Step 2: Gather Required Information

Prepare these details:

- Your UID number

- Personal identification (passport or ID card)

- Business activity description

- Estimated annual turnover

- Business address

- Bank account details

Step 3: Submit Your Application

Option 1: Online (Recommended)

Register through the ESTV SuisseTax portal. The online application is faster and provides immediate confirmation.

Option 2: By Mail

Download the registration form from the Federal Tax Administration website and mail it to:

Eidgenössische Steuerverwaltung ESTV

Hauptabteilung MWST

Schwarztorstrasse 50

3003 Bern

Step 4: Wait for Processing

Timeline: 2-4 weeks if your application is complete. Incomplete submissions take longer.

You'll receive:

- Official confirmation letter

- Your MWST Nummer (UID + MWST suffix)

- Instructions for filing returns

Step 5: Update Your Systems

Once registered:

- Add MWST Nummer to all invoice templates

- Update your website and email signature

- Inform existing clients about rate changes

- Adjust your accounting system

Pro tip: Use Magic Heidi's MWST-compliant invoicing to automatically calculate and display VAT correctly on every invoice.

Swiss VAT Rates 2026

Switzerland applies different VAT rates depending on the type of goods or services. Understanding which rate applies to your services is essential for compliance.

Most freelance services: consulting, design, software development, marketing

Essential goods: food, non-alcoholic beverages, books, newspapers, medications

Accommodation services only: hotels, B&Bs, vacation rentals

Exports outside Switzerland and international services to non-Swiss businesses

Standard Rate: 8.1% (Most Common)

Applies to most freelance services:

- Consulting and professional services

- Design and creative work

- Software development

- Marketing services

- Online courses and digital products

Example invoice:

- Service fee: CHF 5,000

- VAT (8.1%): CHF 405

- Total: CHF 5,405

Exemptions (No VAT Charged)

Certain services are VAT-exempt:

- Healthcare and medical services

- Educational courses and training

- Insurance and financial services

- Real estate rentals (residential)

Important: If your services are exempt, you cannot register for MWST or reclaim input tax.

Upcoming Changes: 2028 Rate Increase

The standard rate is planned to increase from 8.1% to 8.8% in 2028, pending parliamentary approval. This increase, originally scheduled for 2026, was delayed. Stay updated through the Federal Tax Administration.

How to Charge MWST to Clients

Every VAT invoice must meet strict Swiss requirements. Missing any required element can invalidate your invoice and complicate your VAT filing.

Invoice Requirements

Every VAT invoice must include:

- Your complete business name and address

- Client's name and address

- Unique invoice number (sequential)

- Invoice date

- Detailed description of services

- Net amount (before VAT)

- Applicable VAT rate (8.1%)

- VAT amount in CHF

- Total amount including VAT

- Your MWST Nummer: CHE-XXX.XXX.XXX MWST

- Payment terms and due date

MWST Nummer Display Formats

Use the format matching your business language:

- German: CHE-123.456.789 MWST

- French: CHE-123.456.789 TVA

- Italian: CHE-123.456.789 IVA

Never use "VAT" as the suffix—it's not legally recognized.

B2B vs. B2C: Different Rules

B2B (Business to Business) within Switzerland:

- Always charge 8.1% VAT

- Clearly state MWST on invoice

B2C (Business to Consumer) within Switzerland:

- Charge 8.1% VAT

- Consumers cannot reclaim this VAT

B2B International (Reverse Charge):

- No Swiss VAT charged

- Client's country VAT applies (reverse charge mechanism)

- Note on invoice: "VAT exempt - reverse charge applies"

- Obtain client's VAT number for documentation

B2C International:

- Complex rules depending on service type and client location

- Digital services may trigger local VAT obligations

- Consult a tax advisor for recurring international B2C sales

Pricing: Inclusive vs. Exclusive

Exclusive pricing (recommended for B2B):

- Service: CHF 2,000

- VAT 8.1%: CHF 162

- Total: CHF 2,162

Inclusive pricing (sometimes used for B2C):

- Total: CHF 2,162 (including CHF 162 VAT)

Make your pricing structure clear in quotes and contracts to avoid confusion.

Filing and Paying Your MWST

Understanding your reporting obligations and payment deadlines is essential to avoid penalties and interest charges.

Quarterly Filing

Standard schedule for most freelancers with four reporting periods per year

Semi-Annual Filing

Available if annual tax liability stays under CHF 4,000

Effective Method

Calculate based on actual transactions and expenses for maximum deductions

Net Tax Rate Method

Apply flat industry rate to turnover for simplified calculations

Reporting Frequency

Choose your filing schedule:

Quarterly (most common):

- Q1: January - March (due May 31)

- Q2: April - June (due August 31)

- Q3: July - September (due November 30)

- Q4: October - December (due February 28)

Semi-annually:

- Available if annual tax liability under CHF 4,000

- H1: January - June (due August 31)

- H2: July - December (due February 28)

Two Accounting Methods

1. Effective Method (Nachweis der vereinbarten Entgelte)

Calculate VAT on actual transactions:

- Output tax: VAT collected from clients

- Input tax: VAT paid on business expenses

- Net VAT due: Output tax minus input tax

Example:

- Q1 revenue: CHF 30,000

- Output tax (8.1%): CHF 2,430

- Business expenses: CHF 8,000

- Input tax (8.1%): CHF 648

- VAT payment due: CHF 1,782

Best for: Freelancers with significant business expenses.

2. Net Tax Rate Method (Saldosteuersatz)

Apply a flat rate to your turnover based on your industry. The rate already accounts for typical input tax deductions.

Example rate for consultants: 5.7% of total turnover (including VAT)

Advantages:

- Simpler calculations

- Less paperwork

Disadvantages:

- May pay more if you have high expenses

- Less flexible

Best for: Freelancers with minimal expenses and simple business models.

Payment Deadlines

Payment is due 60 days after the end of each reporting period.

Late payment consequences:

- 5% reminder fee on outstanding amount

- Default interest (currently 4.5% annually)

- Potential legal action

Set up reminders or automatic payments to avoid penalties.

MWST Compliance and Record-Keeping

The Federal Tax Administration requires meticulous documentation. Here's what you need to maintain to stay audit-ready.

10-Year Document Retention

Keep all VAT-related documents for a full decade. The FTA can audit any period within these 10 years.

- All invoices issued and received

- Bank statements and payment confirmations

- Expense receipts and VAT documentation

- Contracts, agreements, and correspondence

Input Tax Deduction Rules

Understand exactly what qualifies for VAT reclaim to maximize your legitimate deductions.

- Equipment and office furniture

- Software subscriptions and tools

- Professional services (accounting, legal)

- Business travel and documented meals

Common Audit Triggers

Certain patterns increase your audit risk. Be aware of what catches FTA attention.

- Unusually high input tax deductions

- Significant turnover fluctuations

- Late or missing VAT returns

- Industry-specific risk factors

What Qualifies for Input Tax Deduction?

You can reclaim VAT on:

Eligible business expenses:

- Equipment and furniture

- Software and subscriptions

- Professional services (accounting, legal)

- Marketing and advertising

- Business meals (with proper documentation)

- Coworking space or office rent

- Business travel within Switzerland

Not eligible:

- Private use portion of mixed-use items

- Entertainment expenses

- Gifts over certain thresholds

- Car purchases (special rules apply)

Mixed-use rule: If you use something for both business and private purposes (like a home office), you can only deduct the business portion. Keep detailed records proving business use percentage.

Staying Compliant Without the Headache

Manual VAT tracking is tedious and error-prone. A single miscalculation can trigger an audit. Magic Heidi automates Swiss MWST compliance for freelancers.

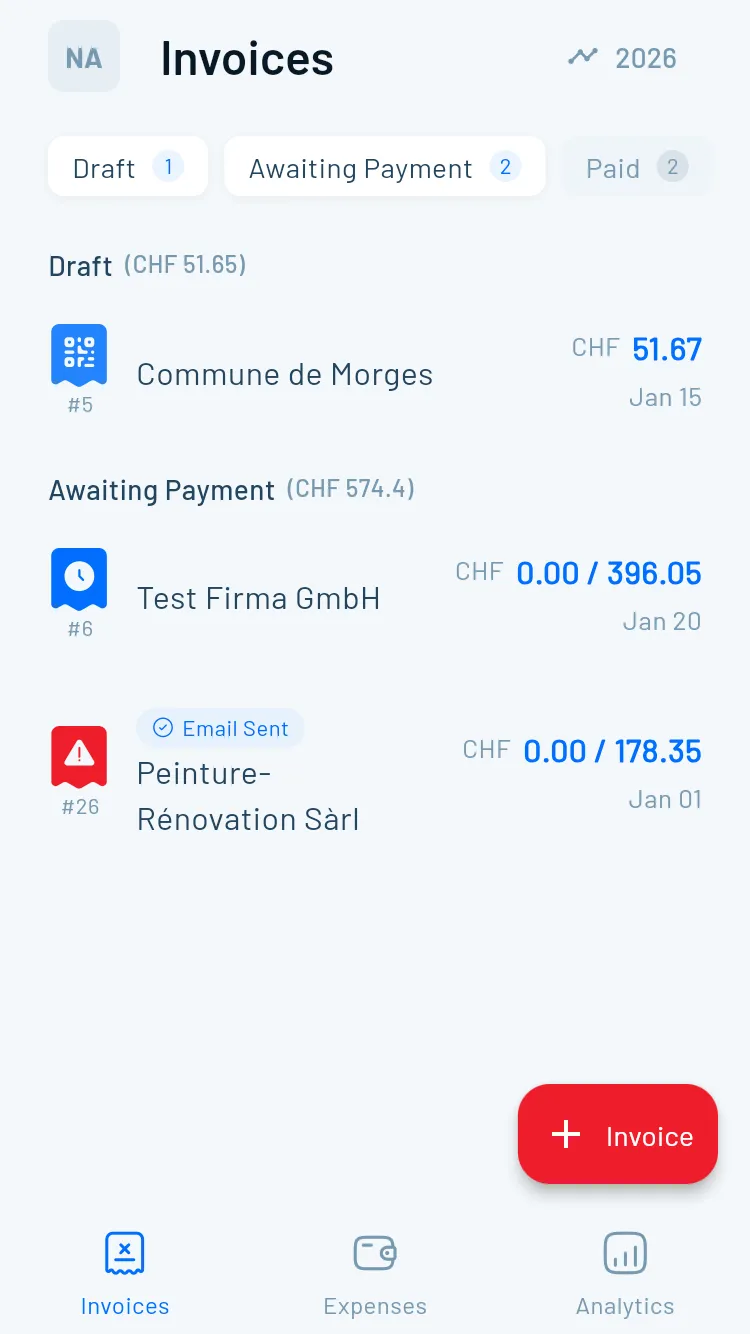

Magic Heidi Simplifies MWST for Freelancers

Automate your Swiss VAT compliance with MWST-ready invoicing, AI expense tracking, and real-time reporting across all your devices.

- 🧾MWST-Compliant Invoicing

Automatically adds 8.1% VAT with your MWST Nummer on QR-invoices

- 📸AI Expense Scanning

Scan receipts and extract VAT amounts automatically with mobile AI

- 📊Real-Time VAT Reports

See your current VAT position anytime with quarterly filing summaries

- 🏦Bank Integration

Import transactions and match payments to invoices automatically

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Why Freelancers Choose Magic Heidi for MWST

Magic Heidi eliminates MWST headaches:

- MWST-Compliant Invoicing: Automatically adds 8.1% VAT to invoices with your MWST Nummer displayed correctly

- Multilingual Templates: Generate invoices in German, French, Italian, or English

- AI Expense Tracking: Scan receipts and extract VAT amounts instantly with mobile AI

- Input Tax Recognition: Automatically categorizes deductible vs. non-deductible expenses

- Real-Time VAT Reports: See output tax vs. input tax breakdown anytime

- Quarterly Filing Summaries: Export reports ready to submit to ESTV or your accountant

- Bank Statement Integration: Import transactions and reconcile VAT payments automatically

- Cross-Platform: iPhone, Android, Mac, Windows, and web—all synchronized

Swiss freelancers using Magic Heidi complete their quarterly VAT filing in under 15 minutes.

Freelancers using Magic Heidi spend 75% less time on VAT paperwork and reduce errors by 95%.

Cross-Border Freelancing: Special MWST Rules

International freelancing adds complexity to VAT. Here's what you need to know when working with EU and global clients.

EU B2B Sales

No Swiss VAT charged. Reverse charge applies—verify client's EU VAT number

EU B2C Sales

No Swiss VAT, but may trigger VAT obligations in buyer's country for digital services

Non-EU International

Generally no Swiss VAT. Document business nature and service delivery location

Importing Services

Self-assess Swiss VAT if foreign provider not Swiss VAT-registered

Selling to EU Businesses

B2B sales to EU companies:

- No Swiss VAT charged

- Reverse charge applies (client pays VAT in their country)

- Verify client's EU VAT number

- Keep proof of service delivery location

Required on invoice:

- Client's EU VAT number

- Note: "VAT exempt - reverse charge mechanism"

Selling to EU Consumers

B2C sales to EU consumers:

- No Swiss VAT charged

- May trigger VAT obligations in buyer's country

- EU VAT thresholds apply for digital services

- Consider registering for EU One Stop Shop (OSS) if significant EU B2C sales

Selling Outside the EU

B2B international:

- Generally no Swiss VAT

- Document business nature of client

B2C international:

- No Swiss VAT on most services

- Export documentation required for goods

Buying from Abroad

Importing services from abroad:

- You may need to self-assess Swiss VAT

- Applies if foreign provider not Swiss VAT-registered

- Report on your VAT return

Common Questions About MWST Nummer

How long does it take to receive my MWST Nummer?

Processing takes 2-4 weeks after submitting a complete application. Incomplete submissions delay the process. Apply well before you need to issue your first VAT invoice.

Can I deduct VAT on expenses before registration?

Yes, but with limits. You can reclaim input tax on expenses made up to 6 months before your VAT registration date, provided you kept proper documentation.

What if I temporarily drop below CHF 100,000?

Once registered, you can't immediately deregister. You must stay registered for the full calendar year. After that, you can request deregistration if your turnover remains below CHF 100,000.

Do I charge VAT to foreign clients?

B2B foreign clients: Usually no Swiss VAT (reverse charge applies). B2C foreign clients: Depends on service type and location. Always document the client's country and business status.

What happens if I forget to charge VAT?

You're still liable for the VAT amount to authorities. You cannot retroactively add VAT to an invoice unless explicitly agreed with the client. Many freelancers absorb this cost—an expensive mistake.

Can I switch from quarterly to semi-annual filing?

Yes, but timing matters. You must request the change at the end of a reporting period. Semi-annual filing is only available if your annual VAT liability stays under CHF 4,000.

Master Your MWST, Stress-Free

Join 15,000+ Swiss freelancers who've automated their MWST workflow with Magic Heidi. Start your free trial today.

Your Next Steps

Here's your action plan based on your situation:

If you're approaching CHF 100,000:

- Track your rolling 12-month turnover monthly

- Set a reminder 3 months before crossing CHF 100,000

- Prepare your registration documents now

- Switch to Magic Heidi for automatic VAT tracking

If you're considering voluntary registration:

- Calculate your annual business expenses

- Estimate potential input tax deduction (8.1% of expenses)

- Compare with administrative effort

- Consult a Swiss tax advisor if unsure

- Use Magic Heidi to minimize admin burden

If you're already registered:

- Review your current VAT filing process

- Ensure all invoices display your MWST Nummer correctly

- Verify you're claiming all eligible input tax deductions

- Set calendar reminders for quarterly deadlines

- Automate with Magic Heidi to reduce errors

The MWST Nummer isn't just a tax formality—it's a tool for legitimate tax deductions and professional credibility. Master it, and you'll save thousands in taxes while staying fully compliant.

Ready to simplify your Swiss VAT management? Start your free Magic Heidi trial today and join 15,000+ Swiss freelancers who've automated their MWST workflow.