Most Swiss employees receive a 13th month salary—an extra month's pay that provides a financial cushion for holidays, taxes, or unexpected expenses.

As a freelancer? You're on your own.

But here's the reality: you have something better than a 13th month salary. You have complete control over your income. The challenge is learning how to create the same financial security that employees get automatically.

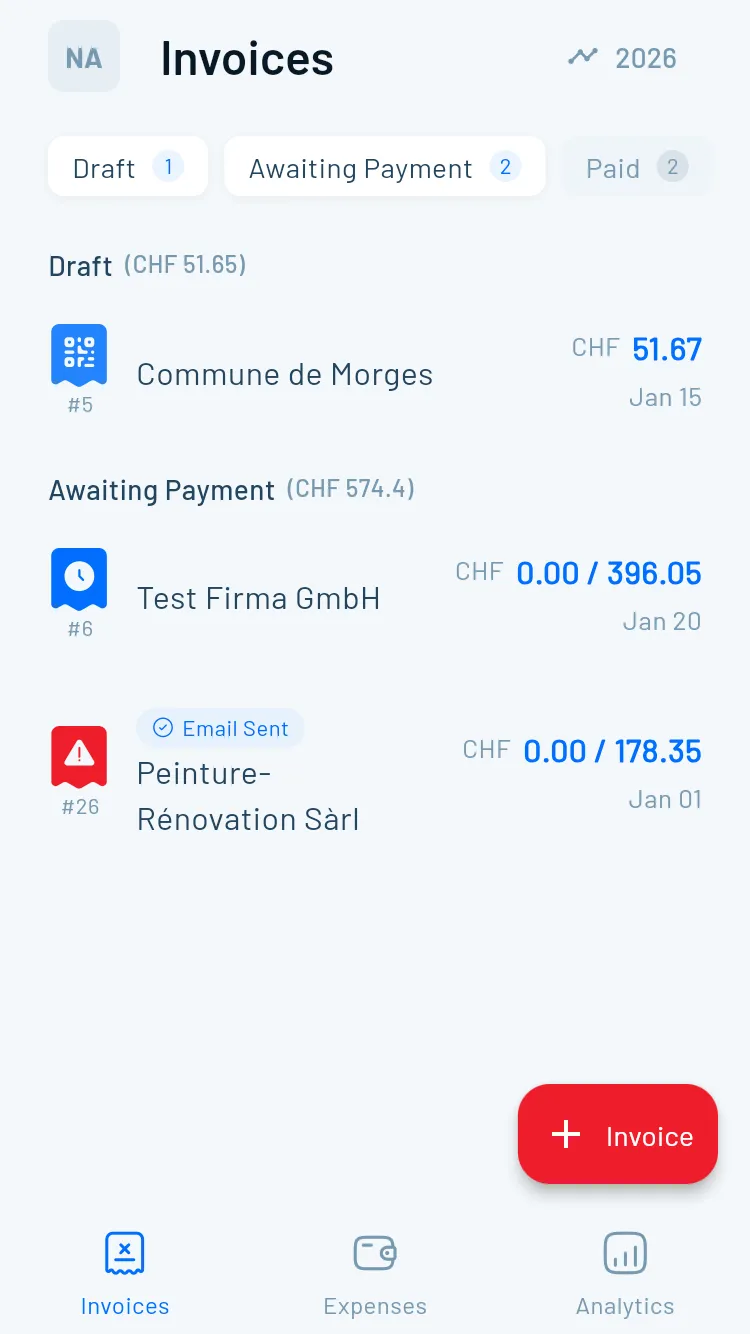

This guide shows you exactly how to build your own "13th month" savings strategy, manage irregular income, and use tools like Magic Heidi to automate the financial complexity of Swiss self-employment.

Let's clear up a common misconception right away.

Freelancers and contract workers in Switzerland are generally not entitled to a 13th month salary. This benefit applies to traditional employment relationships where it's either mandated by collective labor agreements or included in individual employment contracts.

Even for employees, there's no federal law requiring it—though it became customary starting in the 1960s, evolving from the traditional Christmas bonus (Weihnachtsgeld).

For freelancers, the concept works differently:

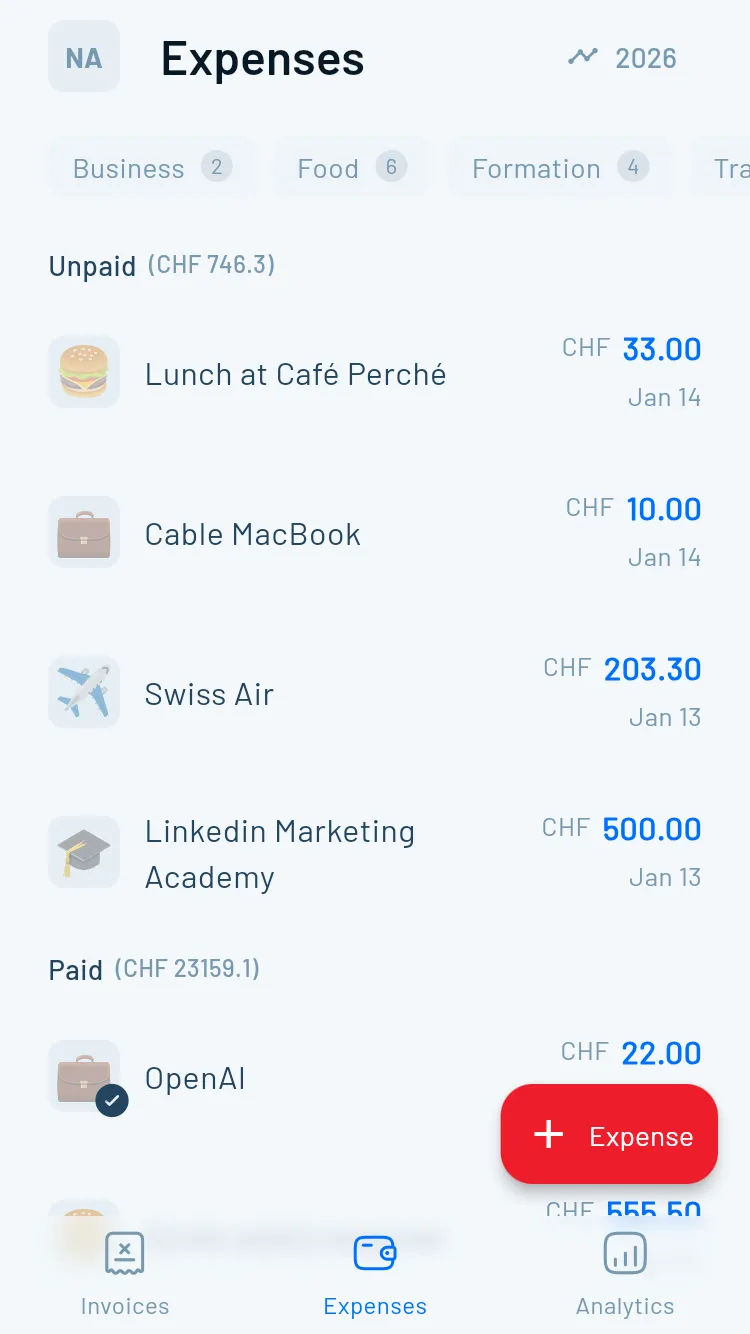

- You don't receive a "salary" at all—you invoice clients for services

- You set your own rates and payment terms

- You're responsible for creating your own financial buffers

- No employer contributes to your pension, insurance, or vacation time

But here's the opportunity: You can create something even more flexible than a 13th month salary by building your own systematic savings approach.