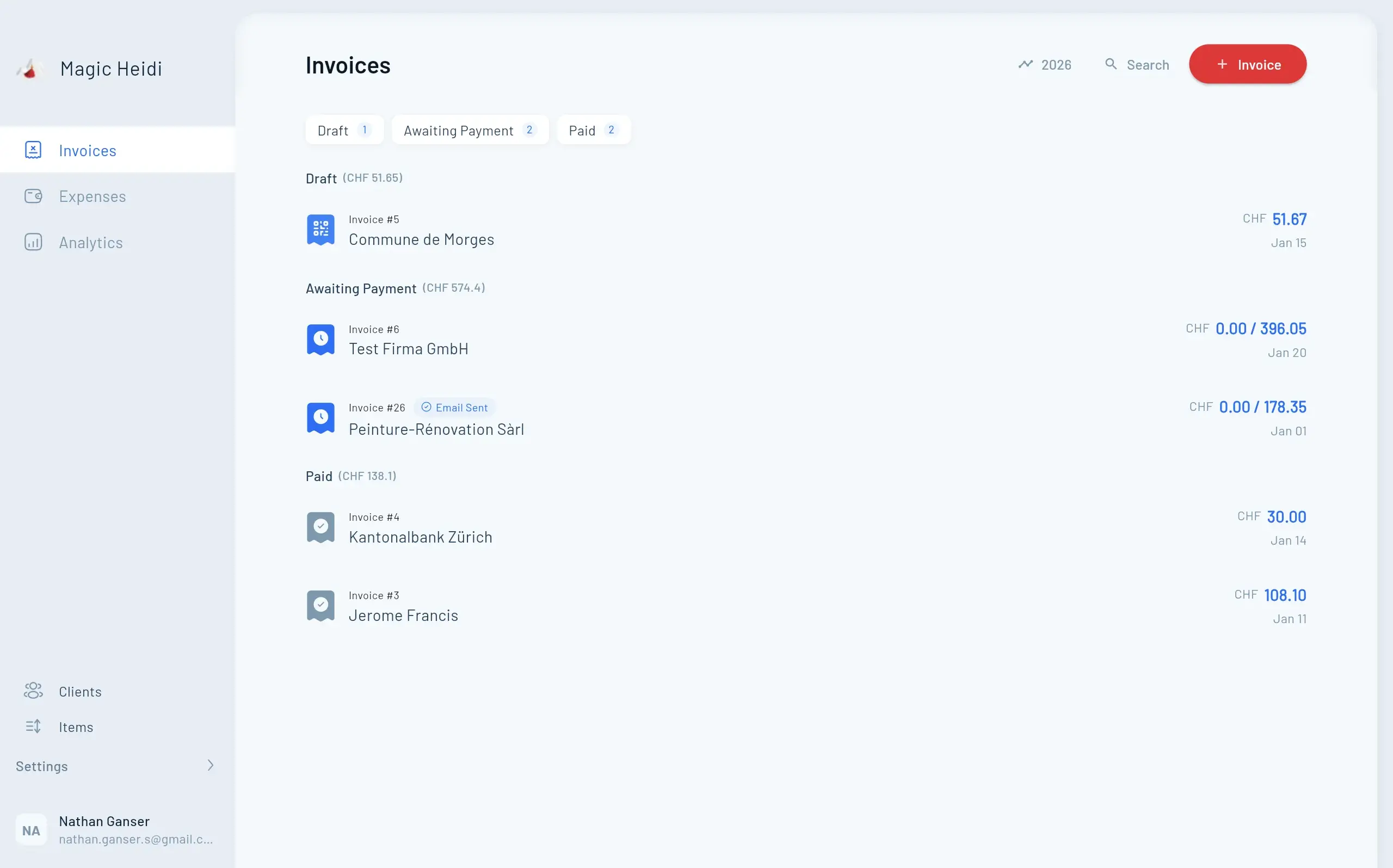

Registration for Swiss-Based Businesses

Timeline: 3-4 weeks from application submission

- Step 1: Gather required documents (commercial register extract, UID, insurance number, turnover forecast, bank details)

- Step 2: Submit application through Federal Tax Administration online portal in German, French, or Italian

- Step 3: Wait for processing and respond quickly to any additional information requests

- Step 4: Receive your official Swiss VAT number (CHE-XXX.XXX.XXX MWST/TVA/IVA)