Swiss VAT (MWST) for Freelancers: Your Complete Guide

Managing Swiss VAT doesn't have to be complicated. Whether you're just starting out or already navigating quarterly filings, understanding VAT (known as MWST in German, TVA in French, IVA in Italian) keeps your freelance business compliant, professional, and penalty-free.

This guide covers everything from registration thresholds to filing deadlines, with practical resources to help you master Swiss VAT management without the headaches.

Understanding Swiss VAT: The Essentials

What is VAT/MWST?

Value Added Tax (VAT) is a consumption tax added to most goods and services in Switzerland. As a freelancer, you collect VAT from clients on behalf of the Swiss Federal Tax Administration (FTA), then remit it quarterly while deducting VAT you've paid on business expenses.

It's not extra income—it's a tax you're managing through your business.

Do You Need to Register?

The Answer Depends on Your Annual Turnover

Understanding registration thresholds is critical to staying compliant and avoiding penalties.

CHF 100,000 Threshold

Mandatory registration at this annual turnover from taxable services30-Day Window

Must register within 30 days of exceeding thresholdVoluntary Registration

Permitted below CHF 100,000 to recover VAT on expensesMandatory Registration:

- CHF 100,000 annual turnover from taxable services/goods (most freelancers)

- Calculated on worldwide revenue for 12 consecutive months

- Must register within 30 days of exceeding this threshold

Voluntary Registration:

- Permitted below CHF 100,000

- Benefits: Recover VAT on business expenses, appear more established to clients

- Drawbacks: Additional administrative work, must charge VAT to all Swiss clients

Important: If you exceed CHF 100,000 mid-year, you're liable for VAT retroactively from the beginning of that period. Register promptly to avoid penalties and back-dated calculations.

Current VAT Rates (2025)

Switzerland uses multiple VAT rates depending on the product or service:

| Rate | Applies To | Example |

|---|---|---|

| 8.1% | Standard rate—most services and goods | Consulting, design, software development |

| 2.6% | Reduced rate | Food staples, books, medicines, newspapers, menstrual products |

| 3.8% | Special rate | Accommodation services (hotels, B&Bs) |

| 0% | Zero rate | Exports, international airline services |

2025 Update: The reduced rate now applies to menstrual hygiene products (effective January 1, 2025). The proposed increase to 8.8% has been delayed until 2028.

Get Your MWST Number in 30 Days

Your Swiss VAT number follows the format CHE-XXX.XXX.XXX MWST and must appear on every invoice once registered.

- 📋When to Register

Within 30 days of exceeding CHF 100,000 annual turnover

- ⏱️Processing Time

Registration typically takes 4 weeks to complete

- 🔢Your MWST Number

Enterprise ID with MWST suffix for all invoices

- ⚠️Plan Ahead

Apply before you need to issue VAT invoices

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

Managing VAT: Methods & Requirements

Switzerland offers two main approaches to VAT accounting. Choose the one that fits your business size and administrative capacity.

Choosing Your VAT Accounting Method

1. Effective Method (Standard)

- Track exact VAT collected from clients (output tax)

- Deduct exact VAT paid on business expenses (input tax)

- Remit the difference to the FTA

- Mandatory for businesses over CHF 5,005,000 turnover

- Most accurate but requires meticulous record-keeping

2. Net Tax Rate Method (Simplified)

- Apply a fixed percentage to your total revenue based on your industry

- No need to track individual VAT amounts

- Available for businesses under CHF 5,005,000 turnover and VAT liability under CHF 103,000

- Typically requires using Effective Method for 3 years first

The Net Tax Rate Method simplifies calculations significantly but may not always minimize your VAT liability. Many freelancers benefit from analyzing both methods annually.

Filing Deadlines You Can't Miss

Stay compliant and avoid penalties with these critical deadlines and requirements.

Quarterly Filing

VAT returns due 60 days after the end of each quarter. Payment due the same day as your return.

- Q1 (Jan-Mar) due by May 30

- Q2 (Apr-Jun) due by August 31

- Q3 (Jul-Sep) due by November 30

- Q4 (Oct-Dec) due by February 28

Alternative Options

Choose the filing frequency that matches your business situation and cash flow needs.

- Monthly filing for regular VAT credits

- Annual filing for SMEs under CHF 5M

- Mandatory e-portal since 2025

- Digital records accepted

Late Filing Consequences

Missing deadlines can result in serious financial penalties and administrative complications.

- First offense: Warning

- Penalties up to CHF 800,000

- Late payment interest: 4% annually

- Retain records for 10 years

Record-Keeping Requirements

Built for Swiss Compliance

The Swiss FTA can request documentation at any time. Digital records are acceptable and often easier to manage with proper backups and organized systems.

Issued invoices with VAT breakdown

For input tax deductions

Transaction documentation

All filings and correspondence

Common VAT Challenges Solved

Invoicing Different Client Types

Domestic Swiss Clients (B2B & B2C):

- Charge applicable Swiss VAT rate

- Include your MWST number on invoice

- Clearly show VAT amount separately

EU Business Clients (B2B):

- Apply reverse charge mechanism—no Swiss VAT charged

- Client pays VAT in their own country

- State on invoice: "VAT reverse charge applies"

Non-EU International Clients:

- No Swiss VAT charged

- State on invoice: "Service not taxable in Switzerland"

Consumer clients abroad (B2C):

- Rules vary by country and service type

- Consult specific cross-border regulations

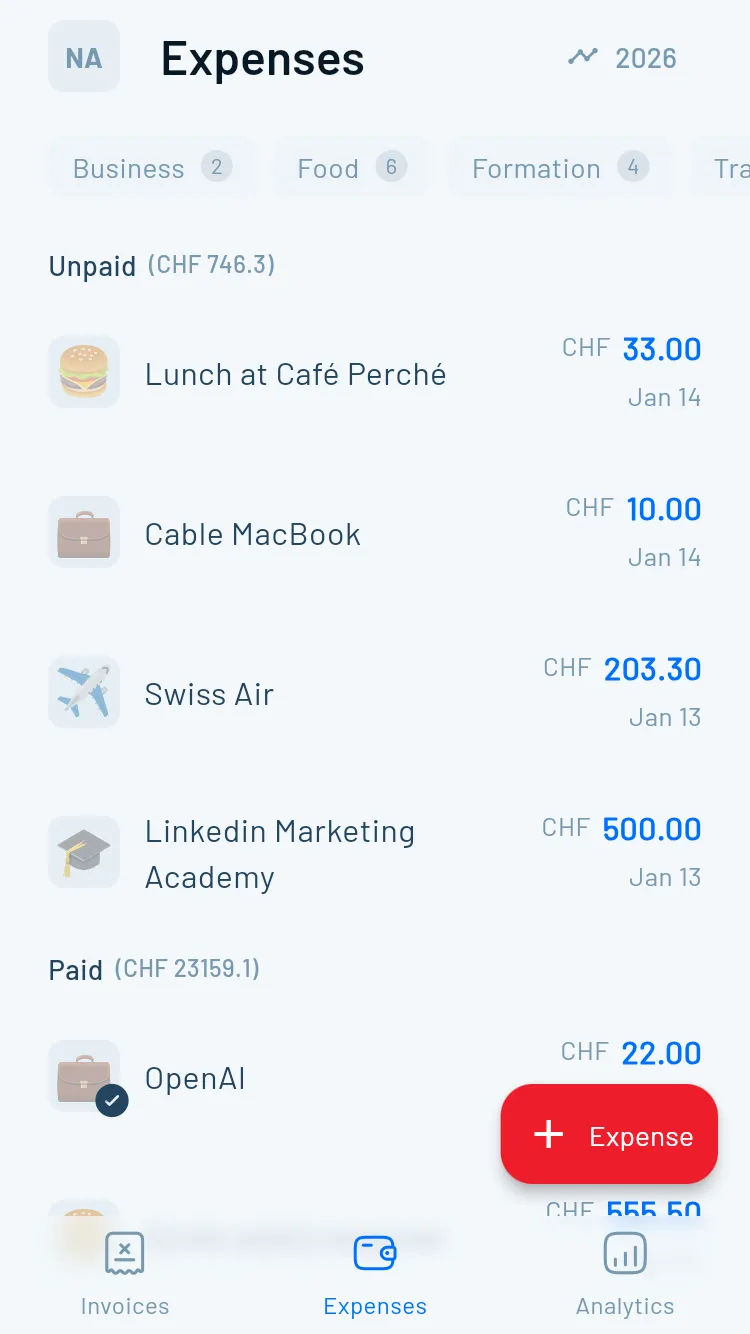

Maximize Input Tax Deductions

Track all business expenses carefully to reduce your net VAT liability. Magic Heidi's AI extracts VAT details automatically from receipts.

You can deduct VAT paid on legitimate business expenses, including:

- Office supplies and equipment

- Software subscriptions and tools

- Professional development and training

- Coworking space or office rent

- Business travel and meals (when properly documented)

Requirements for deduction:

- Expense must be business-related

- You must have a compliant invoice showing VAT separately

- Invoice must include supplier's MWST number

Common mistake: Failing to claim eligible input tax deductions. Track all business expenses carefully—this reduces your net VAT liability.

Avoiding Costly Mistakes

Top errors freelancers make:

- Missing the registration deadline after exceeding CHF 100,000—leads to backdated liabilities

- Applying wrong VAT rates to services or mixed invoices

- Forgetting to file quarterly returns on time

- Poor record-keeping that creates audit nightmares

- Incorrectly handling cross-border transactions

- Not reconciling VAT accounts regularly, causing discrepancies

Prevention: Automate where possible, set calendar reminders for deadlines, and use Swiss-specific tools designed for compliance.

VAT Updates for 2025

Stay current with these important regulatory changes affecting Swiss freelancers this year.

- 💻E-Portal Mandatory

Paper filing ended Dec 31, 2024 - all returns now electronic

- 🏢Platform Taxation

New deemed supplier model for platform sales

- 📅Annual Reporting

SMEs under CHF 5M can now file annually

- 📊Rate Stability

Proposed 8.8% increase postponed to 2028

- Invoice #3

Magic Heidi

CHF 500

Jan 29

- Invoice #2

Webbiger LTD

CHF 2000

Jan 24

- Invoice #1

John Doe

CHF 600

Jan 20

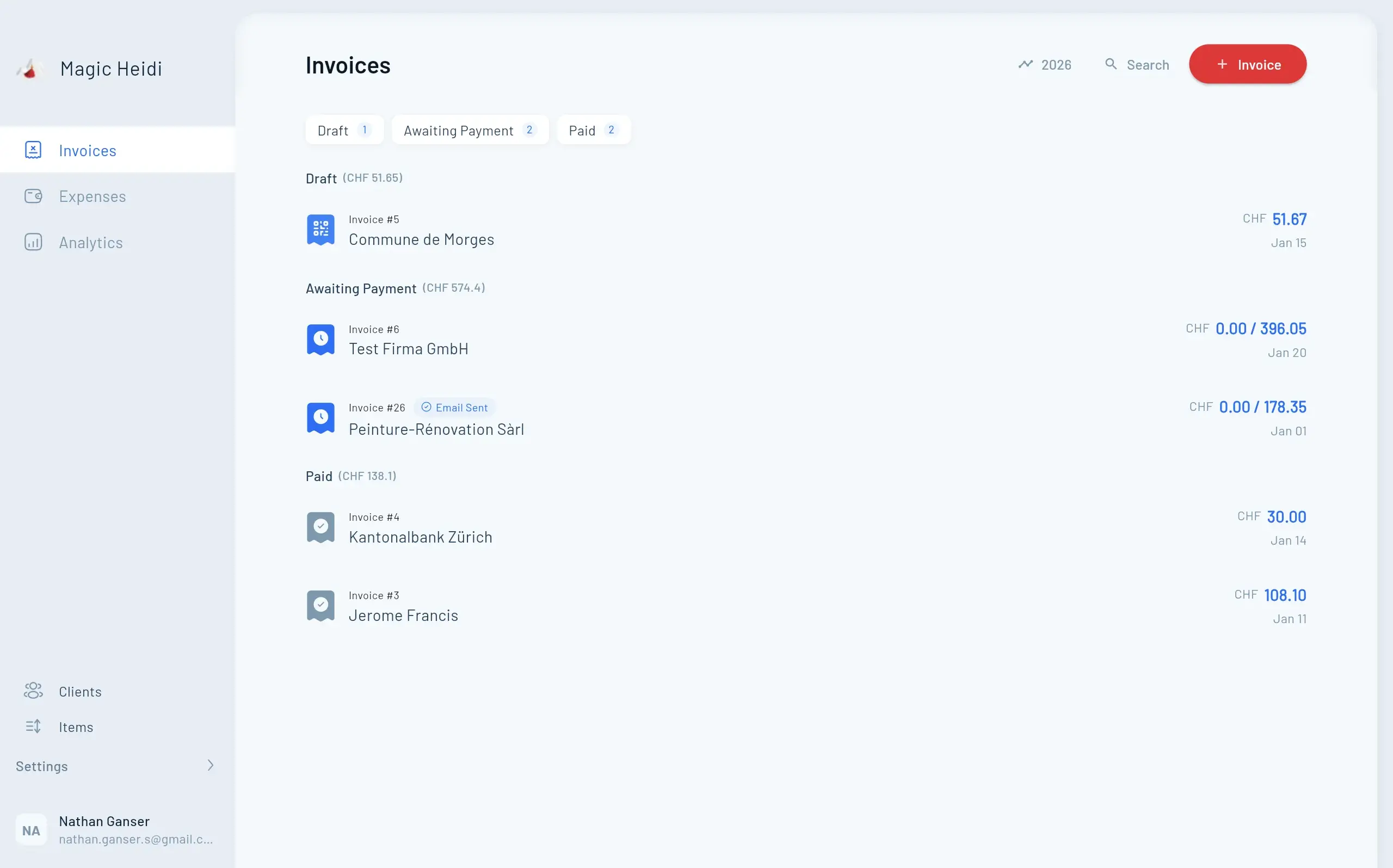

Simplify VAT with Magic Heidi

Managing Swiss VAT shouldn't consume hours every quarter. Magic Heidi automates the complex parts while keeping you compliant.

Automatic MWST Calculations

Current 2025 rates applied automaticallyAI Expense Scanning

Extracts VAT details from receipts instantlyReal-Time Tracking

Monitor your VAT position at a glanceSwiss-Specific, Not Generic

Magic Heidi understands MWST requirements, not just general European VAT rules.

QR-Code Invoicing

Fully compliant with Swiss standards and mandatory invoice elements.

Professional Templates

All mandatory elements included automatically in every invoice.

Multi-Rate Support

Handle invoices with different VAT categories seamlessly.

Export-Ready Reports

Generate quarterly filing reports with one click.

Automatic Categorization

AI organizes expenses for input tax deductions.

Mobile-First Design

Manage VAT from iPhone, Android, Mac, Windows, or web.

Try Magic Heidi Free

Experience stress-free VAT management designed for how you actually work. No credit card required.

Your Complete VAT Resource Library

Go deeper on specific topics with these comprehensive guides written specifically for Swiss freelancers.

Complete Guide to VAT

Everything from registration to filing for self-employed.

VAT for Freelancers

Simplified tax obligations explained clearly.

Mastering MWST Nummer

How to get and use your Swiss VAT ID.

VAT Management

Stay compliant effortlessly with proven strategies.

Online VAT Statement

Submit efficiently through the e-portal.

VAT Reconciliation

Balance your accounts correctly every quarter.

VAT Accounting Methods

Choose between Effective and Net Tax Rate approaches.

Net Tax Method Guide

Simplified calculation guide with examples.

VAT Rates 2025

Current rates and recent changes.

Frequently Asked Questions

What happens if I exceed CHF 100,000 mid-year?

You become VAT liable immediately. Register within 30 days and expect to pay VAT retroactively from the start of that accounting period. The FTA calculates your liability from when you crossed the threshold, not from registration.

Can I deregister if my turnover drops below CHF 100,000?

Yes, but you must wait until the end of a calendar year and apply to the FTA. They'll review your situation and may approve deregistration if your turnover is consistently below the threshold.

Do I charge VAT to all my clients?

Charge VAT to Swiss-based clients (B2B and B2C). For EU B2B clients, apply reverse charge (no Swiss VAT). For clients outside Switzerland, typically no Swiss VAT applies, but verify based on service type.

How long does the registration process take?

Approximately 4 weeks from submitting your complete application. Plan ahead if you need your MWST number by a specific date.

What if I make a mistake on my VAT return?

File a correction as soon as you discover the error. The FTA is more lenient with honest mistakes corrected promptly than with errors discovered during audits.

Can I switch from Effective to Net Tax Rate Method?

Yes, with FTA approval. Most freelancers must use the Effective Method for at least 3 years before switching to the simplified Net Tax Rate Method.

What should I do if I receive a VAT audit notice?

Don't panic. Gather all requested documentation (this is why 10-year record retention matters), respond within the specified timeframe, and consider consulting a tax advisor for complex situations.

Are there any expenses I can't deduct VAT from?

Yes—expenses must be business-related and properly documented. You cannot deduct VAT on purely personal expenses, even if purchased through a business account.

Take Control of Your VAT Management

Swiss VAT compliance doesn't have to be overwhelming. With the right knowledge and tools, you can handle quarterly filings confidently while focusing on what you do best—serving your clients and growing your freelance business.

Start with clarity: Understand your registration requirements and current obligations.

Stay organized: Maintain proper records from day one—it's far easier than reconstructing them later.

Automate the tedious parts: Let tools like Magic Heidi handle calculations, tracking, and compliance automatically.

Keep learning: VAT rules evolve. Review updates annually and adjust your processes accordingly.

Ready to simplify your Swiss VAT management? Try Magic Heidi free and join thousands of freelancers who've automated their MWST compliance.

💶 Questions about your specific VAT situation? Our support team understands Swiss tax requirements and is here to help.