Potential annual cost: Under CHF 5,000

Maximum savings strategy for those in good health

- Choose Telmed or HMO model

- Select CHF 2,500 deductible

- Focus on premium savings

Basel-Stadt has some of Switzerland's highest health insurance premiums. But here's what most 40-year-olds don't know: your age doesn't increase your premium. From age 26 onwards, every adult pays the same base rate.

Basel-Stadt consistently ranks among Switzerland's most expensive cantons for health insurance, alongside Geneva and Ticino. The reason is straightforward: premiums reflect local healthcare costs. Basel's world-class medical infrastructure, high concentration of specialists, and urban healthcare consumption drive costs up.

Here are the most affordable basic insurance options currently available for adults in Basel-Stadt (CHF 2,500 franchise):

| Provider | Model | Monthly (CHF) | Annual (CHF) |

|---|---|---|---|

| Groupe Mutuel | Alternative | 385.65 | 4,627.80 |

| Sympany | Standard | 399.20 | 4,790.40 |

| Vivao Sympany | HMO | 416.30 | 4,995.60 |

| Concordia | HMO | ~420 | ~5,040 |

| Assura | Telmed | ~425 | ~5,100 |

Important context: The average Swiss premium for 2026 is CHF 393.30 per month, representing a 4.4% increase from 2025. Basel-Stadt premiums typically run 10-20% above the national average.

Assura often appears as the cheapest option in premium calculators. However, customer satisfaction surveys consistently rank them last among Swiss insurers. The lowest price doesn't always mean the best value—especially if you need responsive customer service.

Your choice of insurance model can save you 10-30% on premiums. Here's what each option actually means for your healthcare.

Complete freedom to visit any doctor, specialist, or hospital. Highest premiums, no discount.

Use doctors within a specific health centre network. Save 15-25% on premiums.

Call medical hotline before any doctor visit. Save 20-30% on premiums.

One GP coordinates all your care with referrals. Save 10-20% on premiums.

Standard Model — Best for people who value flexibility, have established specialist relationships, or have complex health needs requiring multiple providers.

HMO Model — Best for healthy individuals comfortable with a group practice setting who rarely need specialists. Only 15 of Switzerland's 37 health insurers offer HMO plans.

Telmed Model — Best for tech-comfortable individuals who rarely need medical care and don't mind phone consultations. The hotline is available 24/7, but you cannot simply walk into a doctor's office without calling first.

Family Doctor Model — Best for people who prefer a consistent relationship with one doctor and don't mind the referral requirement.

Your deductible (Franchise) is the amount you pay out-of-pocket before insurance kicks in. Options range from CHF 300 to CHF 2,500 per year.

Lower monthly premium, higher out-of-pocket risk. Can save up to CHF 1,500 per year in Basel-Stadt.

Higher monthly premium, predictable costs. Best for those with regular healthcare needs.

Balance between savings and out-of-pocket exposure. Run your personal numbers to compare.

If you're self-employed in Basel, your LAMal situation differs from employees in one critical way: accident coverage. Employees working more than 8 hours weekly have accident insurance through their employer. When you become self-employed, this coverage disappears.

Accident Coverage (Mandatory): You must add accident coverage to your LAMal policy. This increases your premium by approximately 5-10%, but it's not optional—it's essential protection.

Daily Sickness Benefit (Recommended): Unlike employees who receive continued salary during illness, freelancers have zero income protection. A daily sickness benefit policy pays a percentage of your income if you're unable to work due to illness.

Tax Note: Your LAMal premiums are tax-deductible. Keep records of all payments for your annual tax declaration.

Can't afford full premiums? You may qualify for Prämienverbilligung (premium reduction). Approximately 30,000 people in Basel-Stadt already receive premium subsidies.

CHF 431/month reduction

CHF 461/month reduction

Income, assets, household size

Contact Amt für Sozialbeiträge

Unhappy with your current insurer? Found a cheaper option? Here's the switching process.

Receive your premium letter for the coming year from your current insurer

Compare options on Priminfo.ch (official government calculator)

Apply for your new policy with your chosen insurer

Send cancellation letter to current insurer (registered mail)

Receive confirmation from both old and new insurers

New coverage begins automatically

Your cancellation letter must reach your current insurer by this date to switch for January 1. Your new insurer cannot reject you for basic LAMal coverage—this is a legal right in Switzerland.

Here's a decision framework for 40-year-olds in Basel:

Maximum savings strategy for those in good health

For those with occasional medical visits

For those with regular healthcare requirements

Additional coverage requirements for freelancers

The difference between the cheapest and most expensive LAMal plans in Basel-Stadt exceeds CHF 350 per month—over CHF 4,200 annually. Use Priminfo.ch to run personalised comparisons. Remember: you have until November 30 to switch insurers for the new year.

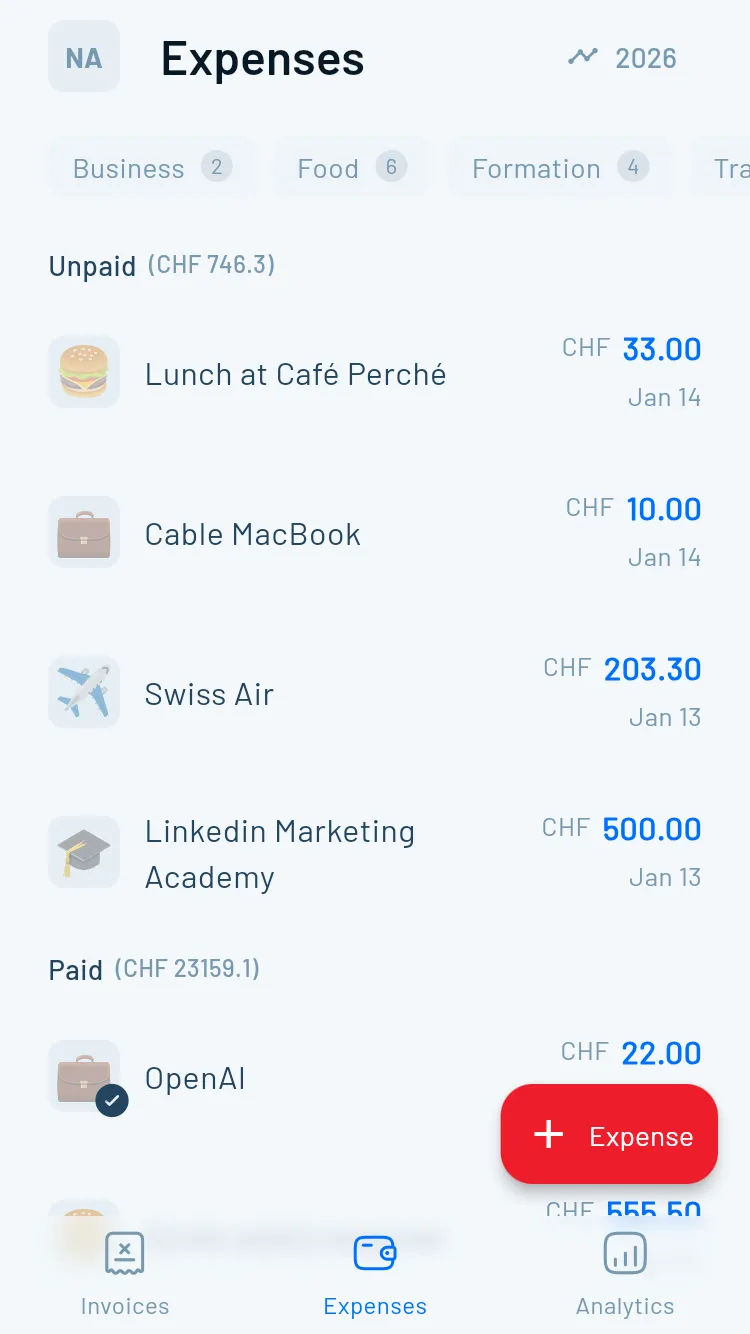

Managing your freelance finances in Switzerland? Magic Heidi helps Swiss freelancers and entrepreneurs handle invoicing, expenses, and accounting—so you can focus on your work instead of paperwork. Try it free today.