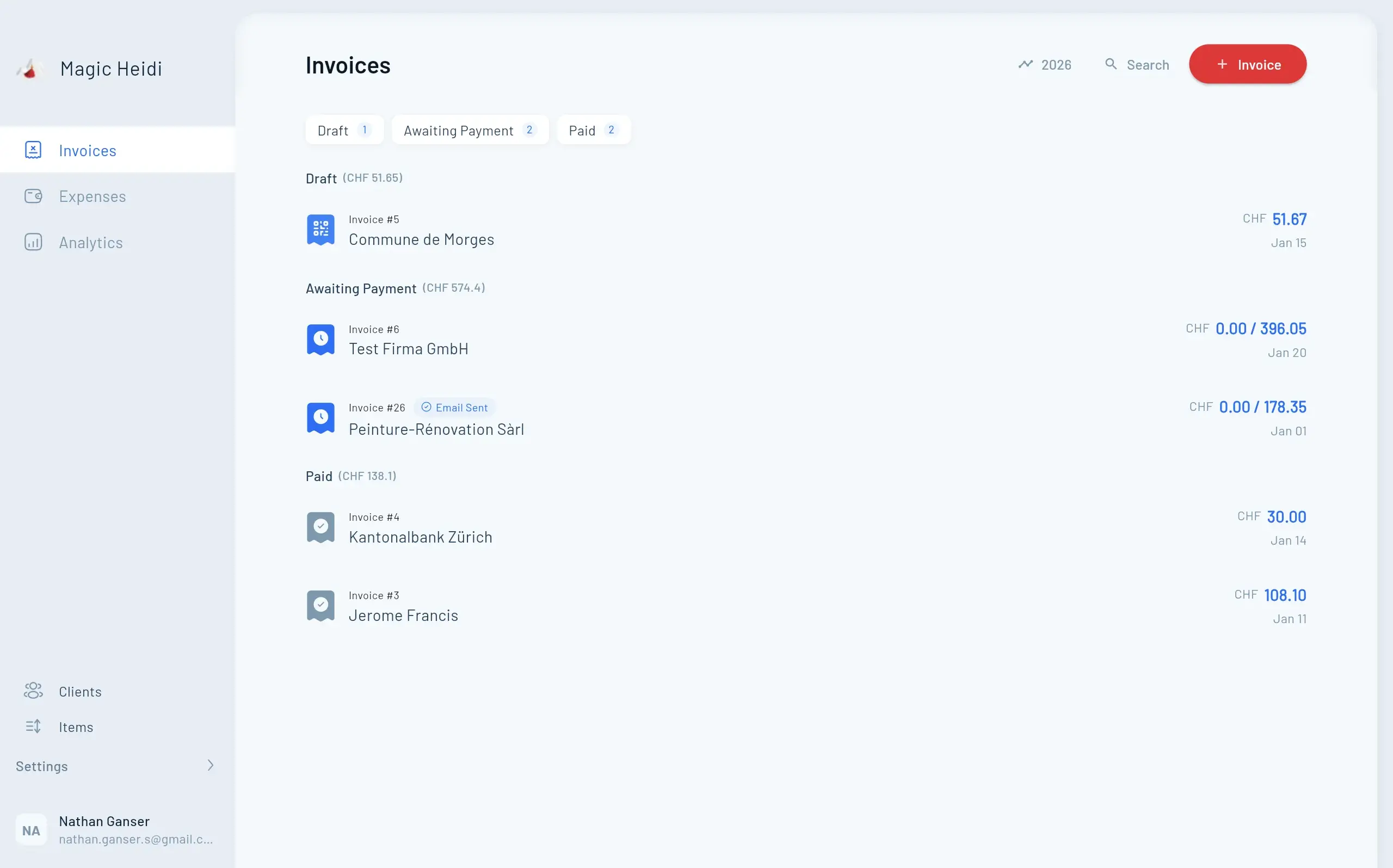

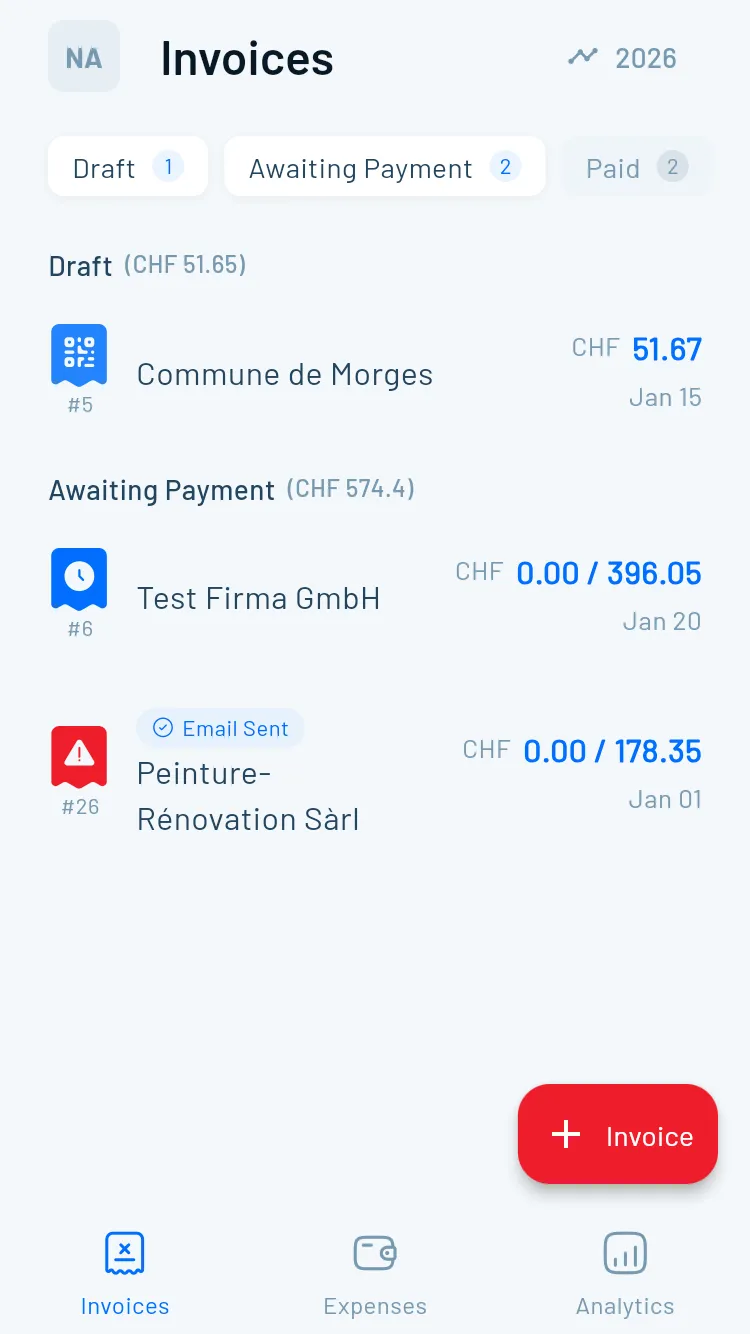

Missing Mandatory Information

Leaving out invoice date, complete address, or UID number makes invoices legally incomplete.

- The fix: Use our template with fields for all mandatory elements

- Why it matters: Incomplete invoices can be rejected during VAT audits

- Prevention: Checklist before sending each invoice