3. Other services that are worth money

Things offered by your customers in return for your service, for example.

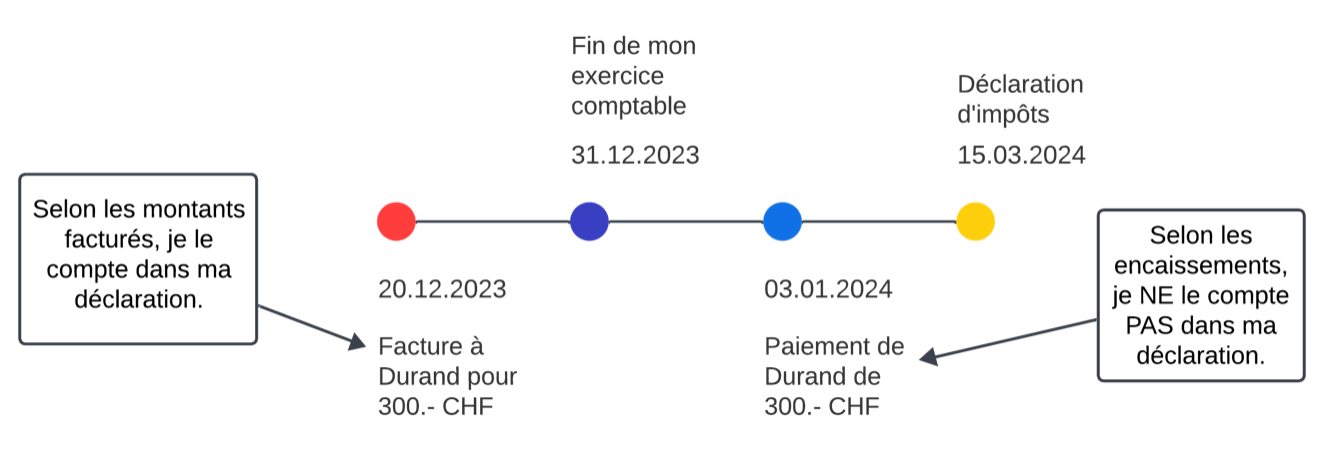

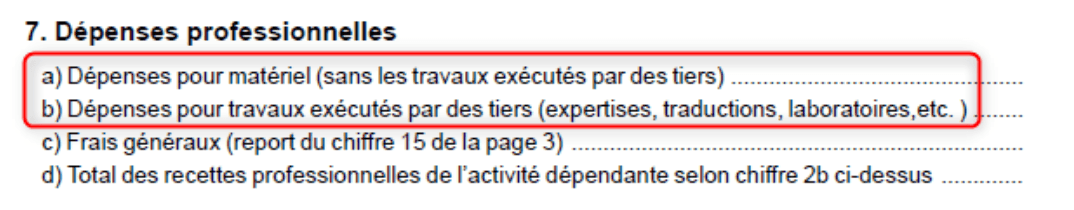

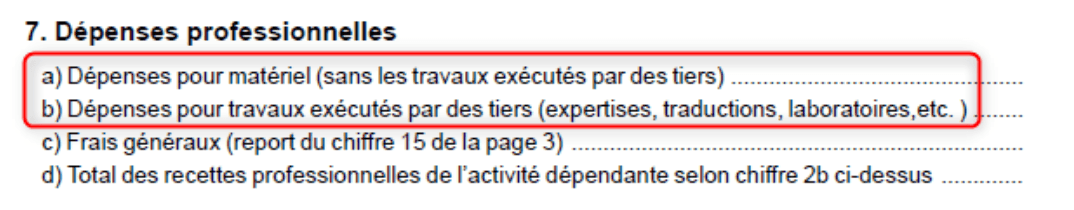

7. Professional expenses

Here, you can only fill in points a) and b). The rest is on page 3 in the "General expenses" section.

8. Inventory variations

As specified at the beginning of the article, this is where the amount of your stock variation (Final inventory - Initial inventory) will be entered from the inventory table on page 3.

If you work on the basis of receipts, the rest is not mandatory. However, the guide "Additional instructions" allows you to enter these amounts.

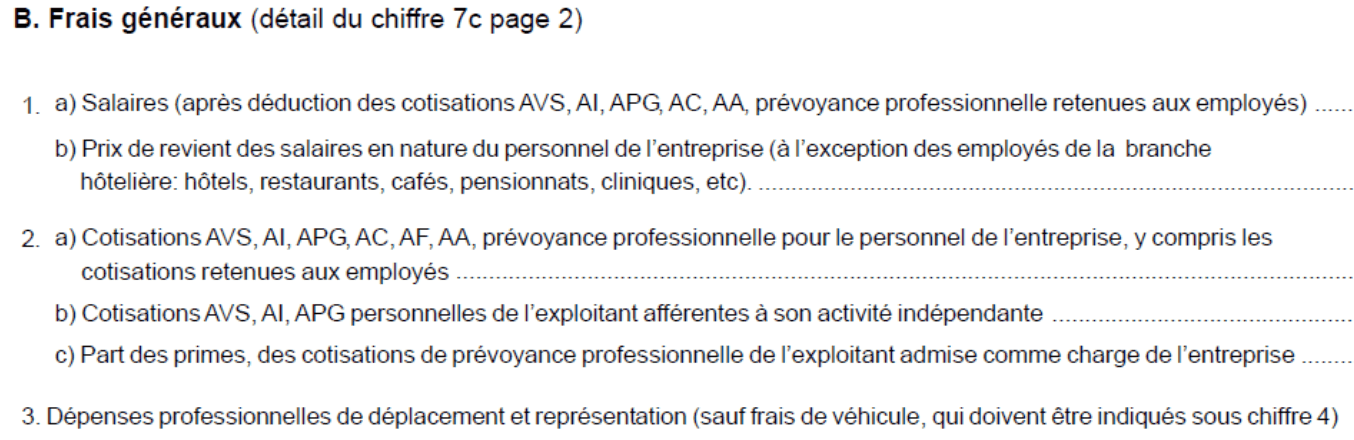

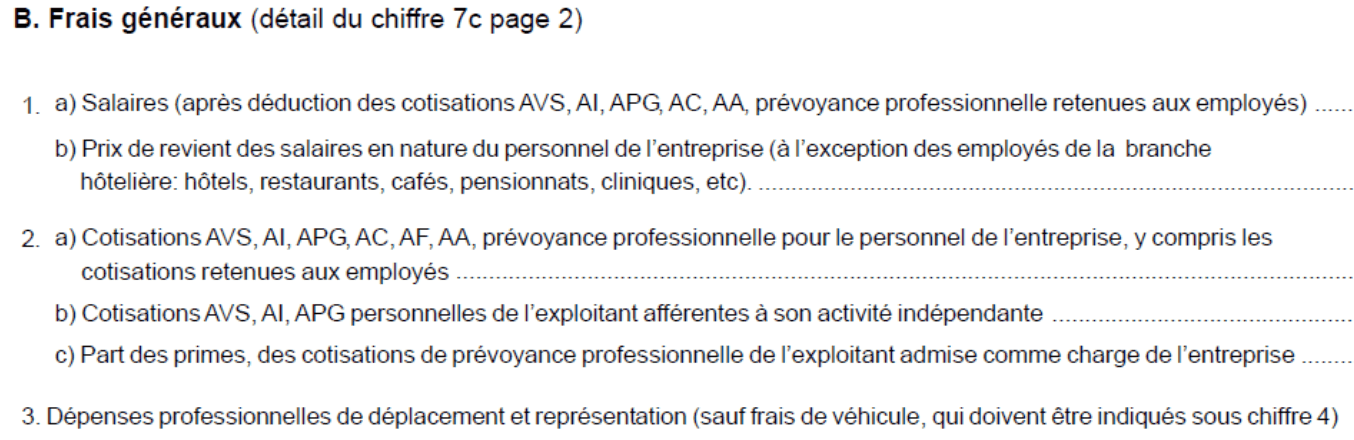

Page 3 – Part 2 - B. General expenses

You can go to this article to identify your expenses. It will be an additional help to tackle this part!

Let's go!

Points 1 and 2 are self-explanatory. You must provide employees' salaries, salaries in kind if applicable (provision of a vehicle for example) and contributions paid to the AVS and 2nd pillar insurance premiums.

3. Professional travel and representation expenses (except vehicle costs, which must be indicated under number 4)

This section includes professional travel expenses of employees and the operator. This is the time to book your stay abroad to meet a client.

4. - 5. Commercial vehicle costs / Private vehicle costs charged to the company

For points 4 and 5, there are two solutions:

- Either your vehicle belongs to your company (commercial assets) then point 4 must be completed.

- Or your vehicle belongs to you (private assets) then point 5 must be completed. In this case, you must include all the costs of the car. Then, you calculate a share of professional use and a private share according to your use.

Example: 60% professional use and 40% private use; the costs amount to CHF 10,000.-; commercial use share = CHF 6,000 and remaining share = CHF 4,000.

You can enter the amount of CHF 6,000 which is an expense for the company in point 5.

6. Interest on commercial debts

You must enter the amount of interest paid during the tax year if you have a loan in progress for your company.

Points 7 to 12 correspond to the operating expenses of the company: rent, property insurance, internet and telephone subscription, etc.

14. Private share of overheads (without the private share of commercial vehicle costs already deducted under number 4)

If you have taken a private share of overheads then you must enter the amount.

Here is an article that explains the use of a telephone in a private and commercial manner.

Page 3 & 4 – Part 3 – Tables to fill in

The inventory table allows you to take stock of the “in progress” spanning 2 financial years.

If you work on the basis of receipts, the rest does not have to be filled in.

For example, the inventory of work in progress corresponds to the part completed during the year and what remains to be done. It is therefore necessary to base it on the estimates and costs of this year. You cannot apply all the charges for a construction site over a year if it is not finished. This instruction applies to construction and craft work as well as to liberal professions.

Inventory of stocks is mandatory. Their estimate in the table "Estimate of stocks of goods" below is not.

Then, these amounts will be reported on page 2, number 8 of the form.

The table of assets and liabilities is a snapshot of your company's balances. This table is not mandatory.

It is linked to the accounting management of your company and can be completed by an accounting professional. This applies to the following table: "Depreciation table for the financial year".

End

Finally, you are at the end of the form! The last table identifies the distribution of your turnover if you have an activity in several municipalities then this will be taken into account in your tax. The name of the table is "Indications allowing intercommunal and intercantonal distributions to be carried out". It is not mandatory.

Summary

Congratulations! You have reached the bout of the form. Only the net result of the activity is to be reported in your tax return in the "Independent activities" section.

This is point no. 10 on page 2 of the form.

Good preparation in advance allows you to complete this form and transfer this information to your declaration.

This allows you to enter your total gross income and the amount of expenses. And Magic Heidi is a great tool for this operation.

As for the private part, it is important to record what you used. And for the car, you must estimate your use.

For information, there are:

24 hours in a day,

120 hours for 5 days,

168 hours in 7 days

A 100% employee works between 210 and 230 days per year depending on the number of authorized vacation days.

Do not hesitate to contact the administration if you have any questions.

As a reminder, the management of depreciation and provisions for charges is worth being transmitted to accounting professionals for good monitoring and a fair declaration. These people are there to save you money.

Here are all the tools that can guide you to correctly fill out your form: