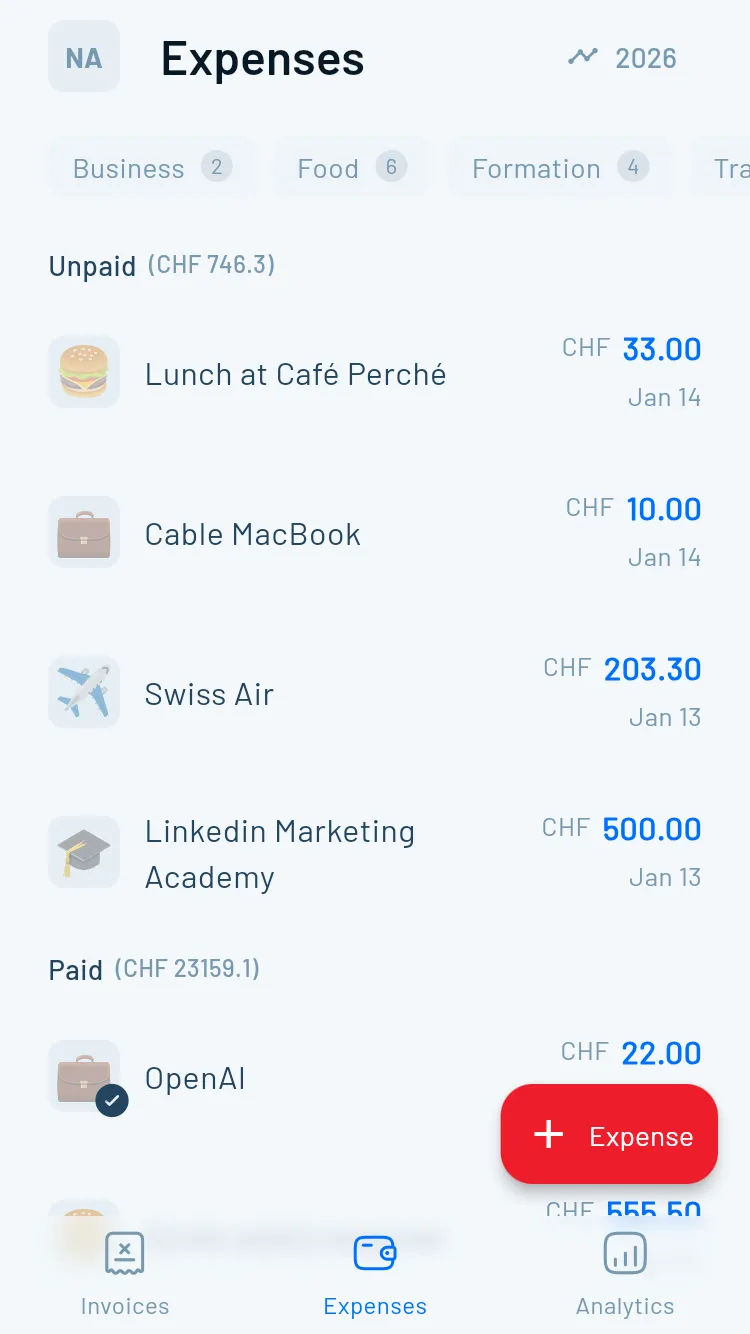

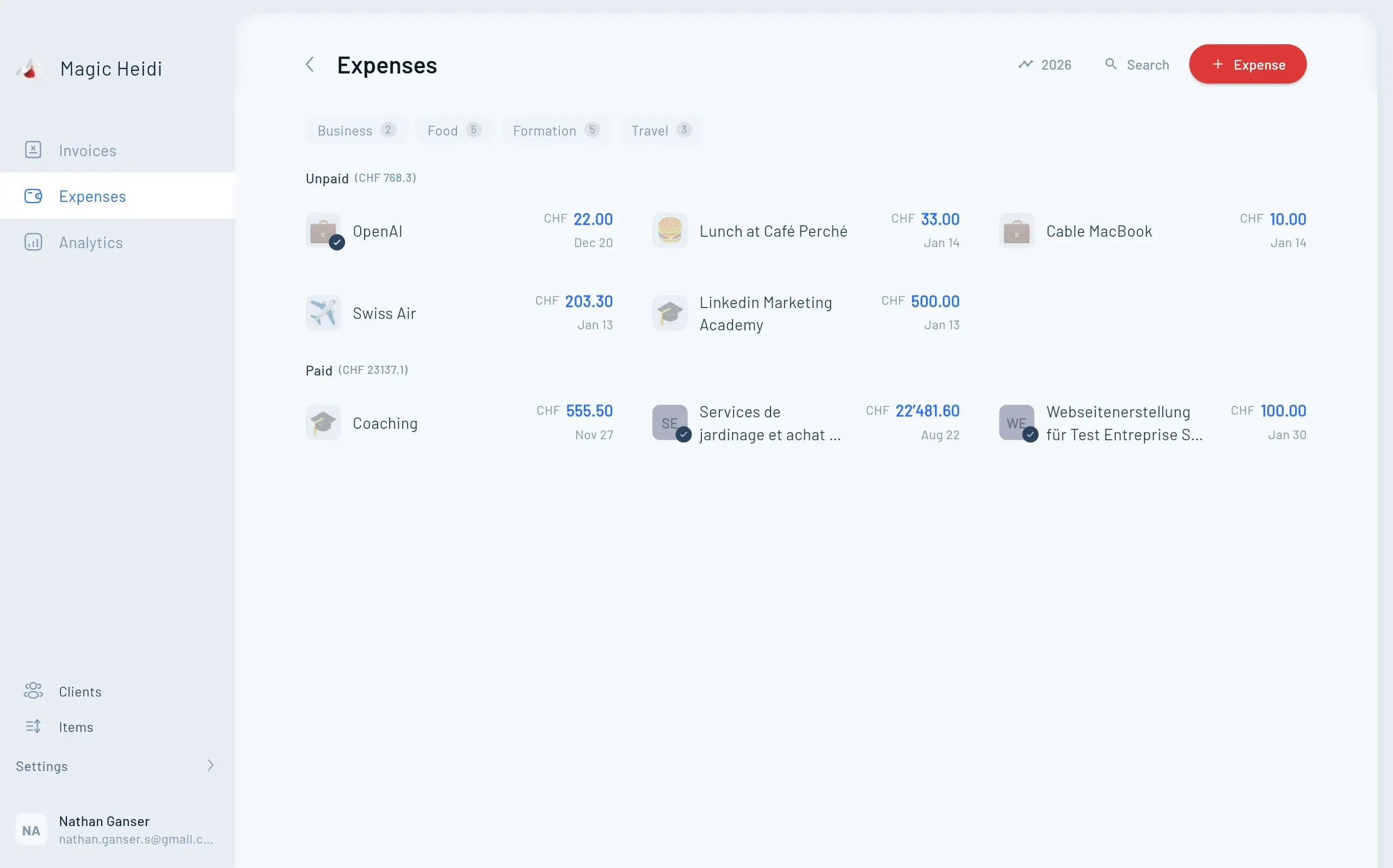

Capture Immediately

The best time to record an expense is the moment it happens. Photograph the receipt immediately using your phone. Takes 5 seconds. Delivers 60% reduction in administrative time compared to batch-processing.

- Mobile-first approach eliminates data entry

- Capture before you leave the shop

- No more lost or faded receipts

- Works offline, syncs automatically