Legal Essentials for Swiss Freelancers (2026):

Contracts, VAT (MWST/TVA), Invoicing & Disputes

A Swiss-specific legal checklist for freelancers: choose the right business structure, write stronger contracts, stay compliant with VAT (MWST/TVA) and QR invoicing updates, and handle late payments (Betreibung) the right way.

Legal Essentials for Swiss Freelancers (2026): The Practical Checklist for Staying Compliant (and Getting Paid)

Freelancing in Switzerland is freedom with paperwork attached. The good news: most legal risk comes from a small set of repeatable issues—business setup, contracts, VAT (MWST/TVA), invoice compliance, and late payments. If you handle those five well, you’ll avoid the most expensive mistakes freelancers make.

This guide is a Swiss-specific legal checklist designed for new and early-stage freelancers (Einzelfirma / sole proprietors), plus international freelancers billing Swiss clients. It includes 2025–2026 updates like VAT administration via the ESTV/AFC ePortal (mandatory since 1 Jan 2025) and the Swiss QR-bill structured address changes effective 21 Nov 2025.

Disclaimer: This article is for general information—not legal or tax advice. For your specific situation (especially cross-border work, disputes, or VAT edge cases), consult a qualified Swiss lawyer or tax advisor.

Your “Swiss Freelancer Legal Starter” Checklist

(80/20 overview)

If you want the 80/20 of legal essentials, start here:

Pick the right legal form

Usually Einzelfirma to start; consider GmbH for liability and credibility.

- Choose structure early

- Understand liability exposure

- Reassess as revenue/risk grows

- Get advice for high-risk work

Separate business admin

Clean bookkeeping + documented client approvals reduce disputes fast.

- Dedicated bank account (ideal)

- One consistent business identity

- Store approvals in writing

- Keep records audit-ready

Use written contracts

Scope, payment terms, IP, termination, and liability cap—every time.

- Define scope + acceptance

- Add change-request process

- Make payment timeline explicit

- Clarify IP ownership/usage

Know your VAT position (MWST/TVA)

Watch the CHF 100,000 threshold and decide on voluntary registration.

- Threshold awareness

- Rate + evidence discipline

- Reporting workflow readiness

- Cross-border nuance

Invoice correctly + be QR-bill ready

Mandatory invoice fields + practical readiness for QR-bill updates.

- Clear invoice content

- Payment terms + due date

- VAT fields if registered

- QR-bill friction reduction

Have a late-payment process

Reminders → final notice → consider Betreibung (with documentation).

- Consistent escalation ladder

- Keep messages + proof

- Pause work when needed

- Lawyer review at the right time

Protect IP + data

Usage rights, confidentiality, and data-processing clauses where needed.

- License vs assignment

- Portfolio rights

- Confidentiality basics

- Security expectations

Consider insurance

Often professional liability / public liability (especially on-site work).

- Match coverage to risk

- Review client requirements

- Document what you have

- Reassess annually

Know when a lawyer is worth it

Before big contracts, disputes, or valuable IP—advice is often cheaper than mistakes.

- Big contract review

- IP / confidentiality disputes

- Non-payment escalation

- Complex VAT edge cases

1) Legal setup in Switzerland:

your baseline

What you need before you “just invoice”: structure choices, evidence-ready admin, and repeatable habits that reduce legal risk.

1) Legal setup in Switzerland: your baseline (what you need before you “just invoice”)

Choose a legal structure: Einzelfirma vs GmbH (and why it matters)

Many Swiss freelancers start as a sole proprietorship (Einzelfirma) because it’s lightweight. But “easy” can come with personal liability. A GmbH (limited liability company) can separate personal and business risk (with more admin and costs).

Typical freelancer fit:

- Einzelfirma (sole proprietorship): simpler setup and admin; but liabilities can hit personal assets.

- GmbH: better risk separation and sometimes more credibility with enterprise clients; requires more structure and ongoing admin.

If you’re doing work with higher risk (e.g., large projects, warranties, regulated industries, subcontractors), it’s worth getting advice early—even a one-hour consult can prevent structural mistakes.

Further reading idea: if you’re weighing structures, look for resources comparing Einzelfirma vs GmbH and how liability works in practice. A useful starting point on sole proprietorship registration and basics is SwissIncorporated’s overview.

Source: https://www.swissincorporated.com/company-formation/sole-proprietorship-registration

Admin readiness: small steps that prevent big legal problems

You don’t need a legal department, but you do need repeatable admin habits:

- Use one consistent business name in contracts and invoices.

- Keep business and personal finances separate (ideally a dedicated account).

- Store client approvals in writing (email counts; better: signed acceptance).

- Keep records: contracts, briefs, change requests, invoices, payment reminders, and final deliverables.

This is not just “good organization”—it’s evidence. If you ever face a dispute, documentation is leverage.

2) Contracts:

your core legal protection

A good contract prevents scope creep, clarifies IP, and makes payment enforceable. If you improve one thing this year, improve your contract.

2) Contracts: your core legal protection (and your best payment tool)

A contract is not about distrust. It’s a shared document that answers:

- What exactly are we doing?

- When is it due?

- What happens if the scope changes or payment is late?

- Who owns what afterward?

If you only improve one thing this year, improve your contracts.

Swiss freelancer contract clauses you should not skip

Use this as a checklist for Swiss freelancer contract clauses (and adapt per project):

1) Scope, deliverables, and acceptance

- Define what’s included (and what isn’t).

- Define acceptance criteria (e.g., “Client has 5 business days to review; otherwise deemed accepted”).

2) Change requests (scope control)

- Set a process: written change request → new estimate → approval before work continues.

3) Payment terms (make the timeline explicit)

- Deposit / upfront payment (common and reasonable).

- Payment due date (e.g., 10/14/30 days).

- Late payment consequences (late fee/interest if appropriate—keep it enforceable and reasonable).

4) Intellectual property (IP) and usage rights

This is where many freelancers lose value.

- State whether the client gets full assignment or a license.

- Specify what happens to drafts, source files, and reusable components.

- Clarify portfolio rights (you may want permission to display work).

5) Confidentiality + data protection

- Basic confidentiality clause for most projects.

- If you process personal data (customer lists, user data), consider data processing language and security expectations.

6) Liability and warranty limits

- Define a liability cap (often linked to fees paid).

- Exclude indirect damages where appropriate.

- Clarify that you don’t guarantee business outcomes (especially in marketing/consulting).

7) Termination and handover

- Notice periods and kill fees (especially for retainer work).

- What deliverables are provided if the project ends early.

8) Governing law and jurisdiction

Especially important if you work cross-border. Decide:

- Swiss law + Swiss venue, or

- a specific canton/court, or

- arbitration (for larger engagements).

Contract types worth having in your “starter pack”

Most freelancers benefit from having these templates ready:

- Master Service Agreement (MSA) + Statement of Work (SOW) for bigger clients

- Simple fixed-price contract template

- Retainer agreement (monthly scope + boundaries)

- NDA (when clients require it)

- Subcontractor agreement (if you outsource work)

If your business relies on a handful of high-value clients, a lawyer-reviewed template is usually a high-ROI purchase.

3) VAT (MWST/TVA):

stay compliant (2025–2026 updates)

Focus on three questions: do you need to register, what rate applies, and how to report with evidence—especially with the ESTV/AFC ePortal changes.

3) VAT (MWST/TVA): when it applies and how to stay compliant (2025–2026 updates)

VAT is where Swiss freelancers often get anxious—and for good reason. The rules are manageable once you focus on three questions:

- Do I need to register?

- What rate applies (if any)?

- How do I report and keep evidence?

VAT registration threshold Switzerland freelancer: the CHF 100,000 rule (and nuance)

Common guidance is that VAT registration becomes mandatory once you exceed CHF 100,000 in turnover (often discussed in freelancer VAT guides).

Source: https://tobill.ch/en/blog/swiss-vat-guide-freelancers-2025

Important nuance: what “counts” toward the threshold and how cross-border turnover is treated can be nuanced. If you’re close to the threshold, or your client base is international, get a VAT-specific check from a professional.

VAT admin modernization: ESTV/AFC ePortal since 1 Jan 2025

From 1 January 2025, VAT administration is handled via the ESTV/AFC ePortal. Practically, this means:

- You’ll manage VAT processes digitally (registration/communication/reporting).

- Your workflow must be “digitally ready” (clean invoice data, traceable records).

Source (secondary summary): https://www.expatica.com/ch/finance/taxes/freelance-tax-switzerland-2173341/

Quarterly vs annual VAT reporting (new planning option from 2025)

From 2025, eligible taxpayers may be able to use an annual VAT reporting option (instead of quarterly), depending on criteria and application timing. This can reduce admin—but it doesn’t reduce the need to track VAT correctly throughout the year.

Source (secondary summary): https://www.expatica.com/ch/finance/taxes/freelance-tax-switzerland-2173341/

VAT rates (don’t guess—configure once and keep it consistent)

VAT rates can change and vary by category. Rather than memorizing, build a habit:

- Confirm current standard rates from reliable sources,

- Configure them in your invoicing/accounting system,

- Keep evidence for zero-rated/exempt or reverse-charge scenarios.

If you sell digital products or operate through platforms, note that platform taxation rules are evolving for 2025, which can affect who is considered the supplier.

Source: https://www.bdo.global/en-gb/insights/tax/indirect-tax/switzerland-platform-taxation-to-apply-as-2025

Voluntary VAT registration: when it can make sense

Even below CHF 100,000, some freelancers register voluntarily to:

- Reclaim input VAT on expenses (depending on situation),

- Signal “grown-up supplier” status to corporate clients,

- Simplify procurement processes for B2B clients.

But voluntary registration also adds admin and reporting obligations—so decide based on your margins, expenses, and client profile.

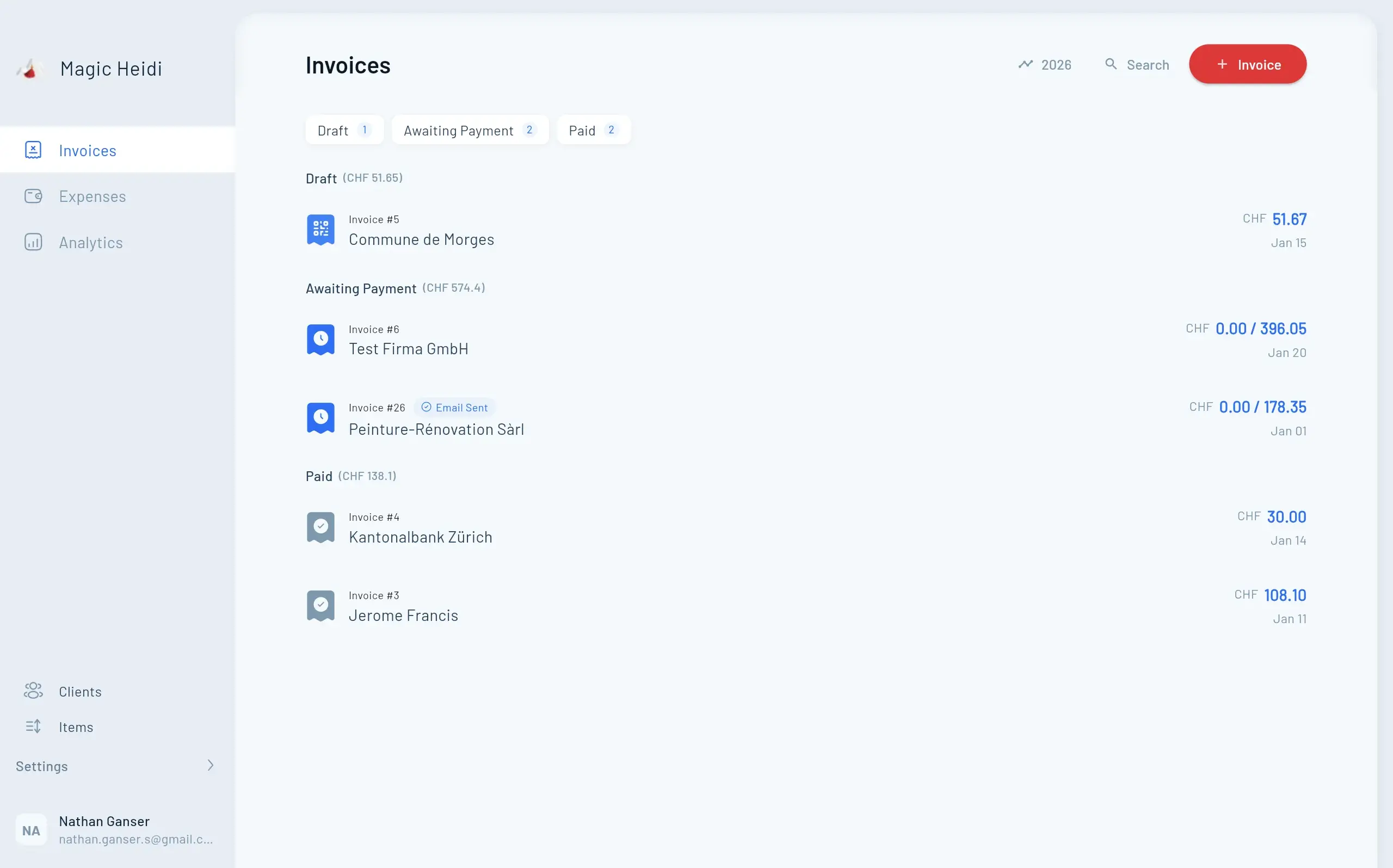

4) Swiss freelance invoice requirements:

and the QR-bill reality

Clarity gets you paid faster and reduces dispute risk. QR-bill readiness matters even when it’s not strictly “mandatory for every invoice.”

4) Swiss freelance invoice requirements (and the QR invoice reality)

People search for Swiss freelance invoice requirements because they want one thing: invoices that get paid quickly and don’t create compliance risk.

What an invoice should include (practical minimum)

While invoice requirements can vary by situation (especially if VAT applies), a solid Swiss-style invoice typically includes:

- Your full business identity (name/address; company number if applicable)

- Client name/address

- Invoice date and invoice number (unique, sequential is best practice)

- Clear description of services (what you delivered)

- Service period or delivery date (helpful for clarity)

- Amount due, currency, payment terms, due date

- If VAT-registered: VAT number + VAT rate and VAT amount (as applicable)

Make invoice clarity part of your legal protection. If you ever need to enforce payment, a detailed invoice reduces “we didn’t understand what we were paying for” arguments.

Do Swiss invoices need a QR code?

A QR-bill is not “mandatory for every invoice,” but it’s become a Swiss payment standard that removes friction—especially for domestic payments.

Critical update: Swiss QR-bill standard Version 2.3 introduced changes effective 21 Nov 2025, including structured addresses and an extended character set (with a transition window into 2026).

Source: https://userapps.support.sap.com/sap/support/knowledge/en/3666713

If you invoice Swiss clients regularly, being QR-bill-ready is a practical advantage (fewer payment errors, faster reconciliation, smoother client experience).

If you want a plain-language breakdown of the 2025 change and what it means operationally, Magic Heidi has a dedicated explainer:

Source: https://magicheidi.ch/qr-bill-2025-changes-explained

5) Late payments & disputes:

the Swiss escalation path (Betreibung)

Escalate professionally, keep documentation tight, and know the point where legal advice becomes cost-effective.

5) Late payments & disputes: the Swiss escalation path (including Betreibung)

Late payments aren’t just annoying—they create legal and cash-flow risk. The goal is to escalate professionally, with documentation, and without burning client relationships unnecessarily.

Step-by-step: what to do if a client doesn’t pay in Switzerland

Use a consistent escalation ladder:

Step 1: Friendly reminder (assume it’s an oversight)

- Reference invoice number, amount, due date

- Include payment details again

- Ask if they need anything from you

Step 2: Formal reminder (clear deadline)

- Provide a new deadline (e.g., 7 days)

- State consequences calmly (service pause, late fees if contract allows)

Step 3: Final notice (last chance before collection/legal steps)

- Final deadline

- Mention next step: debt collection process (Betreibung) and/or lawyer involvement

Step 4: Consider debt collection (Betreibung)

Switzerland has a formal debt enforcement process commonly referred to as Betreibung. Whether you should initiate it depends on:

- amount owed,

- strength of your documentation (contract, approvals, invoice, reminders),

- client relationship value,

- likelihood of recovery.

Because Betreibung is procedural and can trigger disputes, it’s often the point where legal advice becomes cost-effective, especially for higher-value invoices.

Dispute-proofing: prevent “payment arguments” before they happen

Most payment disputes start with ambiguity. Prevent the usual friction points:

- Put scope and change requests in writing

- Use acceptance milestones

- Invoice immediately upon milestone acceptance

- Don’t deliver final files/source assets until payment terms are met (where reasonable and contractually supported)

6) International clients & cross-border basics:

keep it simple, keep it documented

Jurisdiction, payment mechanics, and VAT treatment are the three recurring risk zones in international work.

6) International clients & cross-border basics (keep it simple, keep it documented)

International work is common in Switzerland. The legal essentials are:

Put jurisdiction and payment mechanics in the contract

At minimum:

- Governing law + place of jurisdiction

- Currency and bank fees (who pays)

- Payment method and due dates

- Deliverables and acceptance in writing

VAT on cross-border services: don’t wing it

Cross-border VAT can involve “place of supply,” reverse charge logic, and evidence requirements. The safest approach:

- Keep VAT treatment rules high-level in your template,

- Get specific advice when your client base or revenue makes it material.

If you’re nearing the CHF 100,000 VAT registration threshold, cross-border turnover nuance becomes especially important.

Source: https://tobill.ch/en/blog/swiss-vat-guide-freelancers-2025

7) When to hire a lawyer:

and when you can DIY

You don’t need a lawyer for every invoice. You do need one when the cost of being wrong exceeds the cost of advice.

7) When to hire a lawyer (and when you can DIY)

You don’t need a lawyer for every invoice. You do need a lawyer when the cost of being wrong exceeds the cost of advice.

A simple decision framework: DIY vs lawyer

You can usually DIY when:

- Contract value is low and scope is simple

- You’re using a proven template and not granting broad IP rights

- There’s no sensitive data, unusual liability, or cross-border complexity

Get a lawyer involved when:

- You’re signing a big contract (or a long retainer)

- The client contract includes heavy liability, indemnities, or non-standard IP assignment

- You’re dealing with non-payment beyond reminders / heading into Betreibung

- You have disputes involving IP ownership, confidentiality, or reputational damage

- You’re uncertain about VAT registration obligations or complex cross-border VAT treatment

What to prepare before speaking to a lawyer (saves billable time)

Bring:

- Signed contract + any SOWs

- Email thread/brief, change requests, approvals

- Invoices, reminders, and proof of delivery

- Timeline of events (bullet points)

- What outcome you want (payment, termination, settlement, cease-and-desist, etc.)

FAQ: legal essentials for Swiss freelancers

Do I need to register a business before I invoice?

Often you can start small, but legal and administrative obligations can arise quickly (social insurance, VAT thresholds, client procurement requirements). If you’re invoicing regularly, treat setup seriously: clear business identity, contract templates, and compliant invoicing.

What is the VAT registration threshold in Switzerland for freelancers?

Many guides reference CHF 100,000 as the key threshold for mandatory registration, with nuance depending on turnover composition and situation. Source: https://tobill.ch/en/blog/swiss-vat-guide-freelancers-2025

Can I register for VAT voluntarily?

In many cases, yes—and it may help with input VAT recovery and corporate client expectations. But it also adds reporting/admin duties.

How do VAT reporting and admin work from 2025?

VAT administration is handled via the ESTV/AFC ePortal since 1 Jan 2025, and eligible taxpayers may be able to opt into annual VAT reporting from 2025 (criteria apply). Source: https://www.expatica.com/ch/finance/taxes/freelance-tax-switzerland-2173341/

Do Swiss invoices require a QR-bill?

Not always “mandatory,” but it’s a widely adopted payment standard in Switzerland. Note the QR-bill standard update effective 21 Nov 2025 (Version 2.3), including structured address requirements and a transition period into 2026. Source: https://userapps.support.sap.com/sap/support/knowledge/en/3666713

Who owns the IP by default—client or freelancer?

It depends on your contract and the nature of the work. Don’t rely on assumptions. Put IP assignment or licensing terms directly in your agreement, including what happens to source files, drafts, and reuse rights.

What should I do first when a client doesn’t pay?

Follow a written escalation process: friendly reminder → formal reminder → final notice → consider Betreibung and/or lawyer support. Keep every message, and reference invoice numbers and due dates.

Keep it simple:

your compliance workflow

Most legal problems get expensive because paperwork is missing or inconsistent. A lightweight system makes compliance repeatable.

Make your freelance business

legally ready this week

Standardize your contract, confirm your VAT position, and upgrade your invoicing workflow (QR-bill readiness + clean records).

Sources referenced

- ToBill VAT guide (threshold discussion): https://tobill.ch/en/blog/swiss-vat-guide-freelancers-2025

- Expatica (VAT ePortal, annual reporting option summary): https://www.expatica.com/ch/finance/taxes/freelance-tax-switzerland-2173341/

- SAP note summarizing Swiss QR-bill standard changes (Version 2.3, 21 Nov 2025): https://userapps.support.sap.com/sap/support/knowledge/en/3666713

- SwissIncorporated (sole proprietorship overview): https://www.swissincorporated.com/company-formation/sole-proprietorship-registration

- BDO (platform taxation trend note for 2025): https://www.bdo.global/en-gb/insights/tax/indirect-tax/switzerland-platform-taxation-to-apply-as-2025

- Magic Heidi QR-bill changes explainer: https://magicheidi.ch/qr-bill-2025-changes-explained