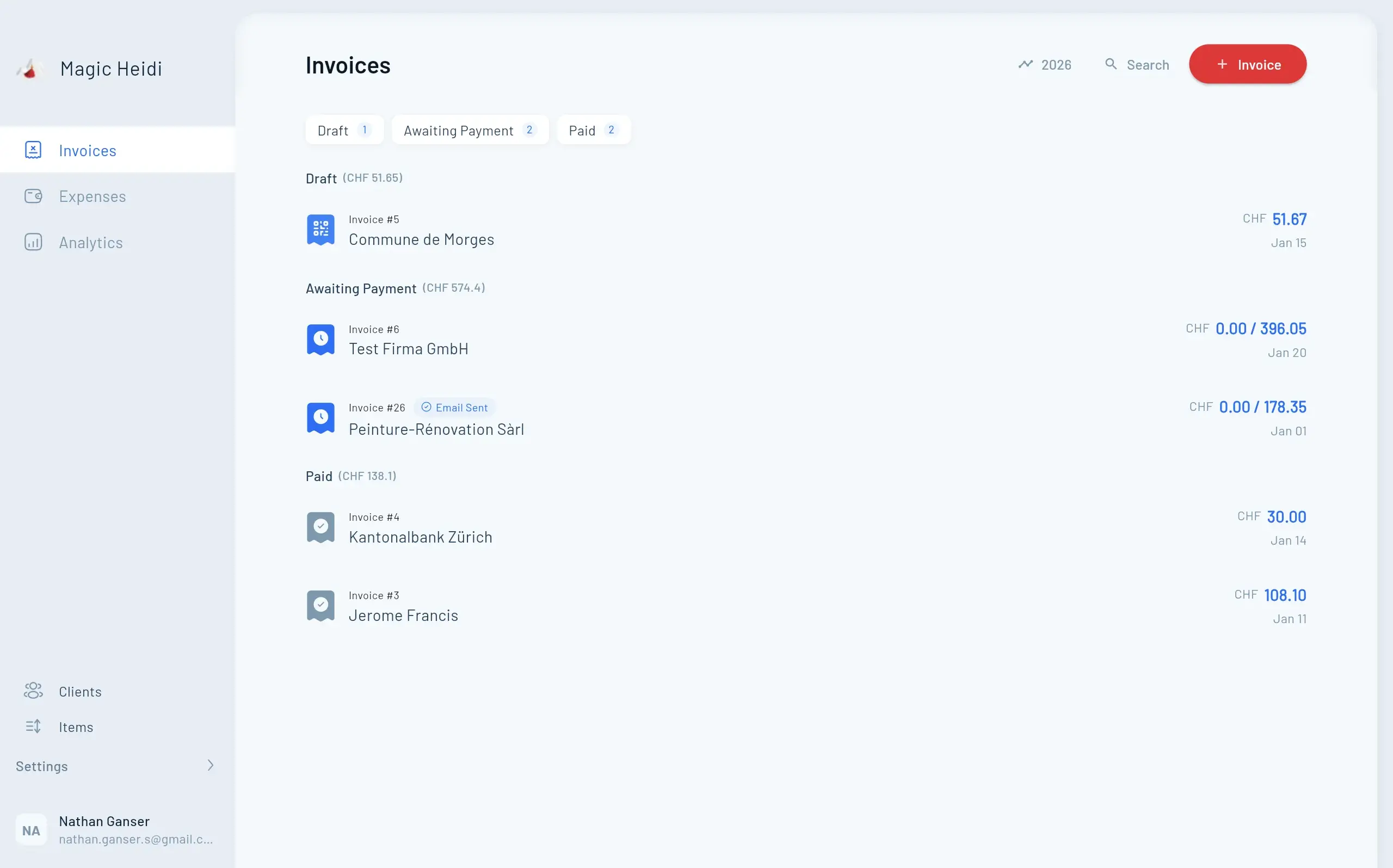

Effective January 1, 2025: All VAT-registered businesses must file returns electronically through the ePortal. Paper submissions are no longer accepted.

If you've been filing paper returns, transition now. The ePortal requires:

- A valid email address

- Two-factor authentication setup

- Modern browser (Chrome, Firefox, Safari, or Edge)

First-time users should allow extra time to familiarize themselves with the interface before the first quarterly deadline.

New for 2025: Businesses with annual turnover not exceeding CHF 5,005,000 and a good compliance history can elect to file VAT returns annually instead of quarterly.

Eligibility requirements:

- Clean compliance record (no late filings or penalties in previous year)

- Turnover under CHF 5,005,000 threshold

- Application submitted through ePortal

How it works:

Make instalment payments on May 30, August 30, and November 30. Submit your final annual return reconciling actual VAT by the following February 28th.

Advantages: Significantly reduced administrative burden. Three advance payments instead of four quarterly calculations. Single comprehensive annual return.

Disadvantages: Cash flow impact if you're typically in credit position. Less frequent refunds if you regularly pay more VAT than you collect.

Effective January 1, 2025: If you operate a digital marketplace or platform facilitating sales in Switzerland, you may be deemed the supplier for VAT purposes.

This affects:

- Marketplace platforms (like Etsy, eBay equivalents)

- App stores

- Online booking platforms

- Gig economy platforms

The principle: The platform, not the individual seller, becomes responsible for VAT collection and remittance when facilitating sales to Swiss customers.

Freelancers affected: If you sell services through platforms, clarify who handles VAT obligations. Some platforms now withhold VAT on your behalf, affecting your net income calculations.