Documenti contabili svizzeri:

Cosa deve conservare ogni freelancer

Una ricevuta mancante è costata a un freelancer di Zurigo CHF 2'800 in tasse extra l'anno scorso. Scopri esattamente quali documenti richiede la legge svizzera, per quanto tempo conservarli e come trasformare le pratiche in un sistema di protezione dei profitti.

Cosa conta come documento contabile

in Svizzera?

L'articolo 957 del Codice delle obbligazioni svizzero richiede di mantenere prove per ogni transazione. I documenti essenziali includono fatture, ricevute, estratti conto, contratti, dichiarazioni IVA e bilanci di fine anno.

Conservazione 10 anni

Tutti i documenti vanno conservati un decennioSoglia IVA CHF 100K

Registrazione obbligatoria al superamentoArchiviazione digitale

Conservazione antimanomissione per leggeIl sistema svizzero a livelli spiegato

Non tutti i freelancer necessitano dello stesso livello di contabilità. La Svizzera usa un sistema a livelli basato sulla struttura aziendale e sul fatturato.

Livello 1 — Sotto CHF 100K

Contabilità semplificata Milchbüechli. Registra entrate, uscite e attività in un libro mastro base. Nessuna IVA o registro di commercio richiesti.

Livello 2 — Da CHF 100K a 500K

Ancora contabilità semplificata, ma la registrazione IVA (aliquota standard 8,1%) e l'iscrizione al registro di commercio diventano obbligatorie.

Livello 3 — Oltre CHF 500K

Contabilità in partita doppia obbligatoria ai sensi dell'Art. 957 CO. Necessari bilancio, conto economico e note annuali.

Livello 4 — Sagl, SA

Requisiti contabili completi indipendentemente dal fatturato. Anche una Sagl con CHF 50K di ricavi necessita della partita doppia completa.

La regola di conservazione 10 anni

L'articolo 958f del Codice delle obbligazioni svizzero richiede di conservare tutti i documenti contabili per 10 anni dalla fine dell'anno fiscale. I documenti del 2025 vanno conservati fino al 31 dicembre 2035. Durante una verifica, le spese non documentate vengono respinte—un rimborso di CHF 5'000 senza ricevuta potrebbe costarti CHF 1'000-1'500 in tasse aggiuntive, più interessi e multe.

Archiviazione digitale:

Cosa richiede la legge svizzera

Buone notizie—non servono schedari. L'OLibC (Ordinanza sulla tenuta e la conservazione dei libri) consente l'archiviazione digitale a condizioni specifiche.

Requisiti di archiviazione

Il tuo archivio digitale deve soddisfare tre criteri chiave per la legge svizzera.

- Antimanomissione — I documenti non possono essere modificati dopo il caricamento

- Accessibile — Leggibile per l'intero periodo di conservazione

- Completo — Tutte le informazioni richieste preservate

- Formato PDF/A raccomandato per l'archiviazione a lungo termine

Opzioni cloud storage

Il cloud storage è consentito purché i server siano in Svizzera o nell'UE.

- Software di contabilità con archiviazione integrata

- Google Drive o Dropbox con cartelle organizzate

- Soluzioni svizzere dedicate come Tresorit

- Archiviazione cloud automatica Magic Heidi

Convenzione nomi file

Una nomenclatura coerente rende la ricerca indolore durante le verifiche.

- Includi la data nel formato AAAA-MM-GG

- Aggiungi nome cliente o fornitore

- Specifica il tipo di documento (Fattura, Ricevuta)

- Includi l'importo per riferimento rapido

Modifiche QR-fattura da novembre 2025

Se emetti fatture con QR-fatture svizzere, segna questa data: 21 novembre 2025.

Da quel giorno, solo gli indirizzi strutturati (tipo "S") saranno permessi nei codici QR. Gli indirizzi non strutturati (tipo "K") saranno eliminati entro settembre 2026.

Cosa significa per te:

Il tuo software di fatturazione deve aggiornarsi prima della scadenza. Se usi modelli vecchi o generazione QR manuale, verifica la compatibilità ora.

Magic Heidi gestisce automaticamente questa transizione—nessuna azione richiesta agli utenti.

Requisiti IVA

per il 2025

Quando il tuo fatturato imponibile mondiale supera CHF 100'000 in un periodo mobile di 12 mesi, la registrazione IVA diventa obbligatoria. Imposta un avviso a CHF 90'000 per prepararti alla registrazione.

La maggior parte dei servizi e beni

Servizi alberghieri e di alloggio

Alimenti, libri, medicinali, giornali

Trimestrale, mensile o annuale

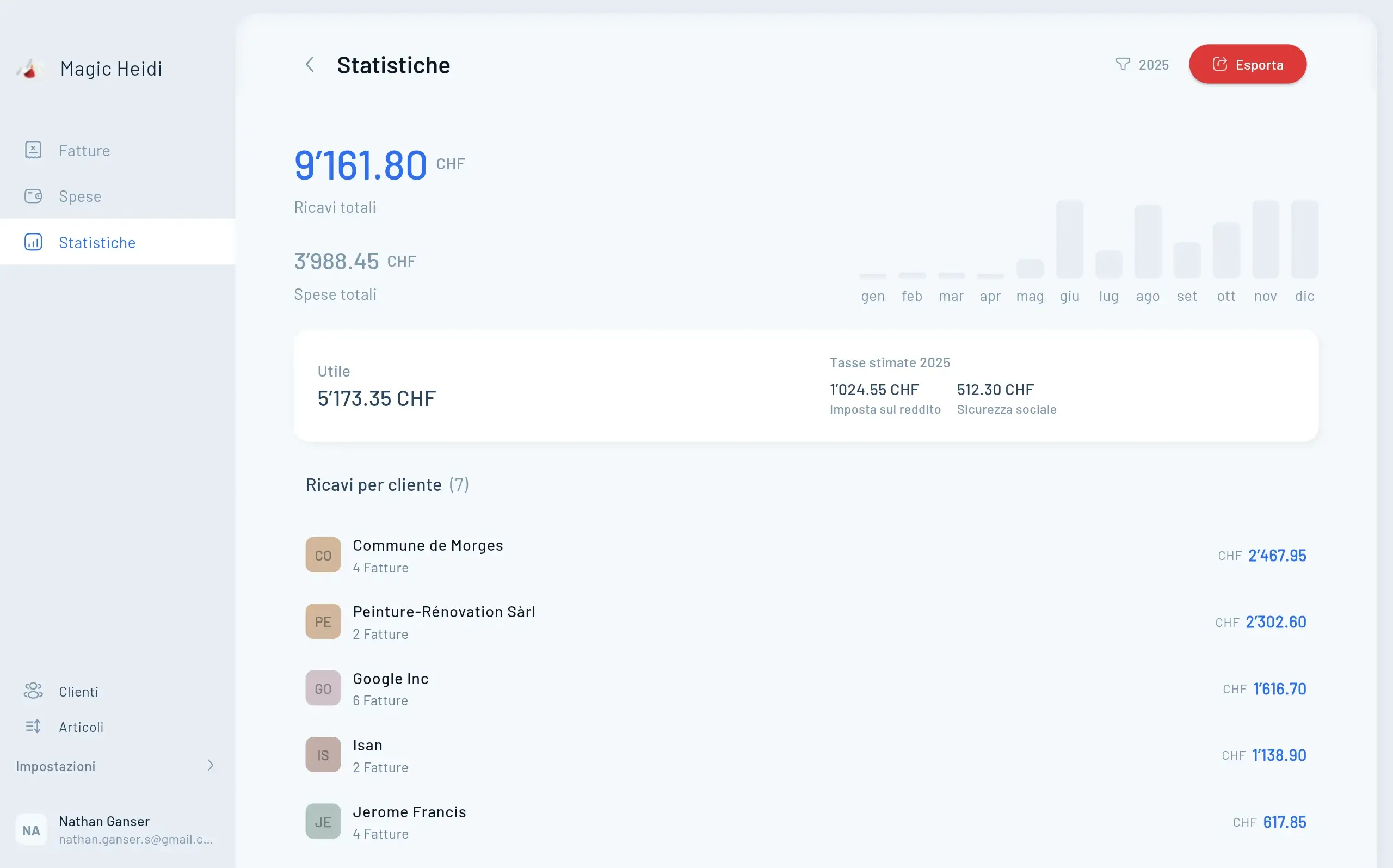

Perché una documentazione corretta ti fa risparmiare

Una buona documentazione non riguarda solo la conformità. Riduce direttamente le tue tasse attraverso deduzioni legittime.

Ufficio e attrezzature

Affitto ufficio, quota home office (10-20% dell'affitto), computer, software e strumenti professionali.

Formazione e viaggi

Corsi professionali, viaggi dai clienti, biglietti FFS, costi carburante e iscrizioni professionali.

Contributi pilastro 3a

Gli indipendenti possono contribuire fino al 20% del reddito netto (max CHF 36'288 nel 2025) al pilastro 3a.

Riporto perdite

Riporta le perdite aziendali per 7 anni, compensando i profitti futuri con documentazione adeguata.

Software di contabilità per freelancer svizzeri

Trova lo strumento giusto per le tue esigenze di documentazione aziendale.

| Funzionalità | Magic Heidi | bexio | CashCtrl | Banana |

|---|---|---|---|---|

| QR-fatture svizzere | ✓ Auto-conforme | ✓ | ✓ | ✓ |

| Scansione ricevute AI | ✓ Inclusa | ✗ Inserimento manuale | ✗ No | ✗ No |

| Prezzo iniziale | CHF 0 freemium | CHF 45/mese | CHF 0 piano gratuito | ~CHF 149/anno |

| App mobile | iOS, Android | iOS, Android | Solo web | Desktop |

| Ideale per | ✓ Freelancer | PMI | Tutte le dimensioni | Esperti di contabilità |

| Accesso commercialista | ✓ Integrato | ✓ | ✗ No | ✗ No |

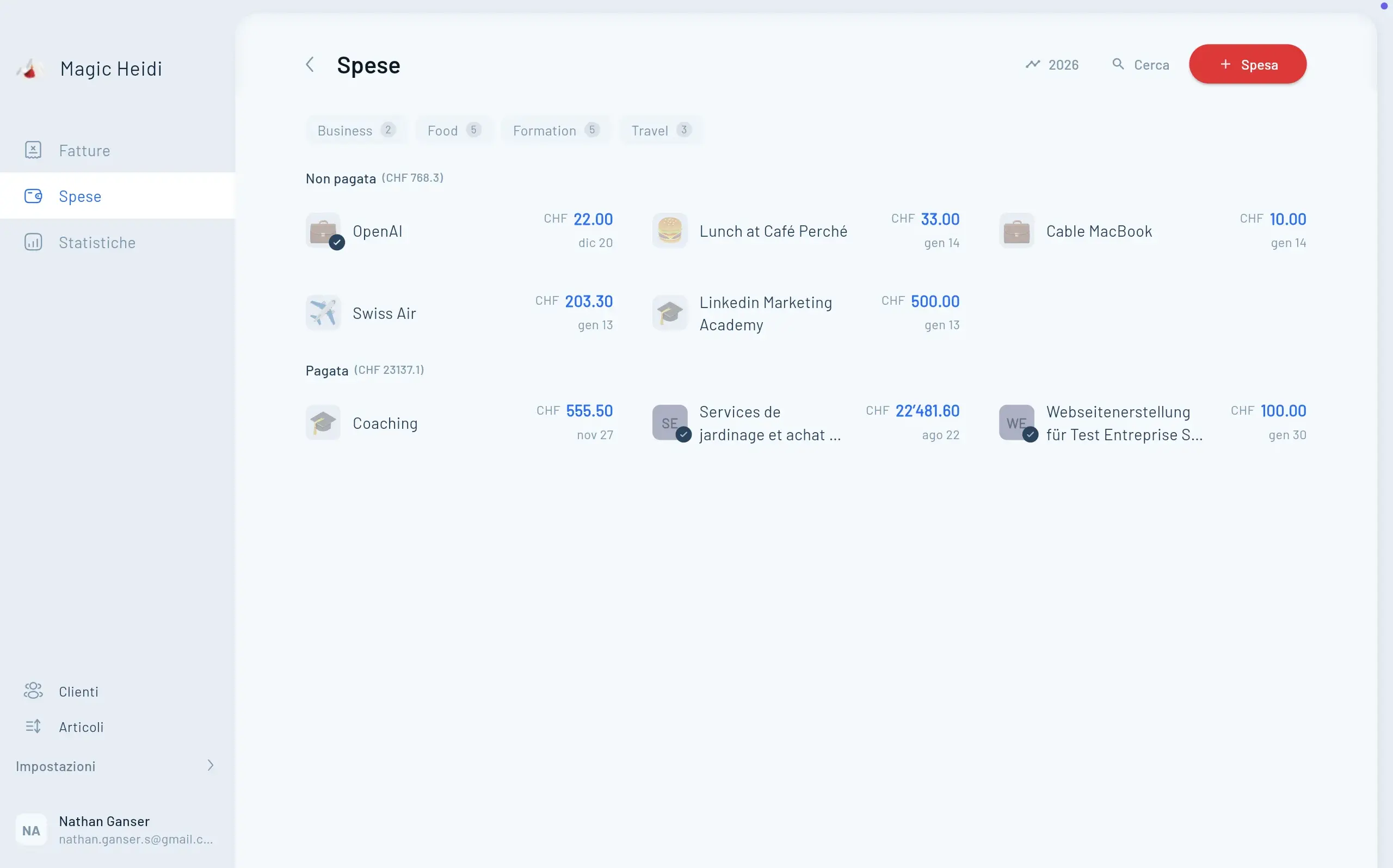

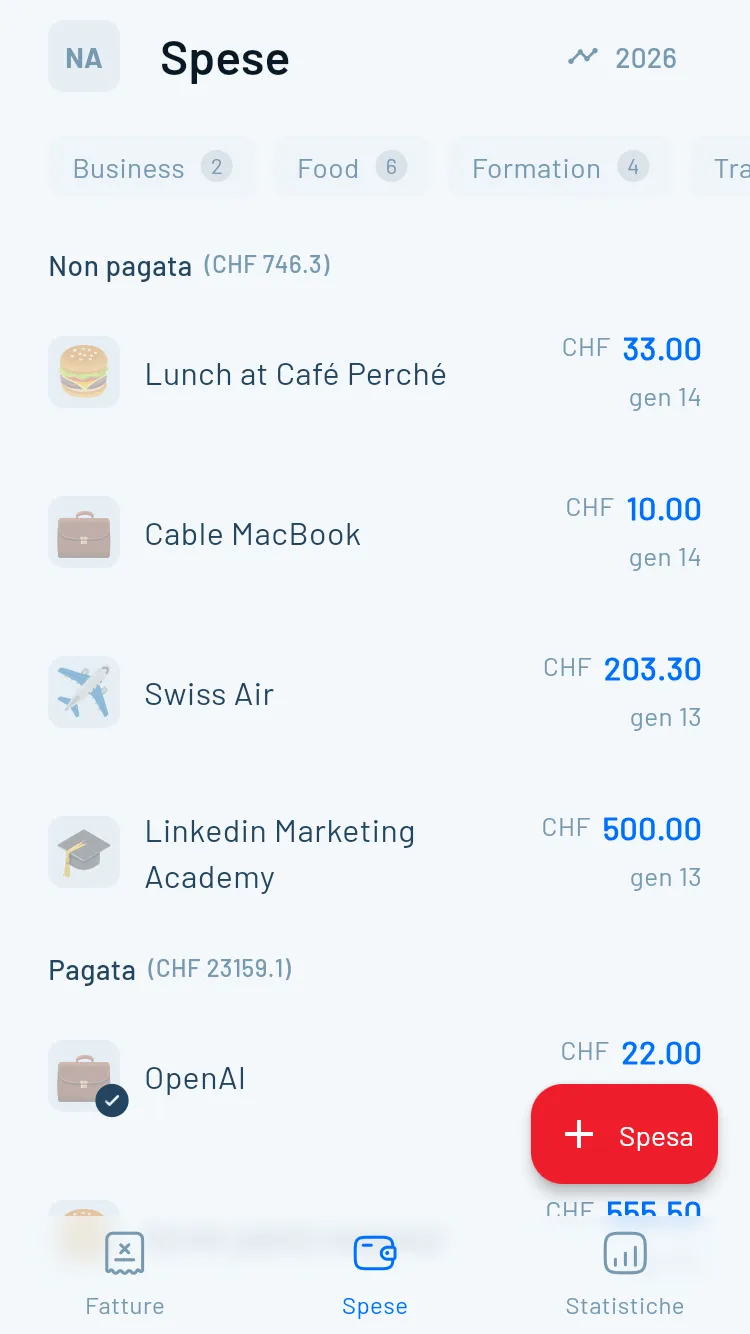

Scansione ricevute AI che si fa da sola

Scatta una foto della ricevuta del pranzo di lavoro e Magic Heidi estrae automaticamente fornitore, importo, data e IVA—poi categorizza la spesa automaticamente. Niente più inserimenti manuali o scatole di ricevute.

La tua checklist gestione documenti

Usa questa revisione trimestrale per essere sempre pronto alle verifiche:

Banca e pagamenti

- ☐ Conto aziendale separato da quello personale

- ☐ Tutti gli estratti conto scaricati e archiviati

- ☐ Transazioni TWINT/carta abbinate alle ricevute

Fatturazione

- ☐ Tutte le fatture emesse numerate in sequenza

- ☐ Formato QR-fattura compatibile con le regole 2025

- ☐ Fatture in sospeso sollecitate

Spese

- ☐ Ogni ricevuta scansionata entro 48 ore

- ☐ File nominati con formato data-fornitore-importo

- ☐ Categorie assegnate per la dichiarazione fiscale

Conformità

- ☐ Fatturato IVA monitorato rispetto a CHF 100'000

- ☐ Documenti di fine anno salvati in due posizioni

- ☐ Accesso commercialista configurato se necessario

Resta organizzato in 30 minuti a settimana

Dedica 30 minuti ogni venerdì all'igiene finanziaria. I freelancer che mantengono routine settimanali riportano l'80% di tempo in meno per la contabilità di fine anno.

- 📅Settimana 1

Abbina ricevute alle transazioni bancarie

- 📧Settimana 2

Invia solleciti fatture scadute

- 🏷️Settimana 3

Rivedi le categorie di spesa

- 📊Settimana 4

Controlla l'avanzamento soglia IVA

- Fattura #3

Magic Heidi

CHF 500

Jan 29

- Fattura #2

Webbiger LTD

CHF 2000

Jan 24

- Fattura #1

John Doe

CHF 600

Jan 20

Quando rivolgersi a un professionista

Scopri cosa gestire da solo e quando chiedere aiuto esperto.

Gestisci da solo

Gestione quotidiana ricevute, generazione fatture, tracciamento spese base e dichiarazioni IVA trimestrali una volta acquisita familiarità.

Rivolgiti a un fiduciario per

Costituzione Sagl/SA, prima registrazione IVA, acquisti immobiliari complessi, conti annuali, ottimizzazione fiscale e rappresentanza in caso di verifica.

Costo tipico

La maggior parte dei freelancer svizzeri spende CHF 1'000-3'000 annui in assistenza contabile professionale. È deducibile e di solito si ripaga da sé.

Consulenza iniziale

Una consulenza di 30 minuti con un fiduciario costa CHF 100-200 e fornisce chiarezza per anni.

Domande frequenti

Cosa fa scattare una verifica fiscale svizzera?

Le autorità fiscali segnalano conti con numeri tondi ovunque, lacune nelle sequenze di fatturazione, spese senza ricavi corrispondenti, transazioni in contanti senza documentazione e spese personali nei conti aziendali. Una documentazione pulita garantisce il superamento di una verifica senza danni finanziari.

Posso distruggere i documenti se chiudo l'attività?

No. Se chiudi l'attività o liquidi una società, l'obbligo di conservazione decennale continua. Non puoi distruggere i documenti solo perché hai cessato l'attività.

Quale formato devo usare per l'archiviazione digitale?

Il formato PDF/A è raccomandato per l'archiviazione a lungo termine. PDF e JPEG normali funzionano se il tuo sistema impedisce le modifiche. Il cloud storage è consentito purché i server siano in Svizzera o nell'UE.

Quando conviene registrarsi volontariamente all'IVA?

La registrazione volontaria sotto la soglia di CHF 100'000 ti permette di recuperare l'IVA sulle spese aziendali—da considerare se hai acquisti significativi. Imposta un avviso a CHF 90'000 per prepararti alla registrazione obbligatoria.

Come devo nominare i miei file contabili?

Usa un formato coerente come 2025-05-27Nome-ClienteFattura_1200CHF.pdf. Includi data, nome fornitore o cliente, tipo di documento e importo per ricerche facili durante le verifiche.

Prendi il controllo dei tuoi documenti contabili oggi

Ogni ricevuta che acquisisci oggi protegge i tuoi soldi domani. L'AI gestisce automaticamente categorizzazione, conformità QR-fattura e requisiti di archiviazione decennale.