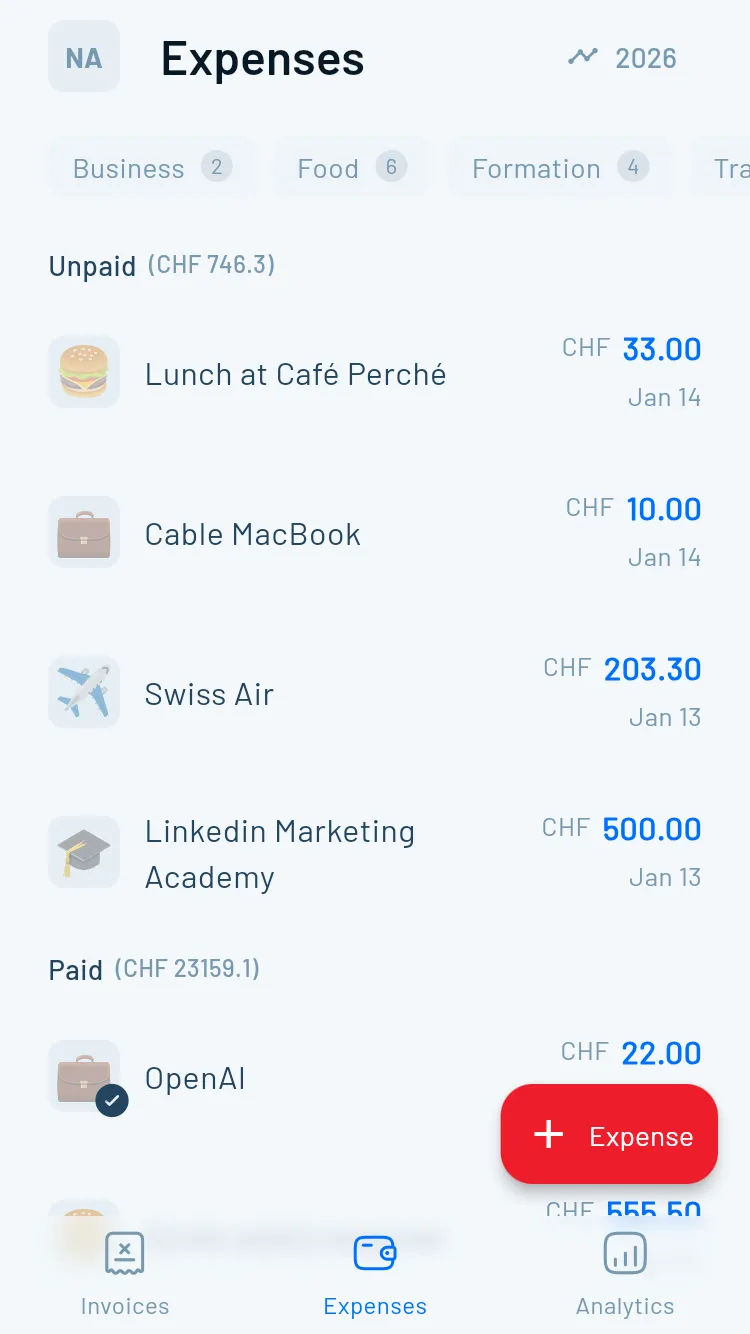

Forgetting VAT Registration

Your income crosses CHF 100,000 but you don't realize registration is mandatory within 30 days. AFC demands retroactive VAT plus penalties.

- Track rolling 12-month income monthly

- Set calendar reminders at CHF 80,000

- Register proactively, not reactively