Swiss Accounting Documents:

What Every Freelancer Must Keep

Missing one receipt cost a Zurich freelancer CHF 2,800 in extra taxes last year. Learn exactly which documents Swiss law requires, how long to keep them, and how to turn paperwork into a profit-protection system.

What Counts as an Accounting Document

in Switzerland?

Swiss Article 957 of the Code of Obligations requires you to maintain evidence for every transaction. Essential documents include invoices, receipts, bank statements, contracts, VAT returns, and year-end financial statements.

10-Year Retention

All documents must be kept for a decadeCHF 100K VAT Threshold

Mandatory registration when exceededDigital Archiving

Tamper-proof storage required by lawThe Swiss Accounting Tier System Explained

Not every freelancer needs the same level of bookkeeping. Switzerland uses a tiered system based on your business structure and revenue.

Tier 1 — Under CHF 100K

Simplified Milchbüechli accounting. Track income, expenses, and assets in a basic ledger. No VAT or commercial register required.

Tier 2 — CHF 100K to 500K

Still simplified accounting, but VAT registration (8.1% standard rate) and commercial register entry become mandatory.

Tier 3 — Over CHF 500K

Full double-entry bookkeeping required under Article 957 CO. Balance sheet, income statement, and annual account notes needed.

Tier 4 — GmbH, AG Entities

Full accounting requirements apply regardless of turnover. Even a GmbH with CHF 50K revenue needs complete double-entry books.

The 10-Year Retention Rule

Article 958f of the Swiss Code of Obligations requires you to keep all accounting documents for 10 years from the end of the fiscal year. 2025 documents must be kept until December 31, 2035. During an audit, undocumented expenses get rejected—a CHF 5,000 claim without a receipt could cost you CHF 1,000-1,500 in additional taxes, plus interest and fines.

Digital Archiving:

What Swiss Law Requires

Good news—you don't need filing cabinets. The GeBüV (Ordinance on Business Records) allows digital storage under specific conditions.

Storage Requirements

Your digital archive must meet three key criteria to satisfy Swiss law.

- Tamper-proof — Documents can't be modified after upload

- Accessible — Readable throughout entire retention period

- Complete — All required information preserved

- PDF/A format recommended for long-term archiving

Cloud Storage Options

Cloud storage is permitted as long as servers are in Switzerland or the EU.

- Accounting software with built-in storage

- Google Drive or Dropbox with organized folders

- Dedicated Swiss solutions like Tresorit

- Magic Heidi automatic cloud archiving

File Naming Convention

Consistent naming makes searching painless during audits.

- Include date in YYYY-MM-DD format

- Add client or vendor name

- Specify document type (Invoice, Receipt)

- Include amount for quick reference

QR-Bill Changes Coming November 2025

If you issue invoices with Swiss QR-bills, mark this date: November 21, 2025.

From that day, only structured addresses (type "S") will be permitted in QR codes. Unstructured addresses (type "K") will phase out by September 2026.

What this means for you:

Your invoicing software must update before the deadline. If you're using older templates or manual QR generation, check compatibility now.

Magic Heidi automatically handles this transition—no action required from users.

VAT Requirements

for 2025

When your worldwide taxable turnover exceeds CHF 100,000 in any 12-month rolling period, VAT registration becomes mandatory. Set an alert at CHF 90,000 to prepare for registration.

Most services and goods

Hotel and lodging services

Food, books, medicines, newspapers

Quarterly, monthly, or annually

Why Proper Documentation Saves You Money

Good records aren't just about compliance. They directly reduce your tax bill through legitimate deductions.

Office & Equipment

Office rent, home office allocation (10-20% of rent), computers, software, and professional tools.

Development & Travel

Professional courses, client site travel, SBB tickets, fuel costs, and professional memberships.

Pillar 3a Contributions

Self-employed can contribute up to 20% of net income (max CHF 36,288 in 2025) to Pillar 3a.

Loss Carry-Forward

Carry forward business losses for 7 years, offsetting future profits with proper documentation.

Accounting Software for Swiss Freelancers

Find the right tool for your business documentation needs.

| Feature | Magic Heidi | bexio | CashCtrl | Banana |

|---|---|---|---|---|

| Swiss QR-bills | ✓ Auto-compliant | ✓ | ✓ | ✓ |

| AI Receipt Scanning | ✓ Included | ✗ Manual entry | ✗ No | ✗ No |

| Starting Price | CHF 0 freemium | CHF 45/month | CHF 0 free tier | ~CHF 149/year |

| Mobile Apps | iOS, Android | iOS, Android | Web only | Desktop |

| Best For | ✓ Freelancers | SMEs | All sizes | Accounting-savvy |

| Accountant Export | ✓ One-click | ✓ | ✗ No | ✗ No |

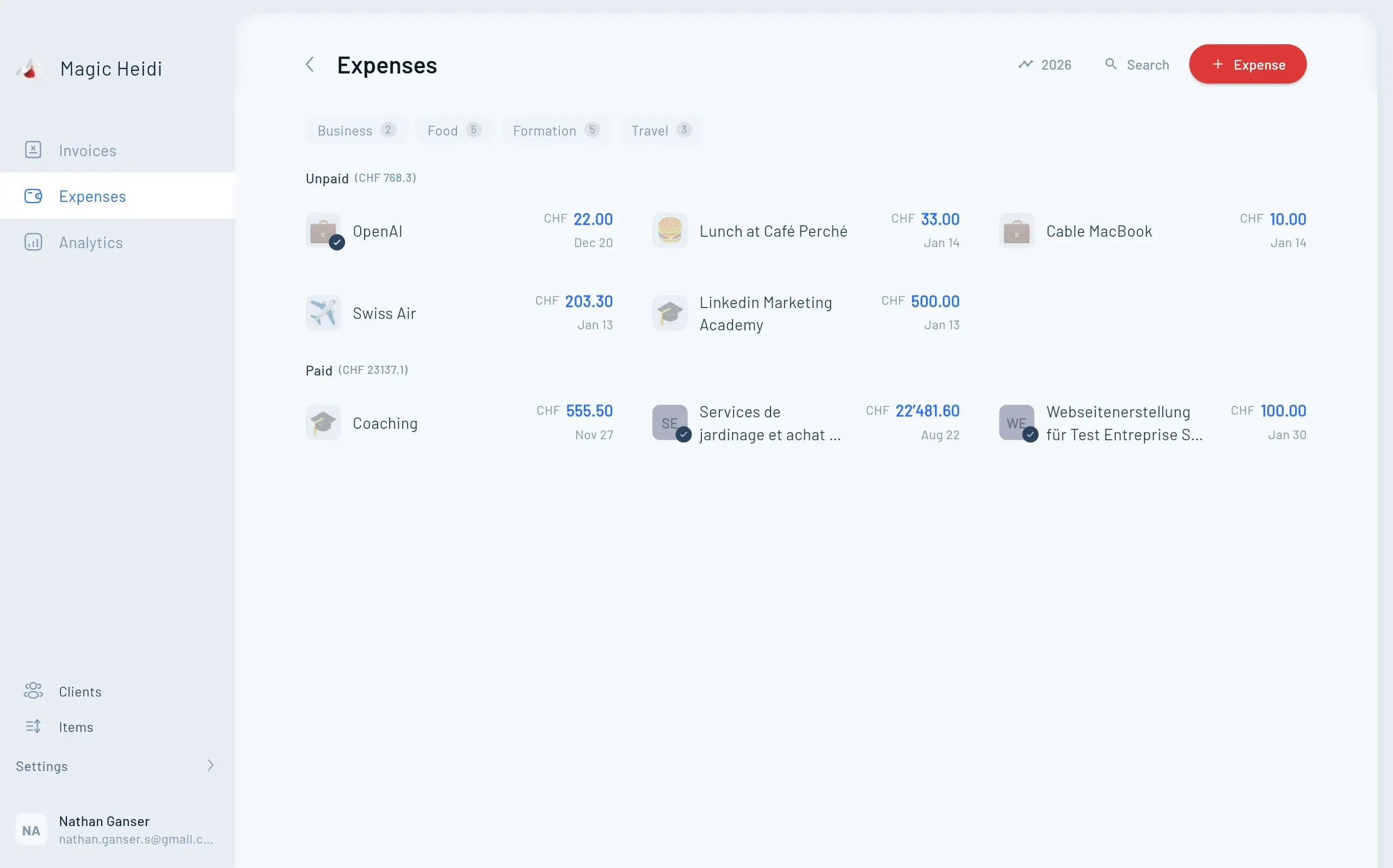

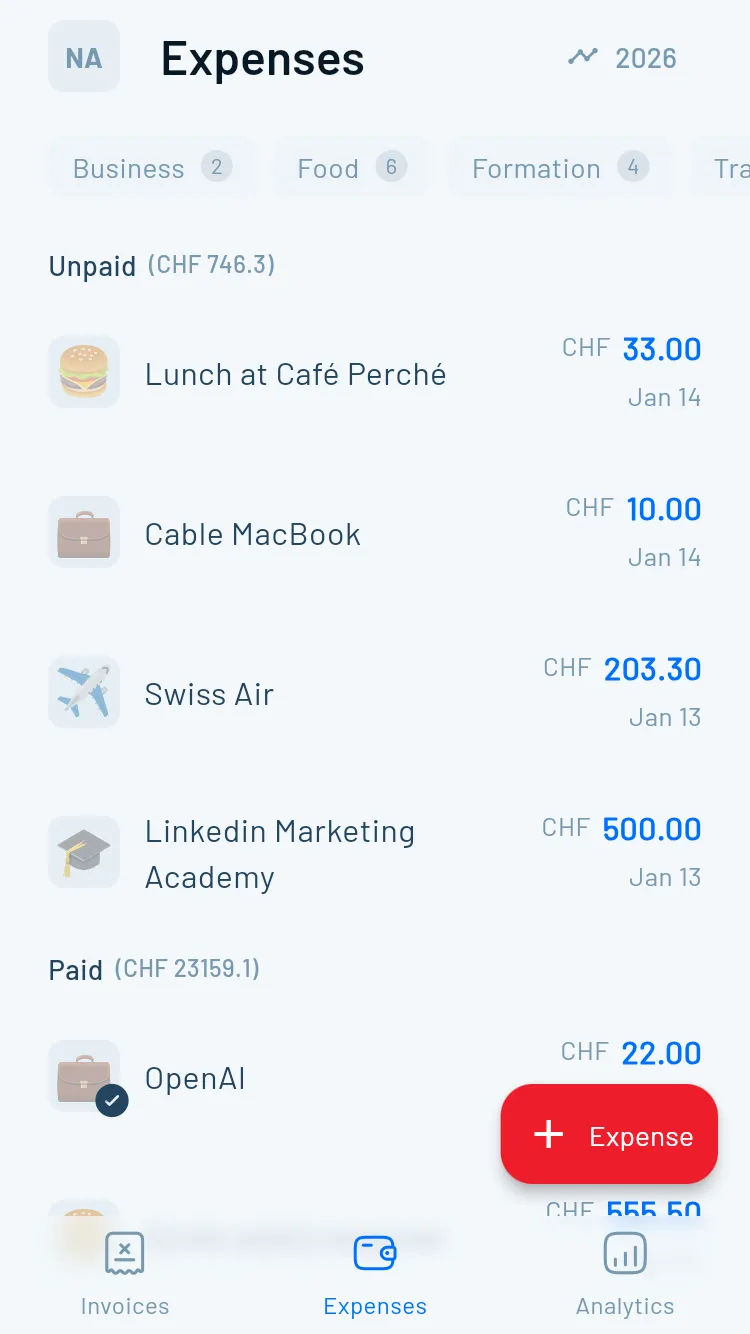

AI Receipt Scanning That Does Itself

Snap a photo of your coffee meeting receipt, and Magic Heidi auto-extracts vendor, amount, date, and VAT—then categorizes the expense automatically. No more manual data entry or shoeboxes of receipts.

Your Document Management Checklist

Use this quarterly review to stay audit-ready:

Banking & Payments

- ☐ Business account separate from personal

- ☐ All statements downloaded and stored

- ☐ TWINT/card transactions matched to receipts

Invoicing

- ☐ All issued invoices numbered sequentially

- ☐ QR-bill format compatible with 2025 rules

- ☐ Outstanding invoices followed up

Expenses

- ☐ Every receipt scanned within 48 hours

- ☐ Files named with date-vendor-amount format

- ☐ Categories assigned for tax reporting

Compliance

- ☐ VAT turnover tracked against CHF 100,000

- ☐ Year-end documents backed up in two locations

- ☐ Data exported and shared with accountant if needed

Stay Organized in 30 Minutes Per Week

Set aside 30 minutes every Friday for financial hygiene. Freelancers who maintain weekly routines report spending 80% less time on year-end accounting.

- 📅Week 1

Match receipts to bank transactions

- 📧Week 2

Send overdue invoice reminders

- 🏷️Week 3

Review expense categories

- 📊Week 4

Check VAT threshold progress

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

When to Bring In a Professional

Know what to handle yourself and when to get expert help.

Handle Yourself

Day-to-day receipt management, invoice generation, basic expense tracking, and quarterly VAT submissions once familiar.

Get a Treuhänder For

GmbH/AG formation, first VAT registration, complex property purchases, annual accounts, tax optimization, and audit representation.

Typical Cost

Most Swiss freelancers spend CHF 1,000-3,000 annually on professional accounting help. It's deductible and usually pays for itself.

Initial Consultation

A 30-minute consultation with a Treuhänder costs CHF 100-200 and provides clarity for years.

Frequently Asked Questions

What triggers a Swiss tax audit?

Tax authorities flag accounts showing round numbers everywhere, missing gaps in invoice sequences, expenses without corresponding income, cash transactions without documentation, and personal expenses in business accounts. Clean documentation ensures you'll pass an audit without financial damage.

Can I destroy documents if I close my business?

No. If you close your business or liquidate a company, the 10-year retention obligation continues. You cannot destroy records just because you've moved on from the business.

What format should I use for digital archiving?

PDF/A format is recommended for long-term archiving. Regular PDFs and JPEGs work if your system prevents editing. Cloud storage is permitted as long as servers are in Switzerland or the EU.

When should I voluntarily register for VAT?

Voluntary registration below the CHF 100,000 threshold lets you reclaim VAT on business expenses—worth considering if you have significant purchases. Set an alert at CHF 90,000 to prepare for mandatory registration.

How do I name my accounting files?

Use a consistent format like 2025-05-27Client-NameInvoice_1200CHF.pdf. Include the date, vendor or client name, document type, and amount for easy searching during audits.

Take Control of Your Accounting Documents Today

Every receipt you capture today protects your money tomorrow. The AI handles categorization, QR-bill compliance, and 10-year archiving requirements automatically.