Find the Cheapest LAMal in Lausanne as a 30-Year-Old

Health insurance premiums rose 4.4% in 2025. But as a 30-year-old in Lausanne, you're in the perfect position to pay significantly less. Your age, health status, and flexibility make you ideal for the cheapest models available.

What LAMal Actually Covers

Every Swiss insurer offers identical basic coverage under LAMal. The law requires it. This means the cheapest plan covers exactly the same services as the most expensive one.

Hospital & Emergency

Hospital stays, emergency treatments, and urgent care abroadDoctor Visits

GP consultations, specialist visits, and outpatient treatmentsMedications & Maternity

Prescription medications and full maternity care coverageLAMal Prices for 30-Year-Olds in Lausanne

Lausanne sits in Vaud's premium region 1. Here are the most affordable options currently available with CHF 2,500 deductible.

| Insurer | Model | Monthly Premium (CHF) | Annual Cost (CHF) |

|---|---|---|---|

| Sanitas | Telmed | ~412 | ~4,944 |

| Assura | Telmed | ~415 | ~4,980 |

| Atupri | HMO | ~418 | ~5,016 |

| CSS | Telmed | ~420 | ~5,040 |

| Vivao Sympany | HMO | ~422 | ~5,064 |

| Helsana | BeneFit PLUS | ~425 | ~5,100 |

Prices based on CHF 2,500 deductible. Always verify current rates on Priminfo.admin.ch—the only official government calculator.

The 3 Factors That

Determine Your Premium

Understanding these factors is the key to maximizing your savings.

Insurance Model

Alternative models offer discounts up to 25% compared to standard coverage. This is where 30-year-olds save the most.

- Standard Model: Full freedom, most expensive

- Family Doctor: 10-15% discount, GP referrals required

- HMO Model: 15-25% discount, network-based care

- Telmed Model: 20-30% discount—maximum savings

Deductible Choice

Higher deductible = lower monthly premium. For healthy 30-year-olds, CHF 2,500 deductible can save CHF 1,800-2,400 annually.

- CHF 300: Frequent doctor visits, chronic conditions

- CHF 1,000-1,500: Occasional doctor visits

- CHF 2,500: Maximum savings, rarely see doctors

- Break-even at ~3-4 significant medical visits/year

Location

Lausanne falls into premium region 1 for Vaud—the higher-cost urban zone. Premiums run 5-10% more than rural areas.

- Can't change unless you move

- Offset with model and deductible optimization

- Urban areas have more HMO options

- More provider choices in Lausanne

Why Telmed is Ideal for 30-Year-Olds

For most healthy 30-year-olds, Telmed offers the best value. You make a quick call, describe your symptoms, and get directed to appropriate care. The savings are substantial (20-30%), and the inconvenience is minimal.

How to Switch Insurance and Save

Mark these dates on your calendar—missing them costs you money.

Step-by-Step Switching Process

- Compare options on Priminfo.admin.ch This is the only official, independent calculator. Commercial sites often steer you toward insurers paying them commissions.

- Apply to your new insurer first They cannot reject you for basic LAMal coverage. Wait for confirmation.

- Send cancellation via registered mail Address it to your current insurer. Keep the delivery receipt.

- Confirm everything in writing Ensure both insurers acknowledge the switch before January 1.

Sample Cancellation Letter

[Your Name]

[Your Address]

[Date]

[Insurance Company Name]

[Address]

Subject: Cancellation of Basic Health Insurance

Dear Sir/Madam,

I hereby cancel my basic health insurance policy number [POLICY NUMBER]

effective December 31, [YEAR].

Please send written confirmation of this cancellation.

Sincerely,

[Signature]

[Printed Name]

Send this registered mail by November 25 at the latest to ensure delivery by the deadline.

Premium Subsidies

in Vaud

Many 30-year-olds don't realize they qualify for help. In Vaud, the canton considers health insurance excessive if it exceeds 10% of household income. Around 30% of Swiss residents receive some form of premium assistance.

Earning under ~CHF 50,000 annually

Higher income thresholds apply

Variable income considered

Handles all applications

Common Mistakes That Cost You Money

Don't let these errors drain your wallet.

Missing November 30 Deadline

Your letter must arrive by this date. Postmark doesn't count. One day late = another full year with your current insurer.

Cancelling Before New Coverage

Always apply to your new insurer first. You don't want gaps in your insurance record.

Ignoring Supplementary Insurance

LAMal and supplementary insurance are separate. Supplementary insurers can reject based on health history.

Choosing Price Alone

CHF 10/month savings isn't worth weeks of frustration with poor customer service.

Forgetting Model Restrictions

HMO and Telmed have real limitations. Consider your travel and specialist needs.

Frequently Asked Questions

What is the cheapest health insurance in Lausanne for 2025?

For 30-year-olds, Sanitas and Assura Telmed models with CHF 2,500 deductible typically offer the lowest premiums—around CHF 412-420 monthly.

How much should a 30-year-old pay for health insurance in Switzerland?

With optimized choices (Telmed model, high deductible), expect CHF 400-450 monthly in Lausanne. Standard coverage with low deductible runs CHF 500-600+.

When is the deadline to switch health insurance?

November 30 for January 1 coverage. Your cancellation must be received (not just sent) by this date.

What's the difference between HMO and Telmed?

HMO requires treatment within a specific network of doctors and facilities. Telmed requires a phone/video consultation before in-person visits but allows more provider flexibility. Both offer similar savings.

Can I switch insurance mid-year?

Only to standard model coverage with CHF 300 deductible, and only by March 31. For alternative models or higher deductibles, you must wait for the November window.

Do I need supplementary insurance?

LAMal covers all essential medical needs. Supplementary insurance adds things like private hospital rooms, dental coverage, or alternative medicine. Most healthy 30-year-olds find basic LAMal sufficient.

The Optimal Strategy for 30-Year-Olds

This combination can save CHF 2,000-3,800 annually compared to standard coverage.

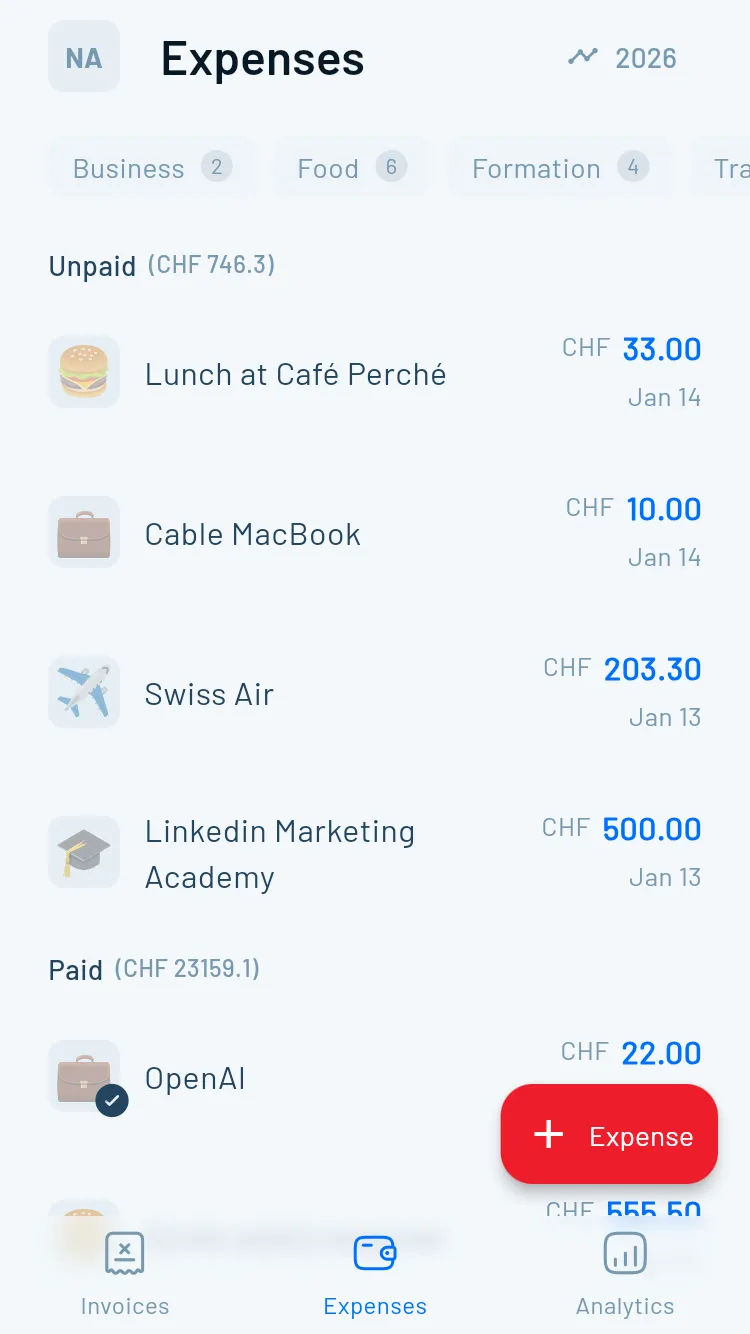

Managing Healthcare Costs as a Freelancer

Unlike employees who may have employer contributions, freelancers pay 100% of premiums themselves. Track your healthcare costs alongside your other business expenses. Every franc saved on fixed costs is a franc available for growth.

Ready to Find Your Optimal LAMal Plan?

Start with the official Priminfo calculator, compare your current premium against alternatives, and mark November 30 on your calendar. A few hours of research now could save you thousands.