Foundation Setup

Get your account configured and ready to use.

- Create your Magic Heidi account

- Add your business details and logo

- Connect your Swiss bank account

- Set up client list

You've built a thriving freelance career in Switzerland. Your clients are happy, projects are flowing, and you're finally living the independent work dream. But then tax season arrives, and suddenly you're drowning in receipts, scrambling with spreadsheets, and wondering if you've calculated VAT correctly.

Then tax season arrives. Or a client questions an invoice. Or you realize you've been missing deductible expenses for months.

Suddenly you're drowning in receipts, scrambling with spreadsheets, and wondering if you've calculated VAT correctly. This isn't why you became a freelancer.

Here's the truth: Poor financial management costs Swiss freelancers 8-12 hours monthly—time you could spend on billable work. Worse, it leads to missed tax deductions, compliance issues, and that nagging anxiety that you're one audit away from disaster.

But it doesn't have to be this way.

Financial management fails for freelancers because you're trying to solve three problems simultaneously—and traditional tools weren't built for your reality.

The result? Freelancers make costly mistakes:

Your creative work deserves better than spreadsheet accounting from 2005.

Before diving into solutions, let's establish the unique challenges of operating in Switzerland's regulatory environment.

Three critical requirements that make or break your business compliance.

Since October 2022, traditional payment slips are history. Every invoice needs a Swiss QR code containing all payment information. The catch? From November 21, 2025, only structured addresses are permitted in QR codes.

Once your annual revenue exceeds CHF 100,000, VAT registration becomes mandatory. Many freelancers don't prepare for this transition.

Your accounting complexity depends entirely on your revenue level. Knowing where you stand prevents costly surprises.

Software solves operational problems, but you need solid fundamentals first. These three principles will transform your financial management.

Two bank accounts minimum. Business income goes into business account. Pay yourself consistently into personal account. This eliminates 70% of bookkeeping headaches.

Save essential living expenses to weather slow periods. This lets you turn down bad-fit projects and make strategic decisions, not desperate ones.

Transfer 30% of income to a separate tax account immediately. Combined income tax and social security typically consume 25-35% of your profit.

You don't need enterprise software with 847 features. You need five core capabilities that work flawlessly.

Automatic generation with November 2025 structured addresses. Save 2.5+ hours monthly.

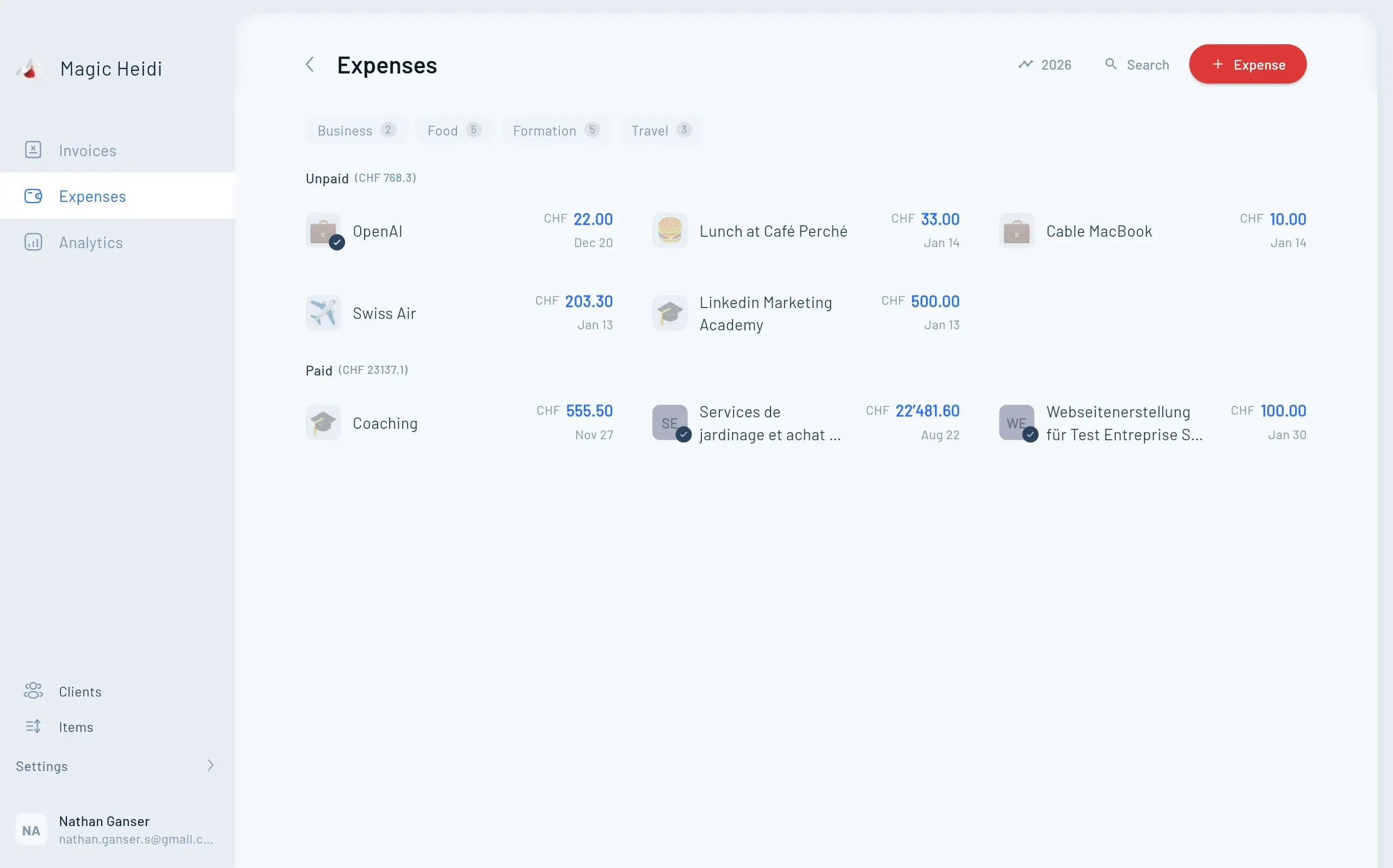

Snap a photo. AI extracts vendor, date, amount, and category. No manual entry required.

Clean interface before CHF 100K. Full VAT features activate automatically after crossing threshold.

Connect Swiss banks, import transactions automatically, categorize in seconds. No manual entry.

Magic Heidi

CHF 500

Jan 29

Webbiger LTD

CHF 2000

Jan 24

John Doe

CHF 600

Jan 20

You should always know your approximate tax liability. As you record income and expenses, the software should update your:

No surprises. No scrambling. Complete confidence.

The Swiss market offers several accounting solutions, but most were built for small businesses, not solo freelancers.

| Feature | Magic Heidi | bexio | Run my Accounts | Banana Accounting |

|---|---|---|---|---|

| Monthly Price | CHF 19 | CHF 35+ | Varies | CHF 7.40/year |

| Target User | ✓ Freelancers | ✗ SMEs | ✗ Full-service | ⚠ Accountants |

| Setup Time | 30 seconds | 30+ minutes | Professional setup | Steep learning curve |

| Built for Swiss Freelancers | ✓ Yes | ✗ SME focus | ⚠ Hands-off | ✗ Desktop only |

Magic Heidi was created by a Swiss freelancer who faced these exact frustrations. The result is software that includes everything freelancers need and nothing they don't.

Built specifically for Swiss freelancers by someone who understands the struggle firsthand.

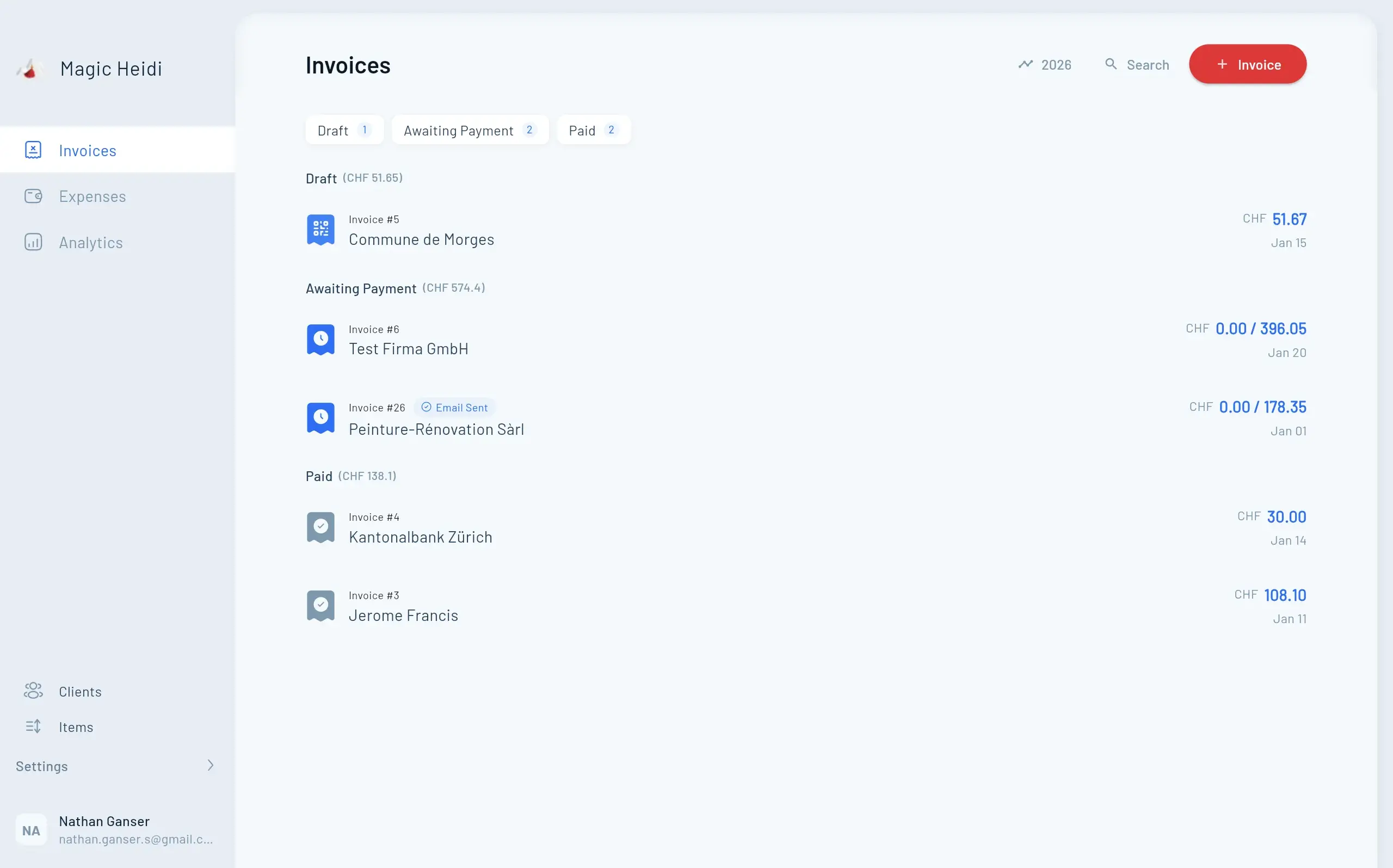

Open the app. Add your client. Enter the amount. Done. Magic Heidi generates a Swiss-compliant QR invoice with your logo, correct VAT, and proper formatting.

Take a photo of any receipt. Magic Heidi's AI reads the vendor name, date, and amount, suggests the category, flags tax-deductible items, and stores it digitally.

Connect your Swiss bank account. Magic Heidi imports transactions automatically, matches them to invoices and expenses, and highlights anything needing categorization.

Operating below CHF 100,000? Magic Heidi stays simple and clean. Cross that threshold? Activate VAT with one click. All future invoices include the correct VAT rate automatically.

Magic Heidi is owned by a Swiss freelancer and built for Swiss freelancers. Your data is stored exclusively on Swiss servers in Zürich. This isn't international software with a Swiss flag pasted on—it's built from the ground up for this market.

Founded and operated in Switzerland

Your data never leaves Zürich

German, French, and Italian

Native apps for all platforms

Let's quantify what disorganized finances actually cost you:

Time waste: 8-12 hours monthly on manual tasks × CHF 80 hourly rate = CHF 640-960 in lost billable time

Missed deductions: Average Swiss freelancer misses CHF 3,000-5,000 in legitimate annual deductions due to lost receipts and poor tracking

Late payment fees: 2-3 late invoice payments annually at CHF 50-100 each in administrative fees and interest

Accountant premium: Disorganized records mean your accountant spends 3-4 extra hours sorting your finances at CHF 150-200/hour

Stress and anxiety: Priceless (but real)

Magic Heidi costs CHF 25 monthly (CHF 300 annually). The ROI is immediate.

A simple roadmap to complete financial visibility and systematic processes that run on autopilot.

Get your account configured and ready to use.

Bring your past records into the system.

Start using Magic Heidi for daily operations.

Refine your processes and gain insights.

No—and it shouldn't. Magic Heidi handles daily operations (invoicing, expense tracking, bookkeeping). Your accountant handles tax strategy, annual filings, and advisory. Magic Heidi makes your accountant's job easier (and cheaper) by providing organized, accurate records.

Magic Heidi is designed for freelancers, not accountants. If you can use a smartphone, you can use Magic Heidi. The interface is intuitive, and Swiss-based support helps with any questions.

International software lacks Swiss-specific features: QR invoices, Swiss VAT rates, integration with Swiss banks, and local compliance requirements. Magic Heidi is built specifically for the Swiss market.

Yes. Magic Heidi offers a free trial so you can test all features without commitment. Most users create their first invoice within 5 minutes of signup.

You own your data. Export everything at any time—invoices, expenses, reports. No vendor lock-in.

Join over 1,000 Swiss freelancers who've taken control of their finances.

Magic Heidi gave me back 10 hours every month. I finally have time to focus on client work instead of drowning in admin tasks.

Graphic Designer, Zürich

Als Freiberufler war die Buchhaltung immer ein Alptraum. Mit Magic Heidi erstelle ich Rechnungen in Sekunden und habe volle Transparenz über meine Finanzen.

IT Consultant, Bern

Le scan IA des reçus a changé ma vie. Plus besoin de saisir manuellement chaque dépense. C'est exactement ce dont les freelances suisses ont besoin.

Marketing Consultant, Geneva

One plan. All features. Cancel anytime.

Managing freelance finances in Switzerland doesn't require an accounting degree or endless hours in spreadsheets. It requires the right system—one built specifically for your needs.

Your creative work deserves your full attention. Let Magic Heidi handle the financial admin so you can focus on what you do best.

Start your free trial today—create your first professional QR invoice in under 30 seconds and see why over 1,000 Swiss freelancers trust Magic Heidi with their finances.

No credit card required. Cancel anytime. Swiss data privacy guaranteed.